QUOTE

LHDN website: http://www.hasil.gov.my/

e-filing website: https://e.hasil.gov.my/

e-lejar website: http://www.hasil.gov.my/

e-filing website: https://e.hasil.gov.my/

e-lejar website: http://www.hasil.gov.my/

QUOTE

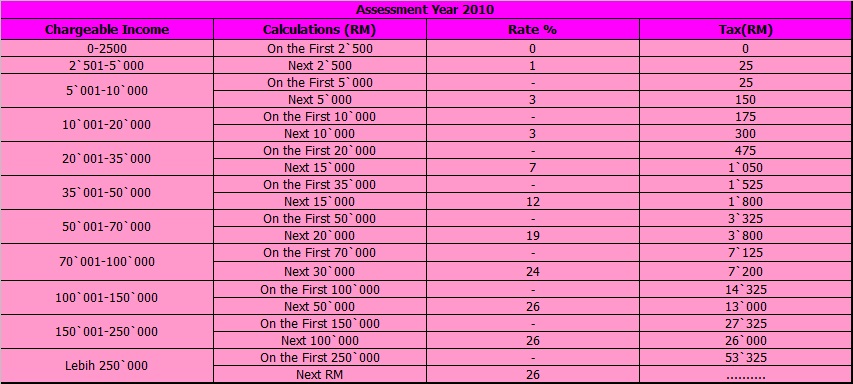

Tax brackets: http://www.hasil.gov.my/goindex.php?kump=5...it=5000&sequ=11

PCB table 2010: http://www.hasil.gov.my/pdf/pdfam/SCHEDULESTD2010.pdf

PCB table 2012: http://www.hasil.gov.my/pdf/pdfam/MTD_Notes_2012.pdf

PCB table 2010: http://www.hasil.gov.my/pdf/pdfam/SCHEDULESTD2010.pdf

PCB table 2012: http://www.hasil.gov.my/pdf/pdfam/MTD_Notes_2012.pdf

QUOTE

Taxable source of incomes: http://www.hasil.gov.my/goindex.php?kump=5...nit=5000&sequ=4

Eligible personal relieves: http://www.hasil.gov.my/goindex.php?kump=5...3&unit=1&sequ=1

Eligible personal rebates: http://www.hasil.gov.my/goindex.php?kump=5...5&unit=1&sequ=1

Eligible donation & gifts: http://www.hasil.gov.my/goindex.php?kump=5...4&unit=1&sequ=1

Eligible personal relieves: http://www.hasil.gov.my/goindex.php?kump=5...3&unit=1&sequ=1

Eligible personal rebates: http://www.hasil.gov.my/goindex.php?kump=5...5&unit=1&sequ=1

Eligible donation & gifts: http://www.hasil.gov.my/goindex.php?kump=5...4&unit=1&sequ=1

Previous version: http://forum.lowyat.net/topic/1840158

QUOTE

BE 2011:

Sample manual 2011 BE form: http://www.hasil.gov.my/pdf/pdfborang/Borang_BE_2011_1.pdf

Guide to fill: http://www.hasil.gov.my/pdf/pdfam/BP_BE2011_1.pdf

Explanatory notes: http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2011_1.pdf

BE 2012:

Explanatory notes: http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2012_1.pdf

Sample manual 2011 BE form: http://www.hasil.gov.my/pdf/pdfborang/Borang_BE_2011_1.pdf

Guide to fill: http://www.hasil.gov.my/pdf/pdfam/BP_BE2011_1.pdf

Explanatory notes: http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2011_1.pdf

BE 2012:

Explanatory notes: http://www.hasil.gov.my/pdf/pdfam/Nota_Pen...an_BE2012_1.pdf

Tax for dividend and distribution:

» Click to show Spoiler - click again to hide... «

QUOTE

Tax offences, fine and penalty: http://www.hasil.gov.my/goindex.php?kump=5...1&cariw=penalti

How to apply for e-filing PIN:

QUOTE

Bagaimana Mendapatkan No. PIN ?

1. Pada BNCP yang dihantar

2. Hadir ke Cawangan LHDNM yang berhampiran

3. Memohon melalui telefon/surat/faks (salinan kad pengenalan perlu dikemukakan sebagai pengesahan)

Option (3):

Permohonan No. PIN e-Filing (secara online)

Permohonan nombor PIN melalui emel perlu dibuat dengan mengisi Borang Maklumbalas Pelanggan. Sila lampirkan dokumen pengenalan semasa mengisi Borang Maklumbalas Pelanggan. Sila klik di sini untuk ke Borang Maklumbalas Pelanggan

URL for BORANG MAKLUMBALAS PELANGGAN: http://www.hasil.gov.my/smp/

1. Pada BNCP yang dihantar

2. Hadir ke Cawangan LHDNM yang berhampiran

3. Memohon melalui telefon/surat/faks (salinan kad pengenalan perlu dikemukakan sebagai pengesahan)

Option (3):

Permohonan No. PIN e-Filing (secara online)

Permohonan nombor PIN melalui emel perlu dibuat dengan mengisi Borang Maklumbalas Pelanggan. Sila lampirkan dokumen pengenalan semasa mengisi Borang Maklumbalas Pelanggan. Sila klik di sini untuk ke Borang Maklumbalas Pelanggan

URL for BORANG MAKLUMBALAS PELANGGAN: http://www.hasil.gov.my/smp/

This post has been edited by David83: Apr 16 2013, 08:07 PM

Jun 2 2011, 10:31 PM, updated 12y ago

Jun 2 2011, 10:31 PM, updated 12y ago

Quote

Quote

0.3349sec

0.3349sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled