QUOTE(jasontoh @ Apr 7 2013, 04:28 PM)

Looking at your expenses, since 2.8K was your take home pay and you manage to save 2K per month, I was wondering how you do it. I know you have listed down everything, but I don't see anything like giving to parents below. So, do you mean your expenses of 800 never included them? Just curious how people with <3K take home pay able to save so much. For me, that kind of expenses is just PAMA fund that I allocated and since I'm working outstation, thus I pay rental. Food wise, we have about the same allocation. I would say that not everyone able to save 2K, in your case a vast 72% of your take home pay due to we have other commitment such as parents. You've been pretty much impressive about savings, but then again, it does not apply to everyone, even people with higher take home pay than you.

RM2.8K is not gross income. RM2.8K is after deducting epf, etc that I work some OT and part time. I managed sometimes can get around 3K , 3.2K, 3.5k

RM2K is savings, RM800 is my spending. If not enough to spend I work harder already mention ma.

I lucky no need give to parents $, coz they are a lot richer than me. They fully retired with many properties to collect rental. U guys did not see when I post my parents is on the tour around the world.

Read this Post #1768..This is how u do it. The forumer give his parents RM500 per month too. Read from the post #1768 onwards, you can see other forumer reply how they managed to cut on expense too.

http://forum.lowyat.net/topic/1577849/+1760

http://forum.lowyat.net/topic/1577849/+1760QUOTE(Gary1981 @ Apr 7 2013, 06:59 PM)

AAAABBB

Just wondering do u plan to get married? Do u think u can still save rm2k with ur low income? U do not require to pay ur parents?

I got post here yes looking into relation, Me low income? A guy with RM200K cash in hand now can easily buy another property cash to collect rental at least RM 800-1K per month. Don't u agree? U must read my current post, I am a Technician but recently only promoted to Engineer. So with passive income RM800-1k per month extra, don;t u think I still can save RM2K per month..

Let say a property is RM300K, I just need to borrow RM50K from my dad and another RM50K from my mom, I calculate back interest 5% for them, I can easily settle the loan RM100K within 4 years or less. Thus I do not need to take bank loans at all.

Even bank don;t want to loan me RM100K for property if I tell them I settle it within 4 years. They wanted me to loan longer so can collect more interest from me. They just ask me to take personal loan.

I do not require to pay my parents. The few lucky ones.

QUOTE(j.passing.by @ Apr 7 2013, 07:04 PM)

true... the guy took his time to share his experiences that it is possible to make savings; don't pour cold water as if it is not a possible thing to do... of course not everybody can do "drastic" savings; otherwise he needn't tell his story.

Save 2k per month + year-end bonus for 6 years = 150k.

He could safely buy a apt costing less than 150k, without any bank loans and without using all the reserves/savings. Apt usually takes 3 years to complete after signing up. Put 10% as down payment; then pay in cash for the progressive payments over the 3 years... Just an example of the virtual of having savings.

150k in FD x 3.5% interest = 5250 per year. The savings would grow easier over time once it got started and achieved sufficient volume.

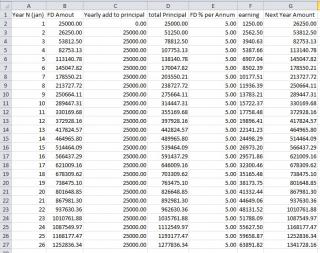

The plan how I do extreme savings RM25K per year, when economic crisis I go buy some good shares. In 1998, I purchased some Unisem shares. It bullish go up up up. Sell before the bubble burst. Then after savings until year 2008. I able to purchased the current condo I living now at low price RM230K. 2008 is bad time when Penang factory start retrench..I got buy some shares too during 2008 time too. so with AFISH formula I should be looking at property buying again when the price drop.

Look at the table in the 6 years should have at least RM170K.

The time when I do the savings fd is high, even today if u save at bank rakyat u can get 4%. Basically my calculation I use 5% is really not that hard to achieve. I got purchase those Sukuk also 5% return.

This post has been edited by AAAABBBB: Apr 7 2013, 09:40 PM Attached thumbnail(s)

Mar 23 2013, 05:19 PM

Mar 23 2013, 05:19 PM

Quote

Quote

0.0685sec

0.0685sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled