QUOTE(ronnie @ Mar 4 2011, 07:28 AM)

Pretty good rate.FD rates in Malaysia, Which bank offer the highest FD rates?

FD rates in Malaysia, Which bank offer the highest FD rates?

|

|

Mar 4 2011, 01:09 PM Mar 4 2011, 01:09 PM

Return to original view | Post

#41

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

|

|

|

|

|

|

Mar 9 2011, 05:36 PM Mar 9 2011, 05:36 PM

Return to original view | Post

#42

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

|

|

|

Mar 9 2011, 05:47 PM Mar 9 2011, 05:47 PM

Return to original view | Post

#43

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

|

|

|

Mar 10 2011, 08:28 AM Mar 10 2011, 08:28 AM

Return to original view | Post

#44

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(den @ Mar 10 2011, 12:21 AM) usually for FD promotions, UOB, OCBC, RHB and Alliance don't put it up on their website. Need to get info at branch. Would appreciate those reporting FD promotion do state the T&C instead of misleading readers here thinking that is applicable like normal FD. |

|

|

Mar 10 2011, 12:05 PM Mar 10 2011, 12:05 PM

Return to original view | Post

#45

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

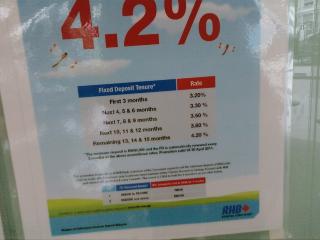

I was at RHB and took the photo below but quality not good as had to "bend" down and took it with my old Samsung slider as left the BB at home.

RHB got FD promotion up to 15 months 4.2% Terms and Conditions - 1. Need to have current or savings account 2. New Fund RM50K - RM199K must deposit RM5K into CASA and maintain for 3 months 3. RM200K and above to deposit RM10K into CASA and maintain 3 months too. Interest will be banked into CASA. Attached thumbnail(s)

|

|

|

Mar 10 2011, 12:55 PM Mar 10 2011, 12:55 PM

Return to original view | Post

#46

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(aeiou228 @ Mar 10 2011, 12:26 PM) Ops...! upon closer look at the picture, it was tiered rates. then can't be 4.18% already. Should be around 3.50% on average for 15 mths placement. Nowadays, banks also like to confuse people just like mobile telcos. Me and Gen X also almost get misleaded and I'm sure aunty aunty surely kena the advertising trick by RHB. Yalah, it is based on tiers |

|

|

|

|

|

Mar 10 2011, 01:31 PM Mar 10 2011, 01:31 PM

Return to original view | Post

#47

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(gerrardling @ Mar 10 2011, 01:26 PM) Basically the offer you have to deposit your money for 15 months tenure from the start and interest paid every 3 months into Savings or Current Account and the interest earned is as follows:First 3 months 3.2% following 4th ,5th and 6th month 3.3% and 7,8,9 month 3.5 and 10,11,12 month 3.8 and finally for the 13th to 15th you earn interest of 4.2% on the principal/ |

|

|

Mar 10 2011, 02:50 PM Mar 10 2011, 02:50 PM

Return to original view | Post

#48

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

Okay here are the T&C for the OCBC promotional rate posted yesterday.

Minimum amount RM10K and promotion period 21st March to 25th March only. You got 5 days to get 3.9% for 9 months FD at OCBC. No other conditions I were told. |

|

|

Mar 10 2011, 08:48 PM Mar 10 2011, 08:48 PM

Return to original view | Post

#49

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(bearbear @ Mar 10 2011, 07:07 PM) 3.6 or 3.9? 3.9% for 9 months. Of course the Ambank's 5 year tenure rate is better. But you must note that AMbank pays you the interest every 6 months (which is good if you don't spend it away) and the interest is not compounded at the same rate. Also 5 years is a long time.hmm heck think i would just go for ambank 5 yrs, kinda troublesome wanna move the money here n there |

|

|

Mar 11 2011, 06:52 AM Mar 11 2011, 06:52 AM

Return to original view | Post

#50

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

|

|

|

Mar 12 2011, 05:14 PM Mar 12 2011, 05:14 PM

Return to original view | Post

#51

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(rstusa @ Mar 12 2011, 04:55 PM) Max RM250K per account per bank.If you got 5 accounts in a bank say yourself, you+father, you+mother, you+wife, you+child, etc, the government guarantees you RM250K per account so the total becomes RM1,250,000. Google PIDM. The other day PM was in Australia say foreign shareholding can be raised to 49% for Ambank if not mistaken but 2 days back said no maintain at 30%. The safest bank in Malaysia to put your money is Affin Bank, the major shareholder in Lembaga Angkatan Tentera. Nobody dares to swindle the armed forces |

|

|

Mar 19 2011, 12:41 PM Mar 19 2011, 12:41 PM

Return to original view | Post

#52

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(Gen-X @ Mar 10 2011, 02:50 PM) Okay here are the T&C for the OCBC promotional rate posted yesterday. Reminders to you guys, you have 5 days next week to enjoy 3.9% for 9 months FD.Minimum amount RM10K and promotion period 21st March to 25th March only. You got 5 days to get 3.9% for 9 months FD at OCBC. No other conditions I were told. |

|

|

Mar 19 2011, 05:26 PM Mar 19 2011, 05:26 PM

Return to original view | Post

#53

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(Lis000 @ Mar 19 2011, 03:09 PM) Is there a link for this promotion? Best you call the nearest OCBC branch on Monday to confirm.Was trying to look for this promotion on the OCBC website but can't seem to find it? Only found this one : http://www.ocbc.com.my/personal-banking/Pr...L_CAMPAIGN.shtm 3 months - 3.15% 9 months - 3.25% |

|

|

|

|

|

Mar 21 2011, 03:59 PM Mar 21 2011, 03:59 PM

Return to original view | Post

#54

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

I did go to OCBC today and the 9 months FD rate is 3.6% Offer until end of this Friday. Minimum RM10K and no other conditions.

|

|

|

Mar 21 2011, 04:25 PM Mar 21 2011, 04:25 PM

Return to original view | Post

#55

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(lonewolf8 @ Mar 21 2011, 04:23 PM) The AmBank FD rates has been revised from 4.68% to 4.30%. Interest is paid upon the maturity of the tenure i.e. 5 years Wah, not every 6 months? Five years interest compounded or not? If not compounded not very good deal. How about for senior citizens, would the interest be banked into the savings account monthly. |

|

|

Mar 21 2011, 05:58 PM Mar 21 2011, 05:58 PM

Return to original view | Post

#56

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

|

|

|

Mar 21 2011, 06:08 PM Mar 21 2011, 06:08 PM

Return to original view | Post

#57

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

|

|

|

Mar 22 2011, 08:49 PM Mar 22 2011, 08:49 PM

Return to original view | Post

#58

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

|

|

|

Mar 23 2011, 04:43 PM Mar 23 2011, 04:43 PM

Return to original view | Post

#59

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(leongal @ Mar 23 2011, 03:05 PM) just calculated, if i take up the PBB step up rates, RM 10,000 - lock up for 10 months, at prevailing rate of 2.75% per annum, compared to a normal monthly renewable fd, onli earns you an additional rm23.41 better go deposit at OCBC before 25th March 2011 and get 3.6% p.a. for 9 months. |

|

|

Mar 23 2011, 08:03 PM Mar 23 2011, 08:03 PM

Return to original view | Post

#60

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

|

|

Topic ClosedOptions

|

| Change to: |  0.0241sec 0.0241sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 11:40 PM |