hope dividend is higher than 8% ....

The best thing for Moslem, they going to pay zakat for you ..

same like saving your money in Tabing Haji ... That would be good ...

Amanah Hartanah Bumiputera (AHB)

Amanah Hartanah Bumiputera (AHB)

|

|

Dec 8 2010, 06:31 PM Dec 8 2010, 06:31 PM

Return to original view | Post

#1

|

Junior Member

27 posts Joined: Nov 2009 |

hope dividend is higher than 8% ....

The best thing for Moslem, they going to pay zakat for you .. same like saving your money in Tabing Haji ... That would be good ... |

|

|

|

|

|

Dec 12 2010, 01:15 PM Dec 12 2010, 01:15 PM

Return to original view | Post

#2

|

Junior Member

27 posts Joined: Nov 2009 |

QUOTE(cybermaster98 @ Dec 10 2010, 10:54 AM) There is a choice. The saving of money in EPF is not against Shariah laws but accepting the dividends is. So reduce the dividends by using the EPF money for house purchases and computer withdrawals or whatever that EPF allows for. Why keep more money in there to earn more dividends? EPF is for retirement saving ... and is compulsory for everybody except those government staff who opt for pension... How many Malays who have invested in Gold Savings Accounts actually withdraw in gold bullion? Most (if not all) prefer to get the profits in cash. Even i do. And even if they withdraw the Gold bullion, its also considered haram by Shariah law since the gold bullion is a result of profits gained which are about 15% per annum based on current prices. If ASB is haram then Gold Bullion should be the same. Im not here to educate anybody about Shariah law. Im just not in favour of double standards especially when it comes to religious beliefs. Most ppl pick and choose which part of religion to follow when it should be all and sundry. I also think its silly to bring Shariah into every damn aspect of our lives. I think that if you really wanna do the right thing, then use the returns from interest or dividends to help the poor. Shariah law in itself is pure and encompases many important aspects in Islam. Its those so called 'religious experts' who damage the true meaning of it. it is not our decision though some of the investments are not shariah compliance ... What you can do ... calculate all the dividend ... and donate it to charity fund, poor citizen or even Baitulmal ... |

|

|

Dec 18 2010, 04:11 PM Dec 18 2010, 04:11 PM

Return to original view | Post

#3

|

Junior Member

27 posts Joined: Nov 2009 |

QUOTE(Milshah @ Dec 18 2010, 08:09 AM) You can have 500k ... or even 1 million in ASB ...but for the dividend .. it only calculated up to 200k ... so if you have money more than 200k .. ask your wife or your child to open a new ASB account and put your money there ... or buy a new house, invest in other thing ... unit trust, save in tabung haji ... and so on ... This post has been edited by kiddo_z: Dec 18 2010, 04:12 PM |

|

|

Jan 30 2011, 08:34 AM Jan 30 2011, 08:34 AM

Return to original view | Post

#4

|

Junior Member

27 posts Joined: Nov 2009 |

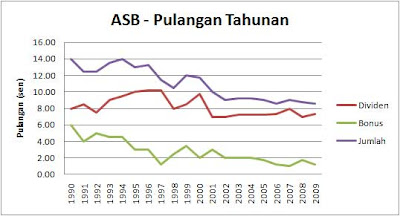

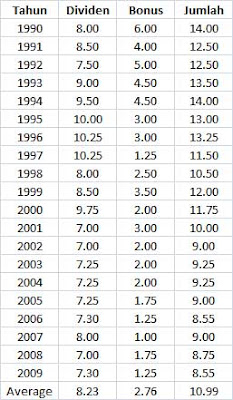

QUOTE(optyx_spider @ Jan 22 2011, 09:59 AM) Guys, so do you think its worth it to invest now??Or should i wait?? The ASB dividend past 20 years ...From what I've read in this thread I can get two things; - dividend might be higher than ASB as gov trying to attract more investors - dividend should be around 5-6% based on some calculation Do anyone has a record track of ASB, the % they gave on their first year?Maybe that can be a good referrence  Added on January 30, 2011, 8:38 amIn numbers ... ASB dividend return and its bonus since 1990.  This post has been edited by kiddo_z: Jan 30 2011, 08:38 AM |

| Change to: |  0.0147sec 0.0147sec

0.39 0.39

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 01:50 PM |