is the rate better than TW as claimed ?

Opening a Bank Account in Singapore

|

|

Feb 8 2021, 11:07 PM Feb 8 2021, 11:07 PM

Return to original view | Post

#1

|

Junior Member

427 posts Joined: Oct 2010 |

|

|

|

|

|

|

Feb 8 2021, 11:31 PM Feb 8 2021, 11:31 PM

Return to original view | Post

#2

|

Junior Member

427 posts Joined: Oct 2010 |

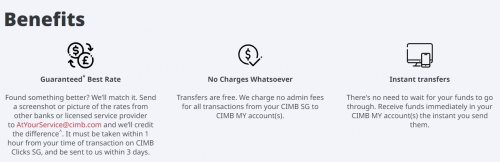

QUOTE(Murasaki322 @ Feb 8 2021, 11:15 PM) You can try for yourself to compare but don't click confirm transfer. Just key in the value you want to transfer in the field. CIMB has higher exchange rate, while Transferwise has a fixed fee on top of exchange rate. just wondering .... cimb even claimed that they will pay you back the difference in the event you found a cheaper way, so confident eh ?This post has been edited by no6: Feb 8 2021, 11:32 PM |

|

|

Feb 25 2021, 01:32 AM Feb 25 2021, 01:32 AM

Return to original view | Post

#3

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(Ramjade @ Feb 15 2021, 08:26 PM) You open sg bank acocunt is not for their FD. If you are using it for FD, better don't open account there cause you don't know how to make use of sg bank account. I don't know about you. I opened my account for 1. Invest into sg reits. They offer 3-8%p.a dividend yield. 2. Use it to invest into US market since overseas broker accept SGD deposit and not RM. And in case you are wondering, my SGD is minimum giving me 6%p.a And no. I don't bring my money back. No intention. QUOTE(donhay @ Feb 17 2021, 12:34 PM) My $$ in my SG bank account is 20% , the other 80% are in SGX ( reits, banks) and UT from the bank. may i know what are the sg reits & banks in sgx that's good for dividend yield ?Will not be bringing any $$ back, as it is part of my diversification from my Msian portfolio and maybe $$ for my child education in SG next time (provided he qualify to be accepted which platform would you recommend for sgx market ? tiger broker ? |

|

|

Mar 2 2022, 06:46 PM Mar 2 2022, 06:46 PM

Return to original view | Post

#4

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(Lon3Rang3r00 @ Mar 2 2022, 04:03 PM) Hi, I wanted to open CIMB SG account for IBKR usage, for the initial S$1000 deposit, i wonder is it still workable to transfer like S$50 from Malaysia Bank account to CIMB SG while remaining using S$950 from Wise? just to save a little from using the Fx rate. yes can. sgd1 via cimb my, sgd999 via wise TOS liked this post

|

|

|

Jul 20 2022, 02:51 PM Jul 20 2022, 02:51 PM

Return to original view | Post

#5

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(Ramjade @ Jul 19 2022, 08:43 PM) Just top-up when you want to spend it. If you are always overseas may want to consider miles game. Sacrifice the Forex rate for free air ticket back to Malaysia which can be worth like 10% cashback. how to play the miles game using youtrip? by reloading youtrip via cc ?I don't have youtrip although I am waiting for them to set up shop in Malaysia which they said they are doing, but looks like taking some time. I suggest use bigpay, youtrip, wise, revolut and see which card give you the best rate and then use that card. Another alternative is play the miles game. |

|

|

Aug 2 2023, 12:50 PM Aug 2 2023, 12:50 PM

Return to original view | Post

#6

|

Junior Member

427 posts Joined: Oct 2010 |

[quote=Ramjade,Aug 2 2023, 11:34 AM]

Medufsaid thanks for proving me wrong. I am happy to be wrong.  money match payable amount 10005 ? |

| Change to: |  0.1509sec 0.1509sec

0.39 0.39

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 10:05 PM |