No options play at the moment.

Not ready to jump into shorts yet.. but got to wait and see. This market wants to go higher because of stupid Fed action.

US stock discussion v4, Bulls-Bears HUAT AH!! Pigs get slaughter

|

|

Sep 15 2012, 10:05 PM Sep 15 2012, 10:05 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

With the US market at 4 years high.. all my long positions (net positive) have been trimmed to 40% and holding 60% cash at the moment.

No options play at the moment. Not ready to jump into shorts yet.. but got to wait and see. This market wants to go higher because of stupid Fed action. |

|

|

|

|

|

Sep 17 2012, 11:45 AM Sep 17 2012, 11:45 AM

|

Senior Member

593 posts Joined: Feb 2009 |

Dow Jones Continue to soar after QE3 was approved. 19/30 Counters in Dow Jones was in positive while the other 11 counters closed negatively.

Let check the Dow Jones Chart which was closed on 14 September for Dow Futures/ Stock Investors

Indicators ( Note using Fibonacci retracement to plot out the new support/ resistance because now it is all time high) 1 ) Trendline - Above the bullish trendline (Bullish) 2) Support/Resistance - formed Higher high and all high( Bullish) 3) MACD - Bullish Crossover and remain green. ( Bullish) . If 4G1R, better watchout for bearish reversal 4) RSI - Broke the 70% overbought resistance ( Bullish) but if observed carefully it is retracing. Watchout if it goes near back to 70% because currently it is a overbought position which means profit taking will take in place 5) STO - Broke 80% and going up. ( Bullish) but if observed carefully it is retracing and closing in closer to the red line.. Watchout if it goes near back to 80% because currently it is a overbought position which means profit taking will take in place 6) Ichimoku - a) Above support cloud (Bullish). b) Conversion line cross base line (Bearish Crossover). c) Price above the baseline ( Bullish) 7) Candlestick - Shooting star was formed (Slightly Bearish) Next Rrading Day : - Black Candle : Watchout for possible bearish reversal - White Candle - Negate the Bearish effect and will continue to be bullish Conclusion: Bullish Resistance at 13932 / 14156 / 14338 Support at 13570/13348/ 13242/ 12984 / 12803 |

|

|

Sep 17 2012, 09:13 PM Sep 17 2012, 09:13 PM

|

Junior Member

176 posts Joined: Feb 2010 |

Apple sold 2 Million Iphone 5 in an hour pre order. Put it into perspective, Nokia sold 4 million Lumia in the last quarter. And the share price is trading at ATH currently. The numbers show everything. If you still think that Apple is not going to increase earnings in the next quarter you are just selectively blind to this info. 2013 Q1 will be huge. Apple will have a record earnings due to the iphone 5 sales. Not to mention china mobile. that would be a huge catalyst to push the stock higher.

If you want to speak numbers to me, i can more than justify it. But please do your homework before that. |

|

|

Sep 17 2012, 09:53 PM Sep 17 2012, 09:53 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(pinkdevil88 @ Sep 17 2012, 09:13 PM) Apple sold 2 Million Iphone 5 in an hour pre order. Put it into perspective, Nokia sold 4 million Lumia in the last quarter. And the share price is trading at ATH currently. The numbers show everything. If you still think that Apple is not going to increase earnings in the next quarter you are just selectively blind to this info. 2013 Q1 will be huge. Apple will have a record earnings due to the iphone 5 sales. Not to mention china mobile. that would be a huge catalyst to push the stock higher. Slow down, don't click your remote yet to fast forward.If you want to speak numbers to me, i can more than justify it. But please do your homework before that. iPhone5 numbers won't be in 2012 Q4 yet. I think it will be another disappointment because everyone was holding off buying iPhones. Definitely will be using the dips to trade AAPL here. Come back down to the 630'-650'.. for another ride. This post has been edited by danmooncake: Sep 17 2012, 09:54 PM |

|

|

Sep 17 2012, 10:05 PM Sep 17 2012, 10:05 PM

|

Junior Member

176 posts Joined: Feb 2010 |

QUOTE(danmooncake @ Sep 17 2012, 09:53 PM) Slow down, don't click your remote yet to fast forward. one week of the iphone 5 sales will go into Q4 numbers and i expect it to be around 10m. Even if Q4 EPS disappoint that would not matter, cos Apple Q1 guidance is gonna send the shares high up. Look forward to Q1. You are welcome to wait for 630 - 650 but i think it is improbable at this time. especially when more iphone 5 sales data is coming in the coming weeks. plus the shares buy back will kick off next month.iPhone5 numbers won't be in 2012 Q4 yet. I think it will be another disappointment because everyone was holding off buying iPhones. Definitely will be using the dips to trade AAPL here. Come back down to the 630'-650'.. for another ride. Added on September 18, 2012, 4:04 am700 in the after hours. I am loving this. Easy money. Added on September 18, 2012, 4:42 am QUOTE(DJJD @ Aug 30 2012, 01:58 PM) Absolutely buying NOK is speculation - and I have never claimed otherwise. Just checking the previous posts when i was not around and stumble to this. The difference between us? I am buying NOK with eyes open as a speculative turnaround trade while you (if you can be believed) are buying a speculative permabull trade as a fundamental portion of your portfolio. That makes one of us delusional. Guess who. Before you tout the old 120B of cash blah blah, remember, that: AAPL is trading 6 times NBV while PSR is only 1.6 (just barely positive above the margin of 1.5). To put those numbers in perspective, to reach your touted $1000 share price (market cap: USD$1T): To maintain the same NBV & PSR ratio, AAPL will need to double its net book value while annual revenue will need to grow by another 70% minimum. All this while already being the most valuable company in history. Logical? Well I suppose miracles do happen......... I do not want to be rude but why are you looking at how many times of net book value?? You should be looking at how many times the Earnings i.e. PE ratio. If AAPL manage to double the earnings without increasing its NBV, do you have a problem with that?? The price is going to double anyway. by the way, where did you get the Price-to-sales ratio of 1.6? please double check on that. You are using all the wrong ratios to justify a stock price. I sincerely wish you Good luck in your future investment. So being said. i am not predicting AAPL to double up EPS so quickly. I am anticipating a share price around 770 - 800 by jan 2013. and the Trillion Dollar mark will come somewhere in 2015. Long term i am super bullish, but there will be dips which come by every now and then. but with this current market, any dips would be bought up quickly. This post has been edited by pinkdevil88: Sep 18 2012, 06:01 AM |

|

|

Sep 19 2012, 01:15 PM Sep 19 2012, 01:15 PM

|

Junior Member

345 posts Joined: Sep 2005 From: Shah Alam |

Hello buddies, complete newbie here. Just opened an account at Firstrade and sent off the paperwork. Want to dip my toes with maybe around RM20-30k but it's not pocket change so don't want to lose it all at one shot!

What got me interested in the first place was stratospheric AAPL rise. Many analysts in the last 24 hours are revising target price to $1k, so looks promising still. Have been reading on some basic stuff, but of course when it comes time to actually spend the money it can be a bit scary. Any quick tips for a newbie? Still somewhat intent on AAPL, but can't help thinking playing with smaller counters would be a little more fun. |

|

|

|

|

|

Sep 19 2012, 02:15 PM Sep 19 2012, 02:15 PM

|

Senior Member

1,410 posts Joined: Jan 2010 |

QUOTE(DeaDLocK @ Sep 19 2012, 01:15 PM) Hello buddies, complete newbie here. Just opened an account at Firstrade and sent off the paperwork. Want to dip my toes with maybe around RM20-30k but it's not pocket change so don't want to lose it all at one shot! If you want bullish opinion on AAPLWhat got me interested in the first place was stratospheric AAPL rise. Many analysts in the last 24 hours are revising target price to $1k, so looks promising still. Have been reading on some basic stuff, but of course when it comes time to actually spend the money it can be a bit scary. Any quick tips for a newbie? Still somewhat intent on AAPL, but can't help thinking playing with smaller counters would be a little more fun. You can just ask the person on top of you He/She VERY bullish on AAPL |

|

|

Sep 19 2012, 09:27 PM Sep 19 2012, 09:27 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(Myoswee @ Sep 19 2012, 02:15 PM) If you want bullish opinion on AAPL The AAPL bulls will continue to pile and stack on top of each other (crowd effect) when they see AAPL price continues to move up..and the stacking won't stop until it become too heavy, then only we see prices crumbling down. What one want be careful here is not to be the last bull on top of the pyramid here. So, be nimble and careful when you play AAPL especially playing the time decaying options. You can just ask the person on top of you He/She VERY bullish on AAPL Now, with Uncle Ben's virtually unlimited PUTs on the market.. perhaps it is time to take a seconds look at the banks and the REITs again. I think they're much better play now. For eg. BAC - this piece of garbage it slowly turning itself into a little nugget. For REITs, I'm eyeing commercial ones like PLD. IMO, the pull backs are to be bought. |

|

|

Sep 19 2012, 09:37 PM Sep 19 2012, 09:37 PM

|

Junior Member

176 posts Joined: Feb 2010 |

QUOTE(danmooncake @ Sep 19 2012, 09:27 PM) The AAPL bulls will continue to pile and stack on top of each other (crowd effect) when they see AAPL price continues to move up..and the stacking won't stop until it become too heavy, then only we see prices crumbling down. What one want be careful here is not to be the last bull on top of the pyramid here. So, be nimble and careful when you play AAPL especially playing the time decaying options. You are looking at AAPL price. Please look at the stock value. Truth is, the share price has a hard time catching up with their earnings growth for the past years. Looking at the iPhone 5 sales, AAPL is very promising going into 2013. I am now having a tough time predicting iPhone sales in Q1, just too many variables to play around with, china mobile, supply constraints, stock channel etc. But anyways, I can guarantee you that it will be a blowout earnings. Just wait and see.Now, with Uncle Ben's virtually unlimited PUTs on the market.. perhaps it is time to take a seconds look at the banks and the REITs again. I think they're much better play now. For eg. BAC - this piece of garbage it slowly turning itself into a little nugget. For REITs, I'm eyeing commercial ones like PLD. IMO, the pull backs are to be bought. Was looking at BAC the other day as I think QE3 will benefit them the most. But based on their earnings, they will probably earn flat the next year. so short term wise their fair value will be around 10 - 12. Could not justify a higher Price than that based on valuations. Of course in the longer term, 5 years horizon, BAC is definitely a bargain at current price. This post has been edited by pinkdevil88: Sep 19 2012, 09:48 PM |

|

|

Sep 19 2012, 09:38 PM Sep 19 2012, 09:38 PM

|

Senior Member

1,410 posts Joined: Jan 2010 |

QUOTE(danmooncake @ Sep 19 2012, 09:27 PM) The AAPL bulls will continue to pile and stack on top of each other (crowd effect) when they see AAPL price continues to move up..and the stacking won't stop until it become too heavy, then only we see prices crumbling down. What one want be careful here is not to be the last bull on top of the pyramid here. So, be nimble and careful when you play AAPL especially playing the time decaying options. I'm looking at wfcNow, with Uncle Ben's virtually unlimited PUTs on the market.. perhaps it is time to take a seconds look at the banks and the REITs again. I think they're much better play now. For eg. BAC - this piece of garbage it slowly turning itself into a little nugget. For REITs, I'm eyeing commercial ones like PLD. IMO, the pull backs are to be bought. Seems it broke a 3 year trend |

|

|

Sep 19 2012, 09:45 PM Sep 19 2012, 09:45 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

Sep 20 2012, 04:11 PM Sep 20 2012, 04:11 PM

|

Senior Member

1,007 posts Joined: Oct 2006 From: island up north |

QUOTE(DeaDLocK @ Sep 19 2012, 01:15 PM) Hello buddies, complete newbie here. Just opened an account at Firstrade and sent off the paperwork. Want to dip my toes with maybe around RM20-30k but it's not pocket change so don't want to lose it all at one shot! If you're truly totally a newbie, pls get yourself educated first. Don't want you to get burnt on advertisement trading. It's usually the mistake of newbie. Buy when everyone else is buying but don't know when to get out. What is the purpose of you getting into the trade? Get lucky and make a few quick bucks or going to a long haul with specific target to achieve? How much time you're willing to spend monitoring and trading daily? There are a number of sites to get started but the first good article is on psychology of trading so you understand where you're at.What got me interested in the first place was stratospheric AAPL rise. Many analysts in the last 24 hours are revising target price to $1k, so looks promising still. Have been reading on some basic stuff, but of course when it comes time to actually spend the money it can be a bit scary. Any quick tips for a newbie? Still somewhat intent on AAPL, but can't help thinking playing with smaller counters would be a little more fun. » Click to show Spoiler - click again to hide... « This post has been edited by kimyee73: Sep 20 2012, 04:12 PM |

|

|

Sep 20 2012, 08:31 PM Sep 20 2012, 08:31 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

kimyee is correct. Newbie must first try to educate themselves first and perhaps try to papertrade BEFORE using your real money. Don't get suck in on what other people say or you hear it is easy to make money. Always do your own due diligence and know your risk. It is tough to navigate this market even for old timers like some of us. The market can turn around easily and teach one a very hard lesson that you'll never forget.

Right now, I think market is looking for an excuse to go back down.. watch out if you buying at the top here. Get those stops ready. |

|

|

|

|

|

Sep 21 2012, 11:33 AM Sep 21 2012, 11:33 AM

|

Senior Member

546 posts Joined: Nov 2011 |

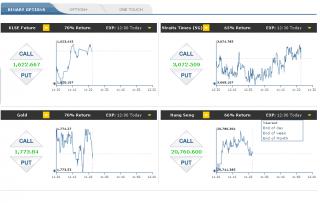

its good many sharing here with TA & FA, cum lets gamble on aapl & lvs, since expiry time very short small capital to burnt by just gambling it will go up or down, usd100 to open ac, usd25 per bet example, klse futures 1622.667 at this point, choose it to go up or down as it will expire every hour if buy up, klse futures close 1622.67, u win & vice versa, all u lose is usd25

I also just testing it out, no idea which is the better website & etc

gambling this 2 to go down

» Click to show Spoiler - click again to hide... «

|

|

|

Sep 21 2012, 09:08 PM Sep 21 2012, 09:08 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Wow! Look at the madness of the long lines of AAPL fans.. around the globe. Even crazy Wozniak lined up in Australia to get the the phone 17 hours ahead of US. I'm not sure what so great about iPhone 5 since it is playing catch up anyway, and disappointing. But, one must acknowledge AAPL price is a monster now.

This post has been edited by danmooncake: Sep 21 2012, 09:10 PM |

|

|

Sep 24 2012, 08:56 PM Sep 24 2012, 08:56 PM

|

Junior Member

166 posts Joined: Apr 2006 |

AAPL shares going down today. News on its supplier factory got temporarily close down due to 40 workers injury,

Already looking @ 2% drop from pre-market quotes. Looking to get in @ abt 679.00 COH went up to 62 , now down to 56 made good money from trending changes. Added on September 24, 2012, 9:01 pm QUOTE(danmooncake @ Sep 21 2012, 09:08 PM) Wow! Look at the madness of the long lines of AAPL fans.. around the globe. Even crazy Wozniak lined up in Australia to get the the phone 17 hours ahead of US. I'm not sure what so great about iPhone 5 since it is playing catch up anyway, and disappointing. But, one must acknowledge AAPL price is a monster now. Oh well, have u heard of a teen in China who would go all the way to SELL HIS KIDNEYS to get an Iphone?I doubt its about how good the phone is anymore, its the Brand. Moreover, from a marketing point of view, the best marketing strategy is people talking, I myself wouldnt go to an extend in comparing inches of detail from different phones, but oh well, why go against the trend when you can make money out of it? c: Added on September 24, 2012, 9:47 pmA turnover for AAPL when it announce that iPhone 5 breaks sales record of 4s. Nowonder Tim increases it's target higher . Looking at a bullish trend after the drop till Earnings report. This post has been edited by halofujima: Sep 24 2012, 09:47 PM |

|

|

Sep 25 2012, 02:08 AM Sep 25 2012, 02:08 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(halofujima @ Sep 24 2012, 08:56 PM) AAPL shares going down today. News on its supplier factory got temporarily close down due to 40 workers injury, Yes, it was actually the iPad (not iPhone) that the kid wanted to so bad that he sold his kidney for it. Absolutely stupid. Already looking @ 2% drop from pre-market quotes. Looking to get in @ abt 679.00 COH went up to 62 , now down to 56 made good money from trending changes. Added on September 24, 2012, 9:01 pm Oh well, have u heard of a teen in China who would go all the way to SELL HIS KIDNEYS to get an Iphone? I doubt its about how good the phone is anymore, its the Brand. Moreover, from a marketing point of view, the best marketing strategy is people talking, I myself wouldnt go to an extend in comparing inches of detail from different phones, but oh well, why go against the trend when you can make money out of it? c: Added on September 24, 2012, 9:47 pmA turnover for AAPL when it announce that iPhone 5 breaks sales record of 4s. Nowonder Tim increases it's target higher . Looking at a bullish trend after the drop till Earnings report. Now that the iPhone5 is out, I won't be surprised some people will do something stupid to get it despite it is just another high tech fad that will fad away is about 1 year. Anyway, over the weekend, the AAPL bulls were expecting 8m in sales during the launch but it only managed to grab 5m units (3m short of expecation but slightly more than iPhone4S - around 4m during launch). AAPL bulls now having second thoughts, so, the stock is being punished now. This post has been edited by danmooncake: Sep 25 2012, 02:10 AM |

|

|

Sep 25 2012, 08:50 AM Sep 25 2012, 08:50 AM

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(danmooncake @ Sep 25 2012, 02:08 AM) Yes, it was actually the iPad (not iPhone) that the kid wanted to so bad that he sold his kidney for it. Absolutely stupid. Suckers abound!Now that the iPhone5 is out, I won't be surprised some people will do something stupid to get it despite it is just another high tech fad that will fad away is about 1 year. Anyway, over the weekend, the AAPL bulls were expecting 8m in sales during the launch but it only managed to grab 5m units (3m short of expecation but slightly more than iPhone4S - around 4m during launch). AAPL bulls now having second thoughts, so, the stock is being punished now. |

|

|

Sep 26 2012, 05:24 AM Sep 26 2012, 05:24 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Looks like the sell signal finally came tonight.. CBOE Volatility spiked up 9%, industrial, commodities, etc.. all retreating.

Time to short this market.. |

|

|

Sep 26 2012, 09:38 AM Sep 26 2012, 09:38 AM

|

Senior Member

1,410 posts Joined: Jan 2010 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0388sec 0.0388sec

0.44 0.44

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 08:36 PM |