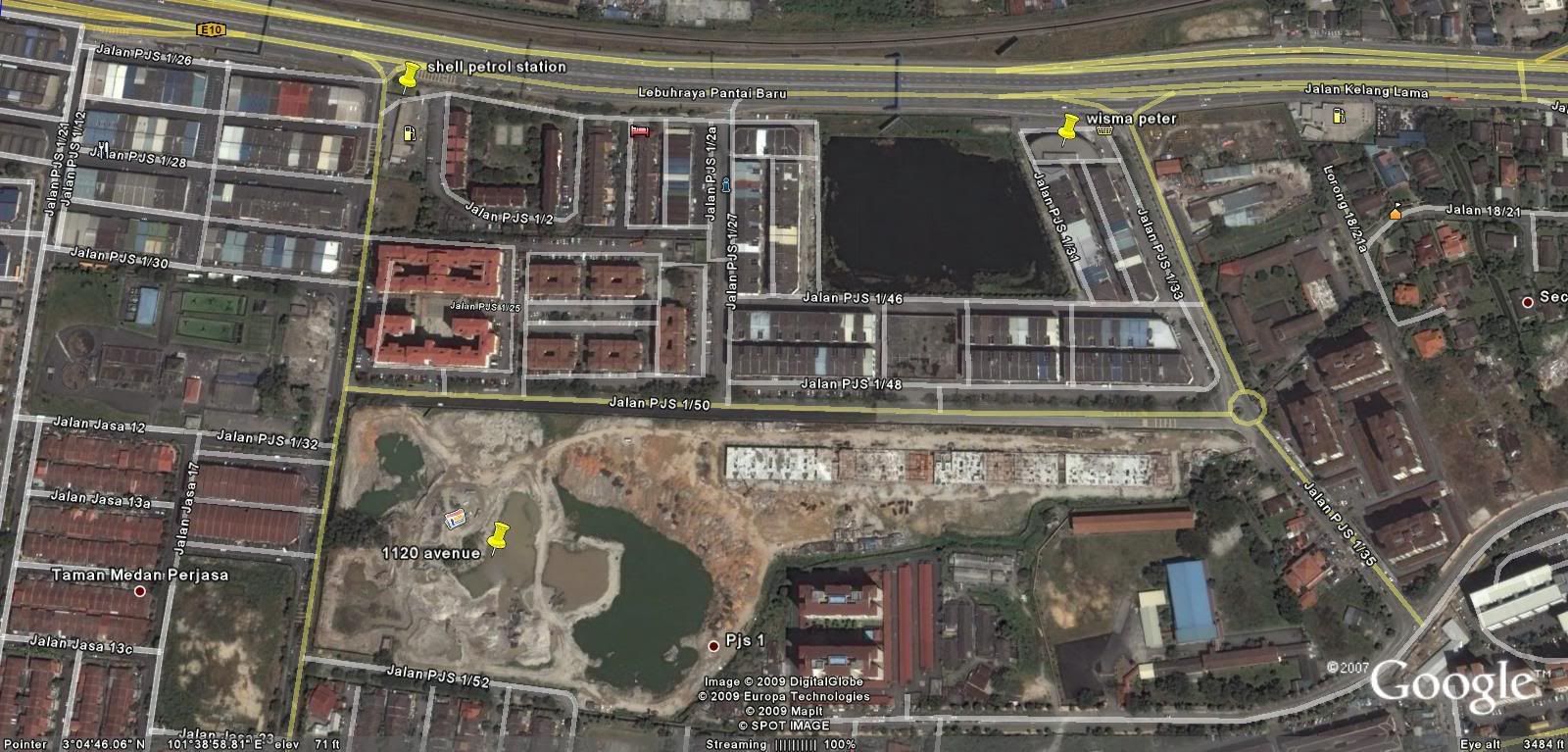

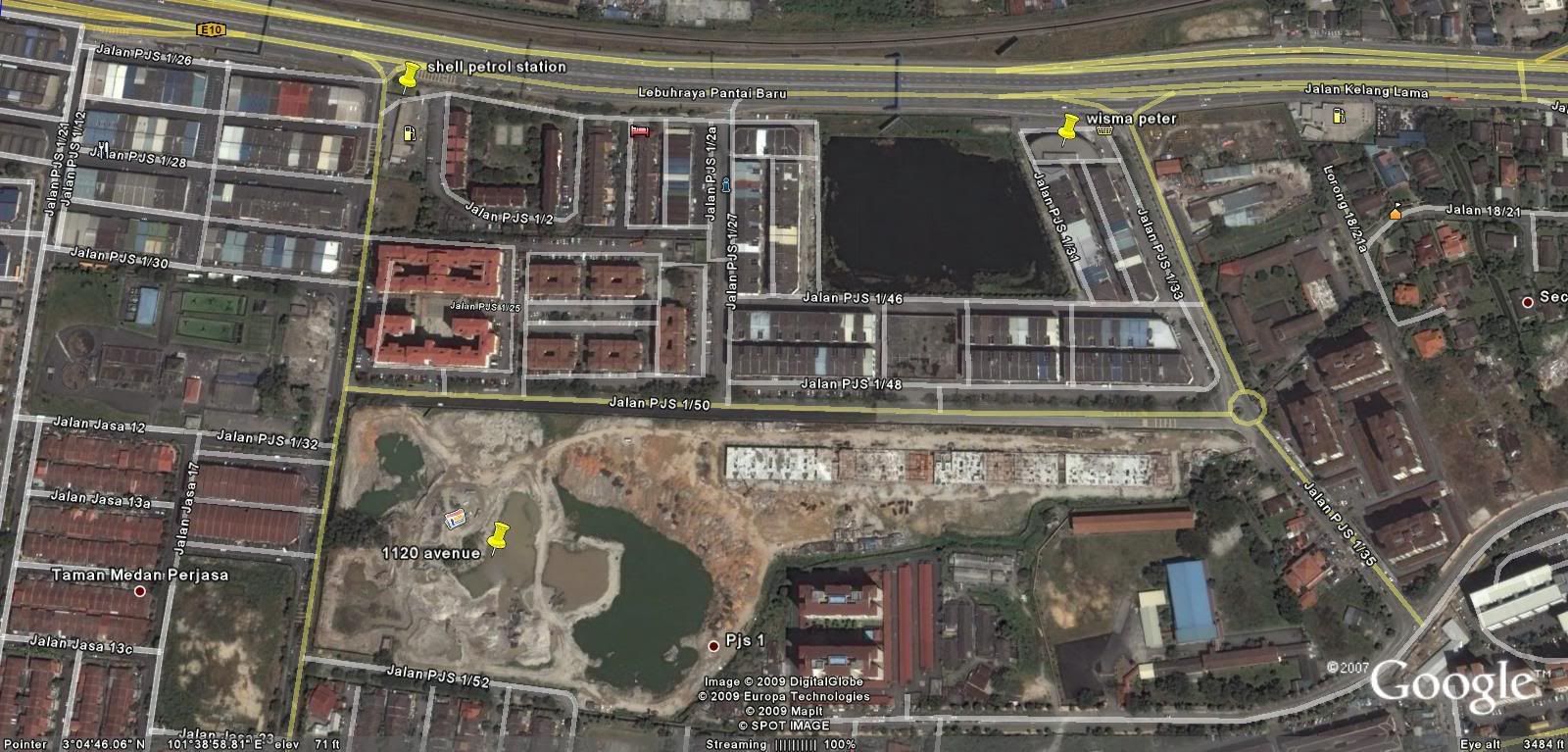

clearly image

the smell that u'll mention is came from

1 is from 'jalan jasa 12', and other 1 is from taman medan thr....

This post has been edited by 211445: Dec 26 2009, 09:58 PM

1120 Park Avenue - PJ South, any comments?

|

|

Dec 26 2009, 09:48 PM Dec 26 2009, 09:48 PM

Return to original view | Post

#1

|

Junior Member

78 posts Joined: Sep 2005 |

clearly image the smell that u'll mention is came from 1 is from 'jalan jasa 12', and other 1 is from taman medan thr.... This post has been edited by 211445: Dec 26 2009, 09:58 PM |

|

|

|

|

|

Dec 27 2009, 10:45 AM Dec 27 2009, 10:45 AM

Return to original view | Post

#2

|

Junior Member

78 posts Joined: Sep 2005 |

When i visit the show unit,i found that most of their SA din familiar with the tmn sri sentosa n tmn manja road

i think they're nvr drive around inside tmn2 to look/understand the area environment perhap, not all area is ex-mining land......only tmn manja place is ex-mine.....last time tmn sri sentosa was a hill land, all resident plant food/fruit to survivie ....IN Property Market, honestly say ~hill land is much valueable than ex-mine land.... This post has been edited by 211445: Dec 27 2009, 02:45 PM |

|

|

Dec 29 2009, 09:29 PM Dec 29 2009, 09:29 PM

Return to original view | Post

#3

|

Junior Member

78 posts Joined: Sep 2005 |

Buying a home: freehold vs leaseholdPosted on November 25th, 2009 by Mindy Yong.

Categories: Singapore Real Estate News. Buying a home: freehold vs leasehold NICHOLAS MAK examines how both tenures perform in rising and falling markets as well as in collective sales THE question of whether to own freehold or leasehold property seems a perennial one, with pros and cons shifting with market cycles and new trends. Here, we examine the issue from the perspective of both a home owner and investor, and see how both tenures perform in rising and falling markets as well as in collective sales. Pros and cons: If the upswing in the property market is bottom-up, leasehold condominiums could outperform freehold ones. Conversely, if the boom is top down, freehold condominiums would deliver superior results The chief attraction of 99-year leasehold property is that it is typically priced lower than a comparable freehold property. As a result, they are popular with HDB upgraders as entry-level private properties. Most mass-market homes are 99-year leasehold condominiums, with prices ranging from $500 per sq ft to $900 per sq ft. A typical family-size apartment could cost anything from $600,000 to $1.2 million. For investors, leasehold properties usually offer a higher rental yield because of their lower capital cost. However, the higher yield merely compensates the owner for the decaying lease. One of the more apparent disadvantages of owning a 99-year leasehold property is that the length of the lease is contracting daily. All else being equal, this would result in falling property value. However, certain external factors could slow the decline in value, such as if the property is sought after by tenants or buyers. This could be due to a prime location, improving infrastructure (such as a proposed MRT station nearby), or good amenities or popular schools in the vicinity. When it comes to collective sales, there are usually fewer opportunities for them with 99-year homes. One reason is that many of them are still relatively new and in good condition. Thus, the owners do not feel any urgency to sell their homes collectively. A more pertinent reason is that the premium payable to the government to top up a 99-year lease is quite high, based on the existing formula. And since developers factor the premium as part of the total land cost, the higher the premium the less the owner of the ageing leasehold would get in any collective sale. As such, collective sales are not attractive to many owners of 99-year leasehold apartments unless the expense of maintaining their ageing properties are so high that a collective sale becomes the cheaper alternative. A key benefit of owning freehold real estate is that the land value does not generally depreciate in the long term. Although all properties are subject to market fluctuations, the price of freehold land tends to be more stable than that of leasehold land over time. However, the value of a freehold property could still decrease over time due to the depreciating value of the ageing building. Over the long term, while the value of freehold land may increase or remain little changed, the value of the building would decline. One factor that supports the value of freehold land in Singapore is its scarcity. Since all the land sold by the government is leasehold, the amount of freehold land would not increase. In fact, it might shrink over time if the government makes acquisitions of such land. Another advantage of owning a freehold property is the potential of a windfall from a collective sale. If the value of the freehold land increases while the value of the ageing building declines, it could reach a stage where the redevelopment value of the property is worth more than the utility value of the existing building. As a result, the property owners may find a collective sale of their property to a developer to be highly profitable. Some developers looking to acquire residential land for development may also prefer freehold land to ageing 99-year leasehold property because freehold land would not require the payment of a hefty premium for extending the lease. For all these reasons, freehold residential properties are generally priced higher than 99-year leaseholds. The price range of freehold non-landed properties is also wider than that of comparable leasehold properties. Depending on the location, freehold property prices could vary from $600 psf to $4,000 psf or more. The majority of high-end residential properties are freehold. For investors, one disadvantage of freehold property is the lower rental yield, a function of the higher cost of the property. Also, while freehold properties have a higher likelihood of a collective sale than their leasehold counterparts, that can prove to be a double-edged sword. The property boom of 2005 to 2008 whipped up a collective sale frenzy. But some property owners who sold for a windfall found they could not get a replacement home in the same location from their proceeds. As the collective sale boom was powered by surging property prices, by the time en-bloc property sellers received their proceeds, the prices of comparable replacement homes would have moved out of reach. Now, we look at the price performance of freehold and leasehold properties. Although freehold properties are usually priced higher than their leasehold counterparts, their rate of appreciation does not always outperform. There were two property cycles between end-1998 and mid-2009. The first market boom, which started at end-1998 and ended in mid-2000, was a bottom-up price recovery. Demand started in the mass-market sector and moved up to the mid-tier and finally the high-end segment. During this 18-month period, the average price of 99-year condominiums rose faster than that of freehold homes. The average price of freehold condominiums grew by 38.2 per cent, while the average price of 99-year leasehold condominiums surged by 46.2 per cent. But on the way down, leasehold home prices also fell more steeply. On the downcycle between mid-2000 and the first half of 2004, the average price of leasehold condominiums fell 26.1 per cent, steeper than the freehold price decline of 17.6 per cent. The most recent boom that lasted four years from mid-2004 to mid-2008 started with high-end property and gradually filtered down to the mass market. Even when the mass-market sector started to pick up in 2007, the momentum in the high-end segment did not let up. As a result, freehold condominium prices jumped by an impressive 64.7 per cent on average, while the average leasehold property price rose some 50 per cent. When the property market here started to contract in mid-2008 due to the global financial crisis, freehold condominium prices fell 26.5 per cent year on year, just slightly more than 99-year leaseholds, which dropped by 23.8 per cent. What this study shows is that if the upswing in the property market is bottom-up, leasehold condominiums could outperform freehold ones. Conversely, if the boom is top down, freehold condominiums would deliver superior results. However, this study also illustrates that the faster the rise, the harder the fall. So in a top-down property boom, owners of freehold condominiums who had enjoyed a sharper price appreciation should be nimble enough to lock in their gains before the downtrend sets in. In comparing freehold and leasehold residential properties, there is no conclusive evidence to show that one is better than the other. Ultimately, the decision boils down to budget and preference. The writer is a real estate lecturer at Ngee Ann Polytechnic Source : Business Times - 25 November 2009 Buy Sell Rent invest In Singapore Property Real Estate MINDY YONG ( +65 ) 91002985 mindy@mindyyong.com ------very good info. |

|

|

Jan 7 2010, 08:46 PM Jan 7 2010, 08:46 PM

Return to original view | Post

#4

|

Junior Member

78 posts Joined: Sep 2005 |

Beside it ia constructing a petrol station....

This post has been edited by 211445: Jan 7 2010, 08:46 PM |

|

|

Jan 19 2010, 08:37 PM Jan 19 2010, 08:37 PM

Return to original view | Post

#5

|

Junior Member

78 posts Joined: Sep 2005 |

this place look so high class....got jaguzi

http://www.papillondesahill.com/ |

|

|

Jan 22 2010, 12:01 AM Jan 22 2010, 12:01 AM

Return to original view | Post

#6

|

Junior Member

78 posts Joined: Sep 2005 |

the land hadnt touch yet..only the petrol is done 70% complete

|

|

|

|

|

|

Feb 3 2010, 06:49 PM Feb 3 2010, 06:49 PM

Return to original view | Post

#7

|

Junior Member

78 posts Joined: Sep 2005 |

as i know...if the developer dont have money to pay their contrators in time...the sub-con. wont start the jobs unless they receive money...so maybe they'll delay the finish contruction

This post has been edited by 211445: Feb 3 2010, 06:50 PM |

|

|

Feb 20 2010, 01:28 PM Feb 20 2010, 01:28 PM

Return to original view | Post

#8

|

Junior Member

78 posts Joined: Sep 2005 |

different thing different price

if u want nice thing/ high expect, then u had to pay high.....just like this type rm440++k http://www.papillondesahill.com/ This post has been edited by 211445: Feb 20 2010, 01:31 PM |

|

|

Mar 9 2010, 09:32 AM Mar 9 2010, 09:32 AM

Return to original view | Post

#9

|

Junior Member

78 posts Joined: Sep 2005 |

QUOTE(20yrsinsrisentosa @ Mar 8 2010, 09:55 PM) maybe they mentioned the piling machine is located next to the petrol station, not 'behind' them??? .....but the land next to petrol is not under 1120 project pun This post has been edited by 211445: Mar 9 2010, 09:36 AM |

|

|

Mar 10 2010, 08:30 PM Mar 10 2010, 08:30 PM

Return to original view | Post

#10

|

Junior Member

78 posts Joined: Sep 2005 |

QUOTE(sup3rfly @ Mar 10 2010, 08:30 PM) just placed my booking, asked about when the construction work start, they mention april... i m not sure if that will be apartment or condo coz i think apartment doesnt have swimming pool, card access at the entrance... i dunno apartment doesnt mean their dun hv pool/ all those things....... This post has been edited by 211445: Mar 10 2010, 08:33 PM |

|

|

Nov 13 2010, 09:02 AM Nov 13 2010, 09:02 AM

Return to original view | Post

#11

|

Junior Member

78 posts Joined: Sep 2005 |

QUOTE(cmk96 @ Nov 13 2010, 08:26 AM) China built 15 storey hotel in 6 days...amazing.... Hey... that means 1120 can be built in less than a month in China. lol.... what happen if the steel rusted?.....if the steel always open-air and contact with o2+rain, it will be 'oxidation' happen n rust.....i open my eye bigger n see when they building repair again http://news.yahoo.com/s/yblog_upshot/20101...n-just-six-days safety 1st This post has been edited by 211445: Nov 13 2010, 09:07 AM |

|

|

Apr 10 2011, 11:59 AM Apr 10 2011, 11:59 AM

Return to original view | Post

#12

|

Junior Member

78 posts Joined: Sep 2005 |

|

|

|

Jun 12 2011, 09:39 AM Jun 12 2011, 09:39 AM

Return to original view | Post

#13

|

Junior Member

78 posts Joined: Sep 2005 |

so suffer ==

This post has been edited by 211445: Jun 12 2011, 09:40 AM |

|

Topic ClosedOptions

|

| Change to: |  0.0433sec 0.0433sec

0.25 0.25

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 04:51 PM |