QUOTE(the snowball @ Feb 11 2011, 10:38 PM)

Actually, Apple stock is not as expensive as most people think it is. The reason that people think so is that it has move up a lot in the past few years. It is cheaper than google on PE terms. Most people do not value the cash on Apple balance sheet. Net off cash, the thing is selling at around 17x net cash TTM, not seriously expensive. Yup, it is dependent on coming up with new products, which probably make it a risky stock compare to your bread and butter Colgate Palmolive (18x TTM) etc. But, it is trading a a cheaper valuation than Google (19x net cash TTM)with a better historical growth trajectory. The key for Apple is that, whether the recently converted Apple cult will stay loyal to their product. If they manage to do so, they have retain a good loyal base with good cross selling opportunity. Apple will remain a seller of high margin niche product.

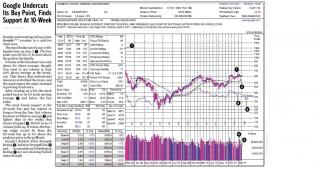

For Google, they are starting to face pressure of becoming a giant like Microsoft. They start to receive antitrust probe and criticism. The "Do No Evil" feel good factor is diminishing. Make no mistake, I think Google has done more to improve the internet than any other company. I think most of us have use at least two of their products- search, youtube, google reader, google docs, android and etc. All great stuff.They have a dominant position in search and with internet advertising still an under utilize platform, they will do well. But, still Google is still a one product wonder. Their financials has just one division-Search, meaning, other revenue stream is not meaningful and relevant. It is all about search advertising.

Google is slightly more expensive than Apple. Both are not that expensive if you take into account the reportedly crazy Facebook valuation of USD50b. Facebook is not as expensive as other tech out there - Netflix (77x TTM) and Open Table ( a stunning 105x TTM and 60+ Forward PE, I don't know what growth they are imputing, this thing is crazily overvalued. If it growth as expected, you will only get a decent return).

I do not own any of that two (GOOG and AAPL), just my 2 cents. But, lol, I do own their common competitor- the lumbering, slow and some says dying and IBM-like giant-Microsoft.

I didn't say it is very expansive..in fact it is trading around between its par to 2 years ahead intrinsic value.since there are many stocks trading at 80%-200% above its intrinsic value.

but the nature of business for apple posses greater downward risk..

for google, probably the intrinsic value of google grows slower than apple and it is more expansive now..but I can guarantee it's downward risk is much more safer than apple.but I won't buy google now too..I just prefer its business nature than apple.

What I am trying to talking here is, you're expecting Apple will come out a great new product in certain way if you're invest in CURRENT price.

Unless you're like some forumer here, invest in apple few years ago,it shouldn't be a concern to you.

I bet everyone would like to own Apple here,but for the current price with some premium paid for it based on valuation, but posses 10-20% of downward risk, so judge yourself are you willing to accept the risk.

For facebook, that is certainly a joke to ask for USD50b judging from its revenue without even looking its net profit...

I do not own those big giant technology, but the company I invest is small to medium type software company with some stable and good return of equity that grows intrinsic value 10%-20% yearly.

So wish the investor here good luck if buy apple at CURRENT price.

Feb 10 2011, 11:25 PM

Feb 10 2011, 11:25 PM

Quote

Quote

0.0342sec

0.0342sec

0.85

0.85

6 queries

6 queries

GZIP Disabled

GZIP Disabled