QUOTE(chabalang @ Sep 18 2011, 10:20 AM)

Just bumped into this thread. I am not a goldbug but do hold some gold in banks (as inflationary and 'doomsday' hedge). On Genneva Gold, the articles in media are more advertisements or 'publicity stunts' (normally, media will feature your company when you advertise or sponsor...'you scratch my back, I scratch yours').

I feel there is a need to clarify this matter for

the benefit of fellow forumers. I am not accusing Genneva Gold of anything and I let the information speaks for itself:

1) Genneva Gold placed on MAS (Singapore central bank) investor alert

http://www.moneysense.gov.sg/check_our_lis...Portal_IAL.html2) Business Times Singapore - Golden Fleece

This article explains clearly how the whole scheme works.

http://www.cpf.gov.sg/imsavvy/infohub_arti...119-9657861589}I rest my case.

thanks for ur link bro. its seems after u stating it..no reply from genneva investor. why issit so?

anyway, i help u post d full article bro.

QUOTE

IN THE last few months, netizens and investors have puzzled over a number of so- called gold investment schemes that aim to pay you regular returns. Are they scams? Gold, after all, does not pay any income, so how are the firms able to pay out as much as 24 per cent per annum?

Two firms with such schemes have been put on the Monetary Authority of Singapore's (MAS) Investor Alert list. The latest on the list is Genneva Pte Ltd.

Late last year, The Gold Label Pte Ltd was put on the list. The company has filed to wind up its operations, reportedly due to cash flow problems. MAS' Investor Alert list reflects persons who are unregulated, and 'may have been wrongly perceived as being licensed or authorised by MAS'.

There are similarities in The Gold Label and Genneva. They appear to be Malaysian in origin, or at least have Malaysian directors. Both were investigated by Bank Negara on suspicions of illegal deposit taking and money laundering.

Genneva Sdn Bhd was investigated in 2009. Three of its directors - who are also directors in the Singapore company - will stand trial in April in Kuala Lumpur on charges of alleged money laundering.

Bank Negara's investigation of The Gold Label started last year, and is ongoing, based on information on Bank Negara's website.

What exactly is the firms' investment proposition? Information on The Gold Label isn't widely available; its Singapore website has been taken down. The firms straddle a fine line between investment and a retail business.

Genneva, for example, has a police licence that enables it to sell second-hand jewellery, gold, and white gold. The fact that customers take home physical gold in the form of bars or coins suggests that the firm isn't taking a deposit or acting as investment manager.

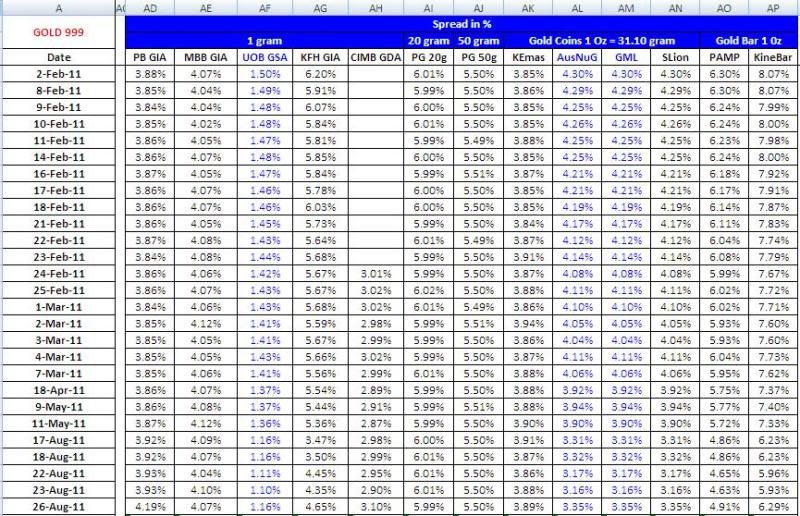

Here's how the scheme appears to work: Customers buy gold from Genneva at a fairly substantial premium to the market of about 22 to 25 per cent. This is based on a comparison of prices quoted by Genneva of roughly $75 to $76.50 per gram against the price quoted by UOB and other retail gold dealers of roughly $61.

Genneva tells customers that it sells the gold to them at a so-called 'discount' of between 1.5 and 2 per cent. It extends an option to customers: it will buy back the gold after 30 to 36 days or after 90 days depending on the scheme, at the original full purchase price. Those who exercise this get to keep the 'discount' of 1.5 to 2 per cent.

Customers may rollover the purchase, and hence they could potentially pocket as much as 18 to 24 per cent a year, from an asset that actually doesn't pay any yield.

How is this done? Genneva has declined to answer questions for now, citing the pending court case in Malaysia. It adds in an e-mail that it expects a 'positive outcome' from the court case.

There are a number of aspects that should cause scepticism. First, the firm illustrates its buyback option on its website in a rather disingenuous fashion. It says customers buy gold at a 'discounted market price'.

But the truth is customers buy gold at a sizeable premium to the market. The firm also does not explain what it does with the premium that it pockets. Presumably commissions are paid to the sales people.

Its website says it has a 'proprietary trading platform' which enables it to 'adopt an active hedging and leveraging strategy' that makes the buy-back option possible.

On whether the scheme is Ponzi in nature, The firm's Malaysian counterpart told a Malaysian paper in 2009 that it is 'obvious' that it is not a Ponzi scheme.

What is likely to transpire is that the firm takes the 22 to 25 per cent premium that it gets from customers' purchases, and after paying off costs and commissions, it could buy and sell options on gold, through which it hedges its exposure.

As long as the gold price rises or is steady, it can continue, and even thrive, as it sources for gold at substantially lower prices on the open market. If gold however drops on a sustained basis, it could face a cash crunch if investors rush to sell back their gold in substantial numbers. This is because it is obligated to buy back the gold from clients at a high price.

Those who enter the scheme are likely to be enamoured of the so-called return, but they face two major risks - price and counterparty risk. As long as gold rises enough to cover their cost, they could sell their Genneva gold in the open market. Over the last year, gold has risen some 26 per cent, based on spot prices.

If gold falls substantially, however, the counterparty risk becomes a material one, as you can recover your cost only if Genneva stays solvent. Those who roll over their purchases must reckon that the potential return far outweighs the risk of loss. Genneva agents tell investors that the worst loss they may suffer is about 20 to 22 per cent, roughly the premium they have paid.

Effectively, Genneva has sold investors a put option along with gold, charging them a premium for it, and sweetening that by sharing some of that premium at the end of the contract period of a month or three months. As the put option writer, Genneva's risk is potentially unlimited if it has not hedged its exposure.

Rollovers, by the way, incur price risk - that is, you re-purchase the gold at the price Genneva quotes you which is presumably pegged to the market price. If gold rises, as it has over the last year, you end up investing larger amounts.

So, who is Genneva? According to filings with Acra (Accounting and Corporate Regulatory Authority), it was registered as a business in 2008 dealing in gold bullion. It has an issued and paid-up capital of $500,000.

Three shareholders are Malaysian, and they are the same ones who will have to fight money laundering charges in Malaysian court. There is one Singapore shareholder. Attempts to contact him were unsuccessful as he was reportedly travelling or in meetings.

There are clearly more transparent ways to invest in gold, without dealing with a counterparty which could shutter its operations as The Gold Label did.

UOB offers a gold investment account, for instance, where you can hold physical gold and re-sell it to the bank. Those who need not buy physical gold but want a piece of its price action can get it through the SPDR Gold ETF. The latter is exchange listed and is easily traded through a broker.

Aug 27 2011, 06:00 AM

Aug 27 2011, 06:00 AM

Quote

Quote

0.0302sec

0.0302sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled