Outline ·

[ Standard ] ·

Linear+

Buying Gold As Investment V3 - $1950?, Gold rush brings windfalls and warnings

|

DM3

|

Aug 27 2011, 09:03 PM Aug 27 2011, 09:03 PM

|

|

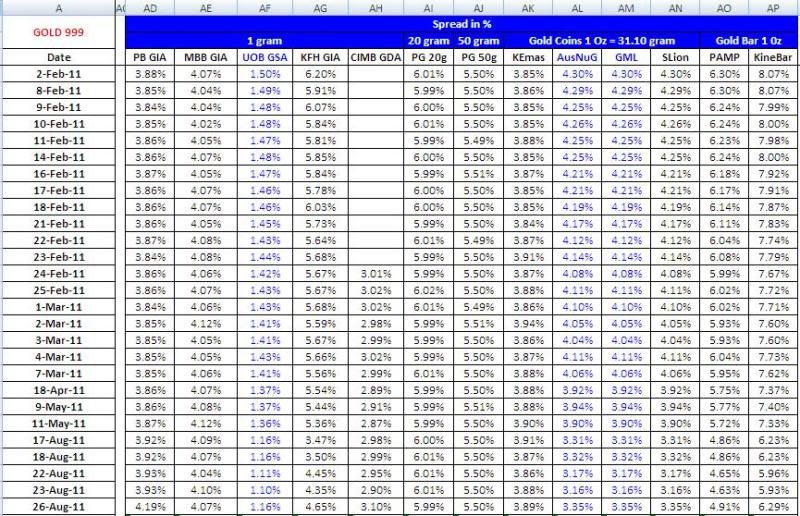

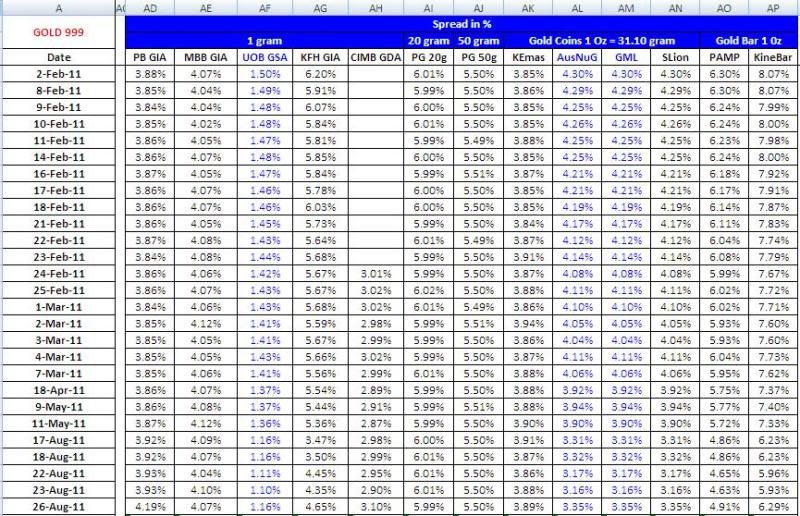

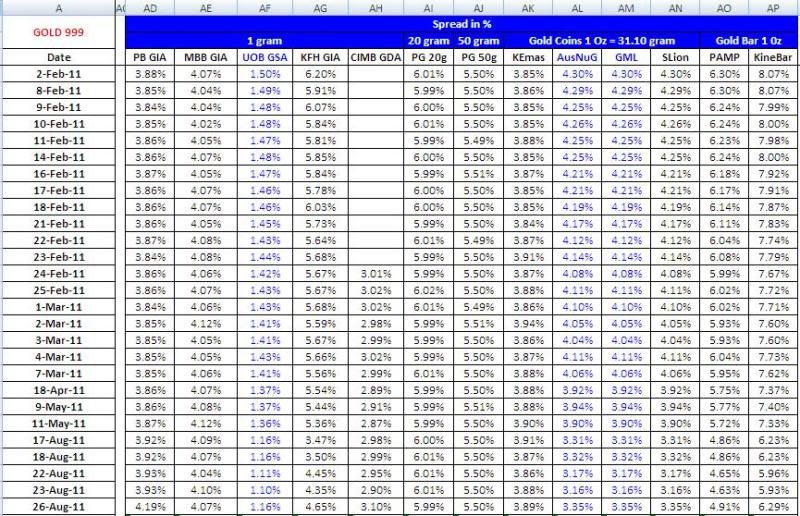

QUOTE(mrsmytb @ Aug 27 2011, 08:27 PM) For Beginner. Spread Analysis - Paper Gold and Physical Gold.  Note: Spread - The lowest, the better. KFH is 995. Others 999. thanks for the useful info. if we show it to MBB maybe they'll revised it for competition purpose  |

|

|

|

|

|

DM3

|

Aug 29 2011, 09:28 AM Aug 29 2011, 09:28 AM

|

|

ya how bout buying gold in singapore?hows the spread?

|

|

|

|

|

|

DM3

|

Aug 29 2011, 10:14 AM Aug 29 2011, 10:14 AM

|

|

QUOTE(eXTaTine @ Aug 29 2011, 10:04 AM) Paper Gold is good, can get from UOB. But don't buy physical, it sucks as GST is charged ok thanks, i guess Uob's spread also low as in here eh. |

|

|

|

|

|

DM3

|

Sep 1 2011, 11:19 AM Sep 1 2011, 11:19 AM

|

|

banks still close today right?

|

|

|

|

|

|

DM3

|

Sep 21 2011, 02:17 PM Sep 21 2011, 02:17 PM

|

|

all these predictions just take it in as a pinch of salt .

|

|

|

|

|

|

DM3

|

Sep 26 2011, 12:30 PM Sep 26 2011, 12:30 PM

|

|

oh no, really goin down now?

|

|

|

|

|

|

DM3

|

Sep 26 2011, 12:46 PM Sep 26 2011, 12:46 PM

|

|

short dip or will climb up again? so goin to buy more eh guys?

|

|

|

|

|

|

DM3

|

Sep 27 2011, 11:47 PM Sep 27 2011, 11:47 PM

|

|

usually investing in gold should be longer term, dont think can make much in very short term

|

|

|

|

|

|

DM3

|

Sep 28 2011, 11:51 AM Sep 28 2011, 11:51 AM

|

|

ya i dont thing it'll drop as much, its more likely the USD will die 1st. past 20 yrs trend vs usd tells alot  |

|

|

|

|

|

DM3

|

Sep 28 2011, 04:05 PM Sep 28 2011, 04:05 PM

|

|

Gold Climbs for Second Day as Investors Seek Haven From Declining Assets

Q

By Glenys Sim - Sep 28, 2011 3:25 PM GMT+0800

Tweet

inShare

More Print Email

Gold gained for a second day, set for a 12th quarterly advance, as investors sought a haven from declining assets including oil and copper on concern European leaders may fail to contain the region’s debt crisis.

Immediate-delivery gold rose as much as 1.2 percent to $1,669.07 an ounce and traded at $1,662.20 at 3:17 p.m. in Singapore. Futures gained before reports that economists say may show U.S. durable goods orders dropped, while European consumer confidence may have slumped to a two-year low in September.

“The recent price declines have been because other markets are falling and some investors have to sell their gold to meet margin calls,” d*** Poon, precious metals trading manager at Heraeus Ltd., said by phone from Hong Kong. “The debt situation in Europe hasn’t changed and as that goes on, we continue to see strong demand for gold, which will keep prices supported.”

Some euro-area countries are demanding private creditors take bigger writedowns on their Greek bond holdings, the Financial Times reported, citing European officials, sending commodities lower and driving the euro down against the dollar.

December-delivery bullion advanced as much as 1.2 percent to $1,672 an ounce in New York before trading at $1,664.10.

“The only negative for gold that we can see is the recent U.S. dollar rally,” Daiwa Capital Markets analysts including Deep Kapur wrote in a note. “As far as we can tell, the buy-on- dips mentality is still intact.”

Platinum Ratio

Spot gold has rallied 17 percent this year as investors sought to diversify from declining equities and depreciating currencies. The precious metal, which reached an all-time high of $1,921.15 on Sept. 6, has climbed 11 percent this quarter.

The ratio of platinum to gold slumped to the lowest level since 1992, a sign that investors may be concerned the sovereign-debt risk in Europe is escalating, potentially trimming demand for metals with industrial uses. One ounce of platinum bought as little as 0.9386 ounce of gold today.

“Platinum and palladium, like silver, are still industrial metals and if there are worries about the economy, the price will go down,” said Poon.

Cash silver gained 1.5 percent to $32.37 an ounce while December-delivery futures advanced 2.7 percent to $32.395 an ounce. Spot platinum was little changed at $1,562.18 an ounce and palladium gained 0.9 percent to $653.50 an ounce.

To contact the reporter for this story: Glenys Sim in Singapore at gsim4@bloomberg.n

|

|

|

|

|

|

DM3

|

Oct 20 2011, 12:55 PM Oct 20 2011, 12:55 PM

|

|

buyin gold/GSA in sg UOB subject to 0.25% /annum but selling it about sgd 0.20 difference

today sell buy

GOLD SAVINGS A/C SGD 1 GM 66.65 66.45

Added on October 20, 2011, 12:56 pmworth it?

This post has been edited by DM3: Oct 20 2011, 12:56 PM

|

|

|

|

|

Aug 27 2011, 09:03 PM

Aug 27 2011, 09:03 PM

Quote

Quote 0.0203sec

0.0203sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled