QUOTE(leetan33 @ May 31 2022, 11:50 AM)

I applied Maybank SG online and got it approved on the next day. I'm still waiting for my SG Debit Card to arrive since mid-May, hopefully it will reach me soon.

With a SG pass?Opening a Bank Account in Singapore

|

|

Jul 26 2022, 03:54 PM Jul 26 2022, 03:54 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

|

|

|

Dec 15 2022, 03:32 PM Dec 15 2022, 03:32 PM

Return to original view | Post

#2

|

Senior Member

2,193 posts Joined: Feb 2012 |

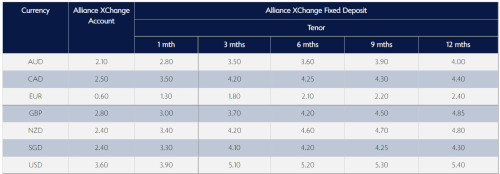

QUOTE(Toku @ Dec 12 2022, 10:38 PM) As discussed in foreign FD thread, Alliance Xchange FD account is better compared to CIMB SG FCY FD account. Would you happen to know what the exchange rate spread is to change currencies to and from USD for the Alliance FCY FD account?  3 mth already 5.1%.  The Alliance TT is RM25++ compared to CIMB SG exorbitant TT fee. Hence, in terms of interest rates and fees both better than CIMB SG. The only downside maybe Alliance's FCY FD is under BNM vs CIMB FCY FD's under MAS. PS: I will share the Alliance Bank Malaysia TT screenshot for your reference in a bit... |

|

|

Dec 21 2022, 04:37 PM Dec 21 2022, 04:37 PM

Return to original view | Post

#3

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Jan 31 2023, 01:26 PM Jan 31 2023, 01:26 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(Mr Gray @ Jan 31 2023, 12:38 PM) Seems like cimb singapore account is taking longer to be approved. Made application and transfered to cimb sg from cimb my on 9 January. You can try Maybank Singapore, if you have a Maybank Malaysia account. I applied online couple of months ago, it was approved the next day, and i transferred funds and started using it immediately.Called cimb sg today and application still pending approval This post has been edited by gooroojee: Jan 31 2023, 03:05 PM |

|

|

Feb 3 2023, 08:42 PM Feb 3 2023, 08:42 PM

Return to original view | Post

#5

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(Mr Gray @ Feb 3 2023, 03:42 PM) Can still apply online. No problem. Applied last wednesday, thursday got email. Today (friday) already approved, deposited SGD500 via Wise and can access M2U SG right away. Tiger damn efficient compared to Sotong. Almost 1 month applied CIMB SG, still no tail no head. Email from maybank said debit card will be delivered within 7 days. Yep mine submitted evening, next day morning approved and good to go. This was 3 months ago. lyyera96 liked this post

|

|

|

Feb 15 2023, 01:08 PM Feb 15 2023, 01:08 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(Ramjade @ Feb 15 2023, 01:01 PM) Dbs account is Multicurreny account (able to deposit, withdraw and transfer foreign currency) while both Maybank and cimb is just SGD account. Depending on what account you ah e with DBS, you can practically keep zero punt inside (,my own account only have SGD0.10) Maybank can open online... and usually with one business day. CIMB takes much longer.CIMB Sg can be opened online. Maybank sg need to visit selected branch in Malaysia. Maybank sg have a min lock in SGD500. If amount drop less than SGD500/month you will be charged SGD2.00/month. CIMB and Maybank sg are easier to open Vs DBS. If you don't care about Multicurrency account. Just pick CIMB sg. Do not keep transfering money between Malaysia and Singapore. Frequent transfer will take up costs.Make sure money you are going to keep in Singapore is at least going to be there for 5 years. |

|

|

|

|

|

Mar 11 2023, 01:22 PM Mar 11 2023, 01:22 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(Ramjade @ Mar 11 2023, 01:13 PM) Very easy to open sg bank account (CIMB and Maybank only). Nobody knew can open Maybank SG account online until we started talking about it here.. at the time when I did it, there was zero forum posts, websites or blogs about it.. seriously, zero... everyone was recommending CIMB and said Maybank was a paper form and need go branch (as per the site u posted above).https://ringgitfreedom.com/banking/opening-...for-malaysians/ It's been there for ages. Don't know where you guys went or miss this thread. It was only when a friendly RM told me to do it online that I realized it finally launched, long after Maybank announced it back in March 2022 or so... So I did mine online, got my account approved and ready in one day and I put money in on the same day. Now these kind of info, because it's not available online.. you won't hear some people advising you to do so, like a know it all ... because it seems like what they know is mostly what other people have shared, not own experience.. This post has been edited by gooroojee: Mar 11 2023, 01:57 PM |

|

|

Aug 24 2023, 08:18 AM Aug 24 2023, 08:18 AM

Return to original view | IPv6 | Post

#8

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(Mr Gray @ Jul 25 2023, 11:47 AM) Happy to share that I have successfully opened my OCBC Singapore account with just my IC and Passport. Tried about 10 times but the IC scan doesn't work.. maybe my phone camera too lousy.. The process of applying through the app is a bit a pain in the ass, as needs to do several times for the app to accept my IC. Tips, the ic can be slightly outside the rectangle. Edit: tried it another 5 times and finally... stroke of luck.. it finally passed... Also, an update on Maybank SG CASA online opening promotion, now you can open a different account from iSavvy, which is the SaveUp account. Promotion is, deposit $50k for 4 months locked in period, and get $400... https://www.maybank2u.com.sg/en/promotions/...its/saveup.page? This post has been edited by gooroojee: Aug 24 2023, 09:40 AM |

|

|

Aug 30 2023, 08:43 PM Aug 30 2023, 08:43 PM

Return to original view | Post

#9

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(john123x @ Aug 30 2023, 08:25 PM) i spend the whole day researching my new maybank SG bank account. You might get stuck at Tiger to MBB, even though MBB is Tiger bank.. ironically.. hahahahere is what i do: -Tiger Broker to Maybank SG -Maybank SG to Tiger broker [via Transfer UEN] -Maybank SG to Tiger broker [via Transfer Other Accounts - DBS Bank] -Maybank SG to Wise [via Transfer UEN] -Maybank SG to Wise [via Transfer Other Accounts - Wise Bank] -Maybank SG to Wise [Maybank App Scan Wise QR] -Wise to Maybank SG its really fun I noticed, transfering SGD around is free, no fee. WISE also didnt charge any fee for receiving and sending SGD. Wise only charge fee for forex conversion. I also managed to register PayNow ID tied to my Malaysia phone number. I tried using WISE to transfer to PayNow Id [My HP Number], it doesnt work. ceo684 liked this post

|

|

|

Aug 30 2023, 09:09 PM Aug 30 2023, 09:09 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(john123x @ Aug 30 2023, 09:03 PM) could you explain why? Nothing wrong with Tiger Brokers, but they want a bank statement before allowing fund withdrawals to that bank, and I assume you're using iSavvy, which doesn't provide you a bank statement...Tiger is safe, its like moomoo, regulated in Singapore. I dont see any need for concern. TOS liked this post

|

|

|

Nov 21 2023, 08:49 AM Nov 21 2023, 08:49 AM

Return to original view | IPv6 | Post

#11

|

Senior Member

2,193 posts Joined: Feb 2012 |

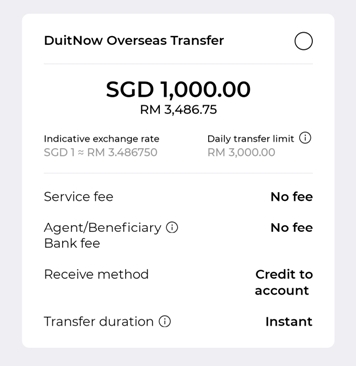

QUOTE(john123x @ Nov 20 2023, 03:05 PM)  the above info from ringgitplus i have maybank MY, TNG, maybank SG and OCBC SG here is probably to do research: - - - - - - - - - i dont know how it works. fyi:my Malaysia duitnow and singapore paynow is using the same number.... i found it: MAE MY App/Transfer/Oversea tab  Transfer SGD1000: -Wise : fee 26.14 total: 3511.04 -MAE total: 3486.75 summary: its cheaper than WISE because WISE charges fee |

|

|

Jan 3 2024, 07:36 PM Jan 3 2024, 07:36 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(markedestiny @ Jul 26 2023, 02:37 PM) The links below are quite clear on the requirements. If first year no fall below penalty then i'll keep my OCBC account, since got statement... See this link for the Statement Savings Account: https://www.ocbc.com/personal-banking/depos...savings-account See below for Global Savings Account: https://www.ocbc.com/personal-banking/depos...nt?qualtric=faq Why do you think there is discrepancies in the above vs T&C on the mobile application? The bank explicitly told you so in your application? For eg, need to maintain SGD20K after one year? Whether if OCBC have made the waivers to waive off the requirements for valid Employment/Student Pass (for foreigners) and also waive off submission of the following Additional document: Include any one of the following documents that shows your residential address Phone bill Half-yearly CPF statement Any bank statement Btw your intention of closing the accounts and then apply for others are subjected to the bank's T&C, they can refuse as per their terms. But my MBB iSavvy account is eating SGD$2 every month. Thinking to terminate it, but the zero fee transfer to/from MBB Malaysia is what's keeping me holding on to it. |

|

|

Jan 4 2024, 09:32 PM Jan 4 2024, 09:32 PM

Return to original view | Post

#13

|

||||

Senior Member

2,193 posts Joined: Feb 2012 |

QUOTE(Medufsaid @ Jan 4 2024, 05:39 PM) come let me share with you the real time midvalley rates I signed up online for iSavvy before it was ever known to Ziet...

so at the very least, you should compare against midvalleyalso content creators like ziet have outdated videos, so only the iSavvy option is known |

||||

|

|

|

|

|

Jan 8 2024, 10:58 PM Jan 8 2024, 10:58 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

2,193 posts Joined: Feb 2012 |

My MBB SG registered number is my Malaysian phone number, but when I try to DuitNow over from MBB MY to MBB SG it says number not found or what error...

Does your Malaysian number work for DuitNow to SG? I wonder why they don't allow DuitNow to SG bank account number? So weird. |

|

|

Jan 8 2024, 11:42 PM Jan 8 2024, 11:42 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

|

|

Jan 9 2024, 09:39 PM Jan 9 2024, 09:39 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

2,193 posts Joined: Feb 2012 |

Thanks. I reregistered my phone in MBB SG but didn't link to paynet. After linking it works now. Don't seem to need to link SG to MY account though.

DuitNow to SG in SGD is a 3.506 rate huh... |

|

|

Jul 16 2024, 03:17 PM Jul 16 2024, 03:17 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

2,193 posts Joined: Feb 2012 |

What's the best approach (cheapest) to move my USD funds in USA to a USD based fund in Moomoo/Tiger in Singapore ?

|

|

|

Jul 16 2024, 03:49 PM Jul 16 2024, 03:49 PM

Return to original view | Post

#18

|

Senior Member

2,193 posts Joined: Feb 2012 |

|

| Change to: |  0.1216sec 0.1216sec

0.63 0.63

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 06:38 AM |