QUOTE(jerrymax @ Jan 22 2013, 04:10 PM)

It's 4%p.a monthly rest, is it worth?Personal financial management, V2

Personal financial management, V2

|

|

Jan 22 2013, 04:35 PM Jan 22 2013, 04:35 PM

|

Senior Member

1,102 posts Joined: Jan 2010 |

|

|

|

|

|

|

Jan 22 2013, 04:58 PM Jan 22 2013, 04:58 PM

|

Junior Member

310 posts Joined: Oct 2007 |

Since you know only need to pay RM14K, why not loan RM15K?

Haha.. unless company need it to be even numbers =P And you plan to finish pay all for how long? 3 ? 5 years? |

|

|

Jan 22 2013, 05:02 PM Jan 22 2013, 05:02 PM

|

Senior Member

1,102 posts Joined: Jan 2010 |

|

|

|

Jan 22 2013, 05:27 PM Jan 22 2013, 05:27 PM

|

Junior Member

310 posts Joined: Oct 2007 |

Looks like not a bad idea la.. Can use =)

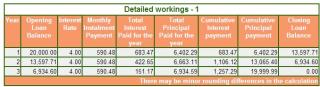

RM1257.29 interest throughout 3 years. Every month pay RM590.48 Better than % rate provided by banks for personal loan. Hope my calculation is correct la.. calculated by monthly rest. This post has been edited by jerrymax: Jan 22 2013, 05:29 PM Attached thumbnail(s)

|

|

|

Jan 22 2013, 05:35 PM Jan 22 2013, 05:35 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(avatar123 @ Jan 22 2013, 04:35 PM) dude - simple talk/view:1. 4%pa (dont care what rest) VS PTPTN x%pa? If less cost %, then worthwhile to take the 4%pa ELSE If more cost %, not logical to take right... unless somehow U need the cash to settle (ie. U owed PTPTN since... and now owe lump sum... and can't clear...) 2. U owe PTPTN $14K but the new loan $20K. U have the discipline to handle the extra cash for making more than 4%pa? Forced to ask this Q coz some people (my previous self included If disciplined enough, no probs. If not, it's like playing with a loaded gun. Just cow sense above, no right/wrong yar Additional thoughts: 4%pa is low leh, even lower than most housing loans which the banks hold collateral. Thus, IF U are an investor AND U have things which can, on average make U >=6%pa, U may want to tap this 4%pa loan. IF lar This post has been edited by wongmunkeong: Jan 22 2013, 05:38 PM |

|

|

Jan 22 2013, 06:28 PM Jan 22 2013, 06:28 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(wongmunkeong @ Jan 22 2013, 05:35 PM) Additional thoughts: Err sorry sifu! 4%pa is low leh, even lower than most housing loans which the banks hold collateral. Thus, IF U are an investor AND U have things which can, on average make U >=6%pa, U may want to tap this 4%pa loan. IF lar PL interest rate is different from most mortgage reducing rate, so the effective interest rate p.a. is much higher than stated. Effective interest rate for PL @ 4% is about ~7.4% p.a. (our in-house accountant pinky can help us count PL @4%, 20K loan 3 years = 622.22 per month x 36 month = 22,399.92, total interest paid = 2,399.92 PTPN 20% rebate = 14K x0.2 = RM 2,800 You only save like RM 400 for 3 years. This post has been edited by gark: Jan 22 2013, 06:35 PM |

|

|

|

|

|

Jan 22 2013, 06:36 PM Jan 22 2013, 06:36 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(jerrymax @ Jan 22 2013, 05:27 PM) Looks like not a bad idea la.. Can use =) PL interest is calculated up-front just like car loan, cannot use reducing principal calculation. Bank also want to cari makan what.. if give you 4% reducing rate want to makan apa? RM1257.29 interest throughout 3 years. Every month pay RM590.48 Better than % rate provided by banks for personal loan. Hope my calculation is correct la.. calculated by monthly rest. This post has been edited by gark: Jan 22 2013, 06:37 PM |

|

|

Jan 22 2013, 06:45 PM Jan 22 2013, 06:45 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(gark @ Jan 22 2013, 06:28 PM) Err sorry sifu! er.. i thought he said company loan wor, not PL?PL interest rate is different from most mortgage reducing rate, so the effective interest rate p.a. is much higher than stated. Effective interest rate for PL @ 4% is about ~7.4% p.a. (our in-house accountant pinky can help us count PL @4%, 20K loan 3 years = 622.22 per month x 36 month = 22,399.92, total interest paid = 2,399.92 PTPN 20% rebate = 14K x0.2 = RM 2,800 You only save like RM 400 for 3 years. if i misread & it's Personal Loan instead of company staff loan (benefits), forget it My bad |

|

|

Jan 22 2013, 07:03 PM Jan 22 2013, 07:03 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(wongmunkeong @ Jan 22 2013, 06:45 PM) er.. i thought he said company loan wor, not PL? Well technically he say company personal loan if i misread & it's Personal Loan instead of company staff loan (benefits), forget it My bad A lot of people has been conned to think they get better interest rate. Typical sales talk is "only 4% mar a bit higher than FD only what, special for GLC employess only u know..." If really he means company benefit loan, then by all means go for it. This post has been edited by gark: Jan 22 2013, 07:05 PM |

|

|

Jan 22 2013, 07:15 PM Jan 22 2013, 07:15 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(gark @ Jan 22 2013, 07:03 PM) Well technically he say company personal loan ah.. then the magic Q our buddy shd be asking is:A lot of people has been conned to think they get better interest rate. Typical sales talk is "only 4% mar a bit higher than FD only what, special for GLC employess only u know..." If really he means company benefit loan, then by all means go for it. what is the effective rate of interest pa? hehhe - then easily comparable to even FD & stuff. |

|

|

Jan 22 2013, 07:27 PM Jan 22 2013, 07:27 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(gark @ Jan 22 2013, 06:28 PM) Err sorry sifu! Since when I have this honour? PL interest rate is different from most mortgage reducing rate, so the effective interest rate p.a. is much higher than stated. Effective interest rate for PL @ 4% is about ~7.4% p.a. (our in-house accountant pinky can help us count PL @4%, 20K loan 3 years = 622.22 per month x 36 month = 22,399.92, total interest paid = 2,399.92 PTPN 20% rebate = 14K x0.2 = RM 2,800 You only save like RM 400 for 3 years. EIR for 4% p.a. 3-year loan is 7.51% |

|

|

Jan 23 2013, 01:08 AM Jan 23 2013, 01:08 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

If it is personal loan, still need to mentioned daily or monthly rest want meh?

|

|

|

Jan 23 2013, 07:40 AM Jan 23 2013, 07:40 AM

|

Senior Member

1,102 posts Joined: Jan 2010 |

QUOTE(wongmunkeong @ Jan 22 2013, 05:35 PM) dude - simple talk/view: Yes I'm investor but not going to touch the extra 5k, will find something higher rate to save it only.1. 4%pa (dont care what rest) VS PTPTN x%pa? If less cost %, then worthwhile to take the 4%pa ELSE If more cost %, not logical to take right... unless somehow U need the cash to settle (ie. U owed PTPTN since... and now owe lump sum... and can't clear...) 2. U owe PTPTN $14K but the new loan $20K. U have the discipline to handle the extra cash for making more than 4%pa? Forced to ask this Q coz some people (my previous self included If disciplined enough, no probs. If not, it's like playing with a loaded gun. Just cow sense above, no right/wrong yar Additional thoughts: 4%pa is low leh, even lower than most housing loans which the banks hold collateral. Thus, IF U are an investor AND U have things which can, on average make U >=6%pa, U may want to tap this 4%pa loan. IF lar Disipline wise, work nearly 3 years, use <rm100 hp, no car, no house, no personal loan, every month clear credit card debt, i think ok kua if i clear ptptn i can have 3+k rebate. Installment with 20k eat me interest 1.3k, thus can save 1.7k lor. But as u said, really need to manage well the remaining 5k.. |

|

|

|

|

|

Jan 23 2013, 07:41 AM Jan 23 2013, 07:41 AM

|

Senior Member

1,102 posts Joined: Jan 2010 |

QUOTE(gark @ Jan 22 2013, 06:28 PM) Err sorry sifu! Oh the PL for this personal loan is 4%p.a monthly rest, means 3 years only 1.3k interest in total for 20k PL interest rate is different from most mortgage reducing rate, so the effective interest rate p.a. is much higher than stated. Effective interest rate for PL @ 4% is about ~7.4% p.a. (our in-house accountant pinky can help us count PL @4%, 20K loan 3 years = 622.22 per month x 36 month = 22,399.92, total interest paid = 2,399.92 PTPN 20% rebate = 14K x0.2 = RM 2,800 You only save like RM 400 for 3 years. |

|

|

Jan 23 2013, 07:43 AM Jan 23 2013, 07:43 AM

|

Senior Member

1,102 posts Joined: Jan 2010 |

|

|

|

Jan 23 2013, 07:54 AM Jan 23 2013, 07:54 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(avatar123 @ Jan 23 2013, 07:43 AM) Best if U know what is the repayment scheduleeg. every month, how much must U pay back per month for 3 years? with that, i can ascertain your effective interest rate pa. coz your "constant rate" is not too comparable with FD rate nor any other compounded pa rate. |

|

|

Jan 23 2013, 08:18 AM Jan 23 2013, 08:18 AM

|

Senior Member

1,102 posts Joined: Jan 2010 |

QUOTE(wongmunkeong @ Jan 23 2013, 07:54 AM) Best if U know what is the repayment schedule For 20k, 3 years i need to pay RM591 monthly. eg. every month, how much must U pay back per month for 3 years? with that, i can ascertain your effective interest rate pa. coz your "constant rate" is not too comparable with FD rate nor any other compounded pa rate. |

|

|

Jan 23 2013, 08:32 AM Jan 23 2013, 08:32 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

Jan 23 2013, 08:34 AM Jan 23 2013, 08:34 AM

|

Senior Member

1,102 posts Joined: Jan 2010 |

|

|

|

Jan 23 2013, 08:44 AM Jan 23 2013, 08:44 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

Topic ClosedOptions

|

| Change to: |  0.0298sec 0.0298sec

0.79 0.79

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 12:04 AM |