QUOTE(alexwsk @ Apr 27 2019, 07:44 PM)

Noted with thanks.Credit Card Foreign Exchange Rate

Credit Card Foreign Exchange Rate

|

|

Apr 28 2019, 11:58 PM Apr 28 2019, 11:58 PM

Show posts by this member only | IPv6 | Post

#1641

|

Senior Member

711 posts Joined: Jan 2006 |

|

|

|

|

|

|

May 13 2019, 04:27 PM May 13 2019, 04:27 PM

|

All Stars

65,273 posts Joined: Jan 2003 |

QUOTE(Vex86 @ May 13 2019, 03:35 PM) Hi everyone, just want to see what is the correct way to calculate overseas transaction when using AMEX. bump you hereFrom maybank: "All foreign charges converted by American Express apply a conversion factor of 2.5% to the converted amount. A charge that is made in foreign currency other than U.S. Dollars will, when the conversion is done by American Express, be converted into U.S. Dollars before being converted in the cardmember billing currency." Say, Purchase amt : USD 100 Exch rate: 4.15 will the calculation be USD100 * 4.15 = MYR 415 * 1.025 = 425.38 is my understanding correct? Hope someone here could help got examples in here. search/read it through. |

|

|

May 14 2019, 10:39 AM May 14 2019, 10:39 AM

|

Senior Member

1,611 posts Joined: Aug 2005 |

Msg from maybank:

Please be informed for credit card usage via the overseas online website or overseas, there will be additional charge 2.25% (VISA and Mastercard) on top of the purchase while for AMEX card will be 2.5% on top of the purchase amount. The conversion rate is based on Visa/Master International currency rates. The calculation will follow the currency rate on the day the merchant made the claim with Maybank. 1.25% + 1% = 2.25% for Visa/Master credit cards. Hopes that this clarifies. Thank you. means the 1.25% is the visa conversion rate and 1% is bank rate? so means if use visa calculator, bank fee put 1% or 2.25%? https://usa.visa.com/support/consumer/trave...calculator.html |

|

|

May 14 2019, 09:26 PM May 14 2019, 09:26 PM

|

Junior Member

283 posts Joined: Mar 2015 |

QUOTE(naruko85 @ May 14 2019, 10:39 AM) Msg from maybank: For the website link to visa, the bank fee is 2.25%.Please be informed for credit card usage via the overseas online website or overseas, there will be additional charge 2.25% (VISA and Mastercard) on top of the purchase while for AMEX card will be 2.5% on top of the purchase amount. The conversion rate is based on Visa/Master International currency rates. The calculation will follow the currency rate on the day the merchant made the claim with Maybank. 1.25% + 1% = 2.25% for Visa/Master credit cards. Hopes that this clarifies. Thank you. means the 1.25% is the visa conversion rate and 1% is bank rate? so means if use visa calculator, bank fee put 1% or 2.25%? https://usa.visa.com/support/consumer/trave...calculator.html As for AMEX, the conversion is first to USD then to MYR. There is double conversion. Then apply 2.5%. |

|

|

May 15 2019, 08:18 AM May 15 2019, 08:18 AM

|

Senior Member

1,611 posts Joined: Aug 2005 |

|

|

|

May 15 2019, 09:08 AM May 15 2019, 09:08 AM

|

All Stars

14,922 posts Joined: May 2015 |

|

|

|

|

|

|

May 15 2019, 09:17 AM May 15 2019, 09:17 AM

|

Senior Member

1,611 posts Joined: Aug 2005 |

|

|

|

May 15 2019, 12:21 PM May 15 2019, 12:21 PM

|

Junior Member

321 posts Joined: Sep 2018 |

for me formula oversea as below

1) Use BigPay Card (use credit load max 10k inside) 2) Use Amex 2card in weekend enjoy 5% rebate 3) If all above finish then use MasterCard instead Visa because i think better rate |

|

|

May 21 2019, 09:39 AM May 21 2019, 09:39 AM

Show posts by this member only | IPv6 | Post

#1649

|

Senior Member

2,126 posts Joined: Sep 2008 From: Kedah |

Anyone got problem using MasterCard for oversea transaction? Mine local no problem, oversea it keep on saying card not authorized

|

|

|

May 21 2019, 08:50 PM May 21 2019, 08:50 PM

|

Senior Member

1,516 posts Joined: Oct 2005 |

QUOTE(yshiuan @ May 21 2019, 09:39 AM) Anyone got problem using MasterCard for oversea transaction? Mine local no problem, oversea it keep on saying card not authorized is your card issuer local bank or international bank?local bank usually need you to call to activate overseas spending for precaution purpose. international bank usually activated as default this nothing to do with mastercard or visa tho |

|

|

Jun 27 2019, 08:53 AM Jun 27 2019, 08:53 AM

|

Senior Member

7,924 posts Joined: Jul 2009 |

is HSBC still at 1.25%? and is the same for Visa and Master?

|

|

|

Jul 19 2019, 02:30 PM Jul 19 2019, 02:30 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

need help, what is the mbb visa and mbb amex exchange rate if to pay online with australian dollar currency?

|

|

|

Jul 20 2019, 11:55 PM Jul 20 2019, 11:55 PM

|

Junior Member

283 posts Joined: Mar 2015 |

QUOTE(spreeeee @ Jul 19 2019, 02:30 PM) need help, what is the mbb visa and mbb amex exchange rate if to pay online with australian dollar currency? For Visa,Use the following link: https://usa.visa.com/support/consumer/trave...calculator.html Bank fee is 2.25% For AMEX, Bank fee is 2.5% No use using AMEX overseas because the bank fee is higher, and they will convert from AUD to USD to MYR. You "lose" in forex exchange twice. |

|

|

|

|

|

Jul 21 2019, 09:43 AM Jul 21 2019, 09:43 AM

|

Probation

12 posts Joined: Jul 2019 |

Used PBB Visa on a JPY transaction

Date: 17 July 2019 Amount: 25850 Visa Website: 1001.06 (after taking into account 1.25% bank charge). PBB Amount: 1006.38 1006.38 - 1001.06 = 5.32 5.32 / 1001.06 x 100 = 0.53%+1.25% = 1.78% Does that mean it's less than 2% charge? QUOTE(mastering @ Jan 14 2019, 10:15 AM) Sharing MU VI vs Amex Reserve of M2CP Calculated based on this formula^Amount $10 MU VI (posted 20/12) Visa website = 31.20 MBB = 31.91 Transaction fee = 2.28% Amex (posted 21/12) Visa website = 31.16 (can't find exchange rate calculator for Amex) MBB = 31.97 Transaction fee = 2.60% Conclusion, use MU VI, at least for M2CP |

|

|

Aug 5 2019, 07:13 PM Aug 5 2019, 07:13 PM

Show posts by this member only | IPv6 | Post

#1655

|

Junior Member

281 posts Joined: May 2015 |

|

|

|

Aug 5 2019, 10:07 PM Aug 5 2019, 10:07 PM

|

Senior Member

1,516 posts Joined: Oct 2005 |

|

|

|

Aug 6 2019, 06:37 PM Aug 6 2019, 06:37 PM

|

Junior Member

187 posts Joined: Nov 2007 |

Hi all, just want to confirm my calculations and plan before going ahead:

I'm going to Poland shortly. Aside from changing cash MYR to Euro (then change to PLN there), I plan to use card mostly. The plan is to load RM 2,500 on BigPay. (Pay for hotel ++) Balance is what I'm not sure... I'm thinking of using UOB One Platinum for anything else. I also have Merchantrade Visa Debit (unfortunately, Polish currency is not on their Multi-currency wallet, so if I bought Euro in my wallet, I'd lose with the conversion, right?) I also have MBB 2 Cards (Visa and Amex). What would all the sifus here recommend? |

|

|

Aug 6 2019, 10:04 PM Aug 6 2019, 10:04 PM

Show posts by this member only | IPv6 | Post

#1658

|

|

Moderator

9,301 posts Joined: Mar 2008 |

QUOTE(James_Padfoot @ Aug 6 2019, 06:37 PM) Hi all, just want to confirm my calculations and plan before going ahead: Used local credit cards that give you some sort of cash back or rewards points to top-up your BigPay MasterCard. Then use your BigPay MasterCard. There is absolutely no contest at all. It is BigPay Mastercard all the way. And you can also use your MBB2 AMEX only weekends only if you aren’t gonna use it in Malaysia on weekends this month. Time difference shouldn’t be an issue as it will follow local merchant’s clearing bank’s time, which in your case is Poland. So as long as you make POS payment on Saturday and Sunday in Poland local time, you should be fine. Bon Voyage!I'm going to Poland shortly. Aside from changing cash MYR to Euro (then change to PLN there), I plan to use card mostly. The plan is to load RM 2,500 on BigPay. (Pay for hotel ++) Balance is what I'm not sure... I'm thinking of using UOB One Platinum for anything else. I also have Merchantrade Visa Debit (unfortunately, Polish currency is not on their Multi-currency wallet, so if I bought Euro in my wallet, I'd lose with the conversion, right?) I also have MBB 2 Cards (Visa and Amex). What would all the sifus here recommend? |

|

|

Aug 8 2019, 05:24 PM Aug 8 2019, 05:24 PM

|

Junior Member

187 posts Joined: Nov 2007 |

QUOTE(MilesAndMore @ Aug 6 2019, 10:04 PM) Used local credit cards that give you some sort of cash back or rewards points to top-up your BigPay MasterCard. Then use your BigPay MasterCard. There is absolutely no contest at all. It is BigPay Mastercard all the way. And you can also use your MBB2 AMEX only weekends only if you aren’t gonna use it in Malaysia on weekends this month. Time difference shouldn’t be an issue as it will follow local merchant’s clearing bank’s time, which in your case is Poland. So as long as you make POS payment on Saturday and Sunday in Poland local time, you should be fine. Bon Voyage! Thank you for the answer. I'll reload on the weekend with UOB then (5% cashback) to my Bigpay and use that. On the advice of using Amex - why? Isn't there a double conversion rate that they hit you with? (PLN > USD > MYR)? |

|

|

Aug 9 2019, 02:14 AM Aug 9 2019, 02:14 AM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

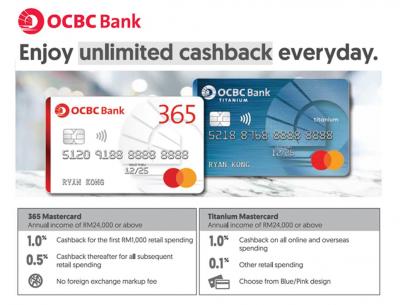

QUOTE(sidefulnes @ Aug 5 2019, 07:13 PM) Received product info from OCBC telemarketer and checked with them. There are no foreign exchange markup fee for both 365 and Ti I remembered OCBC TMC didn’t have a good final rate for foreign currency transaction. And based on the image attached, it says no markup for OCBC 365 only. Are you certain OCBC TMC now has no markup fee too ?

QUOTE(James_Padfoot @ Aug 8 2019, 05:24 PM) On the advice of using Amex - why? Isn't there a double conversion rate that they hit you with? (PLN > USD > MYR)? The weekend 5% cash back is more than enough to cover that. So you shall be fine. |

| Change to: |  0.0204sec 0.0204sec

0.15 0.15

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 09:18 AM |