QUOTE(lunchtime @ Jan 6 2012, 02:41 PM)

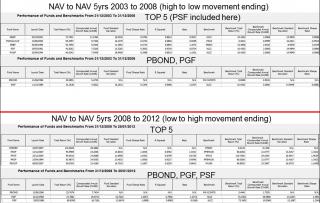

Lunchtime, while i'm in agreement with U that not all funds are ichiban / best thing since sliced bread, as an investor, i'd also look at different time lines, not just current to have better comparisons.

Example:

If i chose to check on PCIF:

1. From inception till now or end 2008 - performance sucks

2. from 23/01/2009 till now - low returns but not negative.

Thus, for an example depending on the entry/exit approach of an investor, if value averaging was done, although kinda miserable (PCIF), one may eek out some returns. Heheh - unsure ar, as i've no data on PCIF's divends and stuff. The only data i have are the NAVs attached.

Mind U, even the supposedly super duper PSmallCap, when viewed in end period of end 2008/early 2009 sucks to high heaven too

and personally, my other Pru SmallCap fund sucked too during those end periods.

Just sharing a thought on different "end period" time lines effects on a fund or any funds, not the only truth yar

Added on January 6, 2012, 4:03 pmQUOTE(Kaka23 @ Jan 6 2012, 03:56 PM)

I notice almost all china funds not only PM, but also other fund house not doing very well based on past records.

Hence, if ppl already bought this fund and dont want to lose money, I think only way is keep on DDI and buy more when if drops alot. Well.. to me, China funds will take longer to break even..

Well, IMHO, if 3 years+ tak jadi AND the current period is not a down-er (eg. end 2008/early 2009 kinda thing), i'd give it up and look to move into another equity fund. Hehhe - i'd just fix the mistake and admit my stupidity in picking that dang thing.

Pls note yar, this is just my own methods - may be illogical to others.

This post has been edited by wongmunkeong: Jan 6 2012, 04:16 PM Attached File(s) PCIF.zip

PCIF.zip ( 17.35k )

Number of downloads: 46

Nov 25 2011, 08:33 AM

Nov 25 2011, 08:33 AM

Quote

Quote

0.0526sec

0.0526sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled