Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

abcn1n

|

Nov 1 2023, 07:10 PM Nov 1 2023, 07:10 PM

|

|

QUOTE(Ramjade @ Nov 1 2023, 06:55 PM) Maybe you need to try ocbc hq at 65 Chulia St. Sometimes branch useless. Sigh. Maybe have to QUOTE(TOS @ Nov 1 2023, 06:58 PM) This account must be very old. What account type/name is it? Banks don't give passbooks these days. In the worst case, you have to fly down here and close it, then reopen a new one (either in person or via the app). Just a normal savings account. It doesn't have any name. Yeah, may have to close and reopen although I am reluctant to close it. May I ask when you took picture of the IC, did it ever mentioned scan 'bottom front card' after the 1st image ie front of IC captured successfully? You only scan 1 front IC and 1 back IC right? |

|

|

|

|

|

abcn1n

|

Nov 1 2023, 07:26 PM Nov 1 2023, 07:26 PM

|

|

QUOTE(TOS @ Nov 1 2023, 07:14 PM) I don't open my OCBC account via this route. Sorry. I refer your question to Mr Gray and others. They should be able to help you. Thanks |

|

|

|

|

|

abcn1n

|

Nov 2 2023, 01:26 AM Nov 2 2023, 01:26 AM

|

|

QUOTE(!@#$%^ @ Nov 1 2023, 08:28 PM) read the instructions carefully. after taking ur IC in right angle, u r suppose to take ur IC in an angle (unusual rectangle). also the ic scanning part was buggy previously, needed multiple attempts. A couple of questions. 1) After taking the front IC in the right angle, for the unusual rectangle, is it still the front IC or the back IC? 2) I tried to tilt handphone so that IC is in the shape of the unusual rectangle but no matter how I do it, IC still isn't in the shape of the unusual rectangle. Any tips? Not sure what I'm doing wrong I tried so many attempts until sweat like crazy also don't work. Sigh. |

|

|

|

|

|

abcn1n

|

Nov 2 2023, 01:44 AM Nov 2 2023, 01:44 AM

|

|

QUOTE(!@#$%^ @ Nov 2 2023, 01:37 AM) front front back back. all i can say is good luck. lol Edit : tried proceeding but confirm can't open account as system could capture I'm an existing customer (which even if log in as existing customer can't create more than 1 account). Have to pay them a visit personally. End of story This post has been edited by abcn1n: Nov 2 2023, 12:11 PM |

|

|

|

|

|

abcn1n

|

Nov 3 2023, 04:34 AM Nov 3 2023, 04:34 AM

|

|

Ramjade or anyone. Does your Maybank Sg savings account have monthly e-statements? What's the name of the savings account? Am looking for a bank account that has monthly e-statements. Thanks

Was looking at Maybank savings T&C and other details. They have several accounts such as i-savvy savings account, isavvy savings plus account, isavvy savings account-i, save-up account, privilege plus savings account and Ar-Rihla Regular Savings Account-i. From what I could understand, it seems that none of them actually have monthly e-statements.

|

|

|

|

|

|

abcn1n

|

Nov 3 2023, 01:45 PM Nov 3 2023, 01:45 PM

|

|

QUOTE(TOS @ Nov 3 2023, 07:05 AM) From my past experience using Maybank SG's iSavvy account, there is no monthly e-statement. You can try CIMB SG, there is monthly e-statement available for CIMB SG FastSaver account. Thanks. Still waiting for CIMB Sg approval This post has been edited by abcn1n: Nov 3 2023, 01:45 PM |

|

|

|

|

|

abcn1n

|

Nov 3 2023, 04:27 PM Nov 3 2023, 04:27 PM

|

|

QUOTE(Ramjade @ Nov 3 2023, 03:14 PM) I got no answer for you. Here is screenshot of my DBS USD bank account in FSM SG. If you noticed, I don't have intermediate bank details.  Here is the screenshot of amount of money I moved out from FSM SG into DBS  Here is the amount that came into my DBS bank account (minus around USD17+)  My advise just do lump sum transfer and forget about FSM after that. Don't bother with testing water. When I found out that no more free USD cheque, I just lump sum transfer. Sorry if not helpful. Thanks. Really appreciate the screenshot. I tried again with a slightly larger amount. Put in address etc. Let's see whether it can work. Can't withdraw everything currently as I did not convert all my USD from sweep account to normal USD account in FSM before withdrawing. If still can't work, then I will decide whether to bite the bullet and withdraw everything 1 shot or leave it there for the time being. |

|

|

|

|

|

abcn1n

|

Nov 3 2023, 06:40 PM Nov 3 2023, 06:40 PM

|

|

QUOTE(Ramjade @ Nov 3 2023, 05:22 PM) No need convert everything into USD. Those in SGD can just transfer out and convert inside inside IBKR. IBKR rates are better than both DBS and FSM. Only those in USD you withdraw and get ready to be charged. I have $ still in USD auto sweep account. When I say convert, I should have phrased it better by saying haven't transferred all my USD from auto sweep account to USD cash account in FSM Singapore. Will see whether this time withdrawal successful, if not successful, then I think I will take a break and later decide what to do with the money there. |

|

|

|

|

|

abcn1n

|

Nov 3 2023, 11:08 PM Nov 3 2023, 11:08 PM

|

|

QUOTE(TOS @ Nov 3 2023, 10:23 PM) You need to keep minimum 500 SGD all the time for iSavvy account, otherwise there is a fall-below fee of 2 SGD... Also there are security problems with the accounts, even if you use it conservatively. My debit card kena hack before lost almost 400 SGD... have to call SG HQ to chase back my money. ------------------- If you don't go to SG often, CIMB SG is a safer bet as there is no debit card issued for FastSaver account. You are very lucky to get back your money. Usually its not successful one QUOTE(TOS @ Nov 3 2023, 10:58 PM) OCBC SG doesn't give debit card if opened from Malaysia? Anyway, more debit card introduces unnecessary risks... If you don't use it/them often better don't apply/take one in the first place. Already learnt my lesson with Maybank SG. Did you put a transaction limit on how much can be withdrawn from the bank using card? Or did you lose the card because usually for debit card, I think theft can only be done through ATM? |

|

|

|

|

|

abcn1n

|

Nov 4 2023, 01:01 AM Nov 4 2023, 01:01 AM

|

|

QUOTE(TOS @ Nov 3 2023, 11:27 PM) Yes, 1k SGD I think... The bad guy transferred 200 SGD once and triggered an alert sent to my email... once I login realize they withdraw some 10...20...50 SGD each day, so I call and chase back. I don't use my Maybank SG card for any other purpose except from buying air ticket, pay for food in SG hawker centers and paying MRT/bus fare in SG. No tie up with any ewallet etc. Scary. They actually withdraw small amounts first each day, then try luck with bigger amounts. |

|

|

|

|

|

abcn1n

|

Nov 4 2023, 04:18 AM Nov 4 2023, 04:18 AM

|

|

QUOTE(!@#$%^ @ Nov 4 2023, 01:09 AM) he's lucky the fraudster did it daily. my credit card last time, made multiple transaction every minute until i called CS to block the card. some banks are really not proactive at all. like 10-15x same *facebook transactions amounting to thousands. Lucky its credit and not debit card. Can refuse to pay. |

|

|

|

|

|

abcn1n

|

Nov 7 2023, 01:01 PM Nov 7 2023, 01:01 PM

|

|

Need help. TOS, Ramjade, anyone? How long do we have to wait for the CIMB Singapore activation code after we receive email that our account has been activated? Thanks. Is it days or simultaneously?

|

|

|

|

|

|

abcn1n

|

Nov 7 2023, 01:26 PM Nov 7 2023, 01:26 PM

|

|

QUOTE(Ramjade @ Nov 7 2023, 01:06 PM) Ramjade Emmm... I mean how long to wait for the sms CIMB clicks internet activation code (OTP etc)? (needed to set up CIMB Sg app) I already received email saying my account is activated (already passed verification test, e-KYC etc). Am at step 4 (application verification) below (received email account activated but did not receive the OTP sms) https://nomoneylah.com/2022/08/21/singapore-bank-account/QUOTE(Medufsaid @ Nov 7 2023, 01:11 PM) abcn1n have Cimb SG called you already? Medufsaid Already received email saying my account is activated. But did not receive sms for CIMB clicks internet activation code. Without that I cannot set up my CIMB app. CIMB Sg did not call me. Everything through email/sms This post has been edited by abcn1n: Nov 7 2023, 01:30 PM |

|

|

|

|

|

abcn1n

|

Nov 7 2023, 01:31 PM Nov 7 2023, 01:31 PM

|

|

QUOTE(Ramjade @ Nov 7 2023, 01:29 PM) I believed activation code is via mail if I am not mistaken Not SMS. Can't really remember. Ben years since I opened my account. You mean email or postal mail? Anyway, now its through sms from what I see from various websites/youtubes |

|

|

|

|

|

abcn1n

|

Nov 7 2023, 02:17 PM Nov 7 2023, 02:17 PM

|

|

QUOTE(Ramjade @ Nov 7 2023, 01:47 PM) Better call them to find out. Use idd calls to bring down cost of calling. Thanks. Will do. I read CIMB only got 1 branch in Singapore and they are very busy. There was 1 person succeeded after 1 week. Yikes QUOTE(Medufsaid @ Nov 7 2023, 02:07 PM) yes it's by sms. here's my experience

- I get email of approval on friday evening saying that still pending my monthly salary slip + informing me that they'll call me for additional verification info

- i emailed them with bank statement pdf

- they call me

- monday afternoon, i get SMS with code to register @ cimb sg

Yours is very fast. Thanks for sharing  |

|

|

|

|

|

abcn1n

|

Nov 7 2023, 03:47 PM Nov 7 2023, 03:47 PM

|

|

QUOTE(Ramjade @ Nov 7 2023, 02:21 PM) Yup 1 branch only. I think sg govt law. Only those like important to economy have more branches. That's why I don't bother with apply debit card from cimb sg. ATM inside their branch and no where else and never have the need to use SGD debit card. Wow. Didn't know that Singapore restrict to 1 branch only. |

|

|

|

|

|

abcn1n

|

Nov 13 2023, 01:23 PM Nov 13 2023, 01:23 PM

|

|

.

This post has been edited by abcn1n: Nov 13 2023, 01:28 PM

|

|

|

|

|

|

abcn1n

|

Nov 13 2023, 01:50 PM Nov 13 2023, 01:50 PM

|

|

QUOTE(Ramjade @ Nov 3 2023, 03:14 PM) I got no answer for you. Here is screenshot of my DBS USD bank account in FSM SG. If you noticed, I don't have intermediate bank details.  Here is the screenshot of amount of money I moved out from FSM SG into DBS  Here is the amount that came into my DBS bank account (minus around USD17+)  My advise just do lump sum transfer and forget about FSM after that. Don't bother with testing water. When I found out that no more free USD cheque, I just lump sum transfer. Sorry if not helpful. Update. Confirmed total charges deducted is USD20-170 for my case. Ramjade, charges deducted for yours is slightly less than USD20 because from your 2 screenshots, the amount withdrawn is different from amount received (xx814.06 vs xx796.12). So around USD17+ difference there. Then add USD 7+ for TT as per your 2nd screenshot. So total deducted USD20+ Happy Deepavali to you. May you have a wonderful time during this festive season |

|

|

|

|

|

abcn1n

|

Nov 13 2023, 02:53 PM Nov 13 2023, 02:53 PM

|

|

QUOTE(Ramjade @ Nov 13 2023, 02:17 PM) If you use wise, it's free. Only need to pay wise withdrawal fees. Yes I have used wise to send USD from inside wise to DBS sg. Thanks. I'm going to convert some money from RM to USD (send to overseas account). Have to see which is the best way to do that. Convert from RM to SGD then to USD or how. Will check the charges and find the cheapest. Last time, I always convert RM to SGD, then from SGD to USD. Realize not a good method as really lost a lot. This post has been edited by abcn1n: Nov 13 2023, 02:53 PM |

|

|

|

|

|

abcn1n

|

Nov 21 2023, 06:36 PM Nov 21 2023, 06:36 PM

|

|

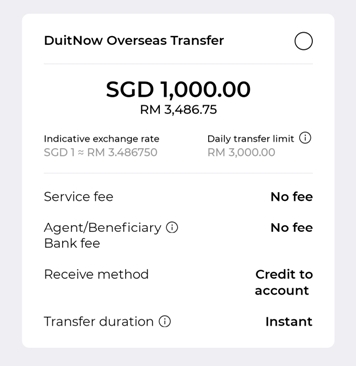

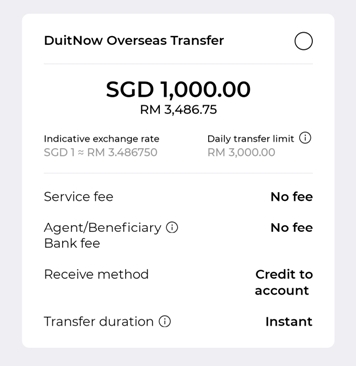

QUOTE(john123x @ Nov 20 2023, 03:05 PM)  the above info from ringgitplus i have maybank MY, TNG, maybank SG and OCBC SG here is probably to do research: - research LiquidPay - must have thailand or singapore phone number - Maybank MY scan Maybank SG - show invalid QR - Maybank MY scan OCBC SG - show invalid QR - TNG scan Maybank SG - show invalid QR - TNG scan OCBC SG- show invalid QR - Maybank SG scan Maybank MY- show invalid QR - Maybank SG to TNG -Not implemented yet - OCBC SG scan Maybank MY- show invalid QR - OCBC SG to TNG -Not implemented yet i dont know how it works. fyi:my Malaysia duitnow and singapore paynow is using the same number.... i found it: MAE MY App/Transfer/Oversea tab  Transfer SGD1000: -Wise : fee 26.14 total: 3511.04 -MAE total: 3486.75 summary: its cheaper than WISE because WISE charges fee Now, people will start opening Maybank SG to get cheaper rates than Wise. Thanks for info |

|

|

|

|

Nov 1 2023, 07:10 PM

Nov 1 2023, 07:10 PM

Quote

Quote

0.0317sec

0.0317sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled