Outline ·

[ Standard ] ·

Linear+

Buying Gold As Investment V2, 2011 Gold Rush From Oil Hype

|

Debuantu

|

Jul 24 2011, 02:12 AM Jul 24 2011, 02:12 AM

|

Getting Started

|

Does it matter where the gold is produced from? There seems to have gold bars/coins that are 'branded' and are produced by different companies. Will the branding of gold affect the resale price? I thought the price is only based on the weight and purity of the gold.

Also, should I go for the gold bars or the bullion coins?

This post has been edited by Debuantu: Jul 24 2011, 02:18 AM

|

|

|

|

|

|

Debuantu

|

Jul 24 2011, 01:56 PM Jul 24 2011, 01:56 PM

|

Getting Started

|

QUOTE(lustman @ Jul 24 2011, 11:28 AM) the safest way to decide which gold to buy is to follow the authority figures, e.g. mike maloney and many more. they have been doing analysis and research for years and they know what they are doing. simply put, get international regconized gold e.g. kijang emas (malaysian govt backed), ASE, maple leaf, nuggets, pamp, etc. to me, yes it does matter where the gold is produced. why would you want to buy gold if you're thinking to resell? why would you want to buy gold at the first place? Thanks for the reply. I thought everyone here is buying gold for investment and so am I. If it matters where the gold is produced then it is wise for me to go for the well recognised gold. By the way which one do you recommend, the bars or the bullions?

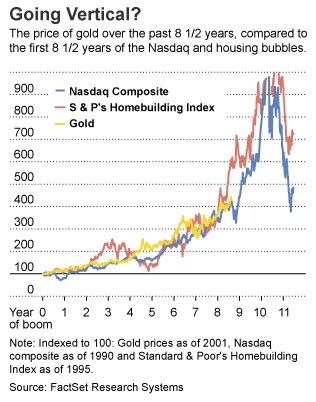

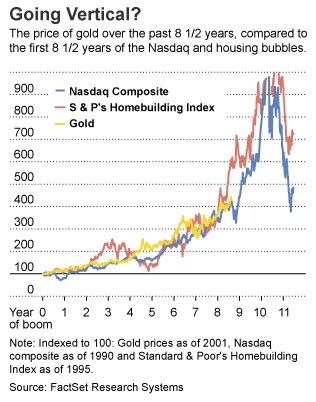

Added on July 24, 2011, 4:32 pmFellow investors, Check out the inflated gold price chart.  If history repeats itself then we will soon see the tanking of gold price. http://www.rapidtrends.com/2009/09/21/the-...ation-adjusted/This post has been edited by Debuantu: Jul 24 2011, 04:32 PM |

|

|

|

|

|

Debuantu

|

Jul 24 2011, 08:20 PM Jul 24 2011, 08:20 PM

|

Getting Started

|

Thanks again. I might go into 'hoarding' gold. LOL gona get myself a few ounces of aussie nugget from perth mint tomorrow. ______________________________________________________________________________________________ Just another graph I would like to share... the bubble... may.... burst sometime in the near future.  This post has been edited by Debuantu: Jul 25 2011, 12:02 AM This post has been edited by Debuantu: Jul 25 2011, 12:02 AM |

|

|

|

|

|

Debuantu

|

Jul 26 2011, 08:01 PM Jul 26 2011, 08:01 PM

|

Getting Started

|

QUOTE(chengcheng @ Jul 26 2011, 12:21 PM) I am new... Almost bought something from Poh Kong last weekend. It was RM 183/gram.It 999 gold. That's a 20% premium walao~ |

|

|

|

|

|

Debuantu

|

Jul 27 2011, 03:19 PM Jul 27 2011, 03:19 PM

|

Getting Started

|

QUOTE(kelvinyam @ Jul 27 2011, 11:42 AM) Nope. You didn't get it wrong. What you saw there could be Gold / Silver ETF. Those are very popular in the State. One of the example is SPDR Gold Trust. Is SPDR Gold Trust an investment or just purely for trading? |

|

|

|

|

|

Debuantu

|

Jul 28 2011, 01:17 PM Jul 28 2011, 01:17 PM

|

Getting Started

|

On Monday gold price was US$1600/oz AU$1502/oz

Current gold price is US$1623 AU$1470

Do you spot the difference? While gold/oz is increasing in USD, the price per oz in AUD is getting cheaper. Do you know why?

How's it like in ringgit?

|

|

|

|

|

|

Debuantu

|

Jul 28 2011, 02:59 PM Jul 28 2011, 02:59 PM

|

Getting Started

|

QUOTE(keii-kun @ Jul 28 2011, 02:18 PM) usd dollar value is dropping = thus you need more USD to buy 1oz of gold. Australia is one of the gold producer and its currency is moving based on gold = thus less AUD required to buy gold. what happen here in malaysia, gold valued in USD. gold price up, usd down, so when convert into ringgit, gold did not goes up as much as the world price  Gold in Aus is quoted in USD too same as Malaysia. The gold price in AUD is cheaper due to the appreciation of AUD not so much on the decreasing value of USD (otherwise gold price in ringgit would have been cheaper too after conversion).  This post has been edited by Debuantu: Jul 28 2011, 03:08 PM This post has been edited by Debuantu: Jul 28 2011, 03:08 PM |

|

|

|

|

Jul 24 2011, 02:12 AM

Jul 24 2011, 02:12 AM

Quote

Quote

0.0436sec

0.0436sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled