Previous thread

http://forum.lowyat.net/topic/593237/+2500

US stock discussion v2

US stock discussion v2

|

|

Dec 5 2009, 12:30 PM, updated 16y ago Dec 5 2009, 12:30 PM, updated 16y ago

Show posts by this member only | Post

#1

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

|

|

|

|

|

|

Dec 5 2009, 12:46 PM Dec 5 2009, 12:46 PM

Show posts by this member only | Post

#2

|

Senior Member

534 posts Joined: Dec 2006 |

Heh, its finally v2.

Second to post. |

|

|

Dec 5 2009, 12:57 PM Dec 5 2009, 12:57 PM

Show posts by this member only | Post

#3

|

Junior Member

131 posts Joined: Sep 2008 |

3rd to post

Holding ERX at 40$ |

|

|

Dec 5 2009, 01:14 PM Dec 5 2009, 01:14 PM

Show posts by this member only | Post

#4

|

Senior Member

1,345 posts Joined: Sep 2009 |

yes.. on board.

holding some MGM now.. |

|

|

Dec 5 2009, 01:46 PM Dec 5 2009, 01:46 PM

Show posts by this member only | Post

#5

|

All Stars

23,851 posts Joined: Dec 2006 |

deleted

This post has been edited by SKY 1809: Dec 5 2009, 02:43 PM |

|

|

Dec 5 2009, 02:19 PM Dec 5 2009, 02:19 PM

Show posts by this member only | Post

#6

|

All Stars

10,123 posts Joined: Aug 2007 |

Wow.. after come back from lunch.. surprise to see we're on v2.

Anyway, looks like someone wants my ERX badly. Sold off 1/4 position early this am before extended pm trading close. Holding 1/4 position for both TNA and ERX into next week. Going to take my afternoon nap. |

|

|

|

|

|

Dec 5 2009, 02:45 PM Dec 5 2009, 02:45 PM

Show posts by this member only | Post

#7

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(SKY 1809 @ Dec 5 2009, 01:46 PM) " on ur point of politics, here is an article on the economic crisis & ben, which if u r upset, of coz u won't read icon_rolleyes.gif " no prob abt tat, nothing to upset abt Thanks for showing me the article. Incidentally I had said something in V45 Post 1465 before I got to read your article. Nothing to be upset about. AND Many right things could be deemed wrong, and many wrong things could be deemed right , at different time of interpretations. Likewise with investments. The exception is , if you could come out with a PERFECT ECONOMIC THEORY FOR ALL TIMES. Reprinted as below :- " Cashflow really works wonder. US is all about Cashflow and money printing machines. So long they keep their printing machines in superb condition, they are still all right. ( worry comes > next election )" This post has been edited by SKY 1809: Yesterday, 01:00 PM we all here looking for $$$, lookie here, i m number 7 aiyoh, if my words can hurt anyone then i no idea what anyone will face, since SIFU MARKET take monies away happily & seldom returns it i shorted ctsh on thursday & got creamed on friday pre market feels like a kentucky fried ayam should hav shorted gld, but nothing is perfect... there r trillions of usd sloshing around now, better grab some b4 they turn off the tap next month, jobless rate will be 9.99% & job loss is lessen by 10,000 - means another bull, dun u love the usa market as usual, u all know la, i m politically incorrect  » Click to show Spoiler - click again to hide... «

|

|

|

Dec 5 2009, 05:02 PM Dec 5 2009, 05:02 PM

Show posts by this member only | Post

#8

|

Senior Member

4,305 posts Joined: Sep 2008 |

Check in.

|

|

|

Dec 5 2009, 05:04 PM Dec 5 2009, 05:04 PM

Show posts by this member only | Post

#9

|

Senior Member

1,120 posts Joined: Jul 2006 |

Wow, this thread started second version.

dreams_achiever reporting in Just bought Goldman call options yesterday night. Time for bull to run..hehe Employment data stand at 10% better than previous month of 10.2%. If it continue to better next month, it may sign of reversal for employment data. I may wary abit for this month data due to holiday season. Not many employer will fire employee during festive season. Anyway, just buy and wait for bull run. *finger crossed* |

|

|

Dec 5 2009, 10:19 PM Dec 5 2009, 10:19 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(dreams_achiever @ Dec 5 2009, 05:04 PM) I may wary abit for this month data due to holiday season. Not many employer will fire employee during festive season. You're right on the nail head. Next month Jan 2010, we'll get the December month unemployment data and it may be down because of a lot of "temp" hiring during festive season. I know this because I work for outsourced US companies and we're processing a lot of their calls. US Thanksgiving to Christmas is the busiest times for retailers. I say "temp" because it is for what it is. A lot of retailers aren't hiring permanent staff and a lot of them don't have benefits. After the New Year, their contract will be terminated and they will have to look for openings if the companies are willing to open up more slots. Anyway, just buy and wait for bull run. *finger crossed* This may give false impression to market that we're on recovery. Be cautious. Just trade the trend. Those who shorted Gold/Commodities and who long Dollar got a surprise break yesterday but it won't last. Good luck to all. |

|

|

Dec 6 2009, 03:09 PM Dec 6 2009, 03:09 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

wow, new thread. Welcome V2. Behold the swinger party of NYSE

|

|

|

Dec 7 2009, 01:21 AM Dec 7 2009, 01:21 AM

|

Senior Member

1,120 posts Joined: Jul 2006 |

|

|

|

Dec 7 2009, 09:21 AM Dec 7 2009, 09:21 AM

|

All Stars

17,018 posts Joined: Jan 2005 |

Morning guys. US stock thread going really fast now. V2 liao.

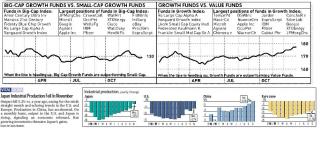

Some weekly report for you guys. QUOTE The Weekly Report For December 7th - December 11th, 2009 Commentary: To say there was some fireworks on Wall Street this week would be an understatement. The week started with a wide range day on Monday as traders returned from the holiday weekend, which held the prior week’s lows successfully. The following day there was a sharp gap higher which took the indexes towards their recent highs. The following three days had the markets probing new highs with each test getting rejected thoroughly. By the end of the week, the markets still showed a small gain, although certain market leaders such as Apple Inc. (Nasdaq:AAPL) finished much lower. Also, the commodities markets, and gold in particular had a spectacular reversal this week. The overall trend remains higher, but this drop could put a scare in many speculators. In stepping back and looking at the chart for the S&P500 as represented by the S&P 500 SPDRS (NYSE:SPY) ETF, you can see that despite the commotion the past few days, the index remains near the middle of its trading range, not unlike where it finished last week. The recent highs will now become even more important, as the rally attempt brought in high volume selling. This type of selling is usually attributed to institutions, so caution is certainly warranted. [attachmentid=1342410] The Diamonds Trust, Series 1 (NYSE:DIA) ETF is in much the same position as SPY. The breakout attempt failed right away, but DIA also finished the week higher. It also respected the rising 20-day moving average as support and the late week pullback really only filled in the open gap. It will be interesting to see if the markets will be ready to attempt another breakout or first test support near the last week’s gap down lows. [attachmentid=1342411] While it appeared that the iShares Russell 2000 Index (NYSE:IWM) ETF was finally beginning to re-emerge as a leader, in the end, the breakout attempt failed here as well. IWM was able to clear it’s November high early on Friday morning, but it quickly reversed and closed back in the recent trading range. This new high now takes on increased importance as well, and should be watched as a potential selling area moving forward. The lows near $56 continue to be critical for IWM, as a break below would cement a topping pattern and project to a move near the $50-$51 area. [attachmentid=1342412] The Powershares QQQ ETF (Nasdaq:QQQQ) also ended the week on a similar note, with a breakout failure, but still a higher close on the week. Much like the other market ETF’s, the recent highs now take on more importance with multiple failures from this area. This group has been a leader throughout the recent months, and remains an important one to track in order to try and gain clues as to where the market is headed. [attachmentid=1342413] Bottom Line It was certainly an interesting week, as the breakout failures were disappointing for the bulls, but in all reality, by the end of the week the net result was still positive. The bears have really been unable to push the markets lower, and the recent lows across each of the market ETF’s remain out of reach. Will next week be the week where the bears make some headway? This post has been edited by ozak: Dec 7 2009, 09:24 AM |

|

|

|

|

|

Dec 7 2009, 08:07 PM Dec 7 2009, 08:07 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

mali mali... skim cepat kaya, open to first 20 responders onli » Click to show Spoiler - click again to hide... «

|

|

|

Dec 7 2009, 09:33 PM Dec 7 2009, 09:33 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Looks like we're going down..

Oil below $75, Dollar Up, VIX up slightly. But.. looks like we're ok since it close to fair value. This post has been edited by danmooncake: Dec 7 2009, 10:04 PM |

|

|

Dec 7 2009, 10:11 PM Dec 7 2009, 10:11 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Nvidia (NVDA) and Advanced Micro Devices (AMD) reveling in Intel's (INTC) failure to produce a consumer version of its much-touted, much-delayed multi-core graphics chip Larrabee. NVDA +11% premarket to $15.79. AMD +3.7% to $8.15.

Premarket gainers: ROY +47%. NVDA +11%. NYB +9%. TRA +9%. ASIA +9%. SNTS +6%. CTIC +6%. KERX +6%. SNV +5%. AKAM +5%. S +5%. SEED +5%. VG +4%. AMD +4%. SPWRA +4%. Losers: ALTH -11%. RBS -5%. CAL -5% Wow, RBS really longkang. Seems like C previously. |

|

|

Dec 7 2009, 11:14 PM Dec 7 2009, 11:14 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Sold TNA 39.05

I'm selling the pop. Market internals look weak. |

|

|

Dec 7 2009, 11:20 PM Dec 7 2009, 11:20 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

don't why weak..

|

|

|

Dec 7 2009, 11:22 PM Dec 7 2009, 11:22 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(danmooncake @ Dec 7 2009, 11:14 PM) You would think that insiders would finally change their tune after almost a year of straight line gains in the market. Think again. The most recent insider trading data from finviz indicates that insider sellling outpaces buying by a ratio of 82! In the most recent data set, $11.6 million in stock was purchased by insiders, while a whopping $957 million was sold. And somehow pundits are still spinning this mass orchestrated sell into the bid by those in the know as a bull market.http://www.zerohedge.com/article/most-rece...uying-ratio-821 Added on December 7, 2009, 11:23 pm QUOTE(epalbee3 @ Dec 7 2009, 11:20 PM) Ur MGM doin well. Dun wanna re-enter?Should Short MGM and RBS. This post has been edited by zamans98: Dec 7 2009, 11:23 PM |

|

|

Dec 7 2009, 11:25 PM Dec 7 2009, 11:25 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Energy and metals commodities are going south..,financials heading that way.

Dollar up, Rest of Stocks maybe undecided 'coz small caps holding.. Watch that Dollar. If it continues uphill, equities will tank. |

|

|

Dec 7 2009, 11:31 PM Dec 7 2009, 11:31 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

QUOTE(zamans98 @ Dec 7 2009, 11:22 PM) You would think that insiders would finally change their tune after almost a year of straight line gains in the market. Think again. The most recent insider trading data from finviz indicates that insider sellling outpaces buying by a ratio of 82! In the most recent data set, $11.6 million in stock was purchased by insiders, while a whopping $957 million was sold. And somehow pundits are still spinning this mass orchestrated sell into the bid by those in the know as a bull market. Bought at 10.80. Will tanking..http://www.zerohedge.com/article/most-rece...uying-ratio-821 Added on December 7, 2009, 11:23 pm Ur MGM doin well. Dun wanna re-enter? Should Short MGM and RBS. Hope will rebound to 11. I think someone is trying to pull down the price for next rally.. |

|

|

Dec 7 2009, 11:39 PM Dec 7 2009, 11:39 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

Dec 7 2009, 11:58 PM Dec 7 2009, 11:58 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 8 2009, 01:33 AM Dec 8 2009, 01:33 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Sold ERX 38.40, small profit.

Waiting for re-entry. Update: 3:08am Uncle Ben has spoken.. going long again. Update: 3:52am Hoo Hoo.. selling into close.. Waiting for a bigger dip. Closing Update: 5:25am Dow 10390.11 +1.21 +0.01% Nasdaq 2189.61 -4.74 -0.22% S&P 500 1103.25 -2.73 -0.25% Oh... market doesn't seem to like Uncle Ben speech. We sold into the close. My rebuy queue for ERX 37.50 didn't happen. All cash for today. This post has been edited by danmooncake: Dec 8 2009, 05:28 AM |

|

|

Dec 8 2009, 09:16 AM Dec 8 2009, 09:16 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Wow, look at ASIA.

NVDIA, AMD gained on Intel Failure to launch new chip. Short INTC Re-entered LVS after-market @ 15.90 |

|

|

Dec 8 2009, 09:22 AM Dec 8 2009, 09:22 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

Dec 8 2009, 09:37 AM Dec 8 2009, 09:37 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 8 2009, 09:33 PM Dec 8 2009, 09:33 PM

|

Junior Member

81 posts Joined: Jun 2009 |

QUOTE(zamans98 @ Dec 8 2009, 09:37 AM) still looking @ nice entry point. Big jumped form 28$. ya, i m also interested in rbs...Another candidate is RBS. been on down trend since last month. wondering what's the bad news that resulted for the dropping This post has been edited by syong: Dec 8 2009, 09:34 PM |

|

|

Dec 8 2009, 09:50 PM Dec 8 2009, 09:50 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Whoa.. nice. Oil down, Copper down, Gold down.. Futures down. Dollar up!

S&P target 1080 today. |

|

|

Dec 8 2009, 10:14 PM Dec 8 2009, 10:14 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

wow, very good market.

Damn, missed RBS again. whaddafuk. 10.08, worth to SHORT? hmm. Maybe after dumping INTC. Added on December 8, 2009, 10:15 pmC is pretty much dead. Almost 2 months and no movement. Now in a very tight channel 400-420. Big sum stuck in C - and never even reach 4.40. The spare cash can use to swing MGM and LVS! This post has been edited by zamans98: Dec 8 2009, 10:15 PM |

|

|

Dec 8 2009, 10:50 PM Dec 8 2009, 10:50 PM

|

Junior Member

81 posts Joined: Jun 2009 |

[quote=zamans98,Dec 8 2009, 10:14 PM]

wow, very good market. Damn, missed RBS again. whaddafuk. 10.08, worth to SHORT? hmm. Maybe after dumping INTC. missed? u short? tot it is dropping? |

|

|

Dec 8 2009, 10:56 PM Dec 8 2009, 10:56 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

[quote=syong,Dec 8 2009, 10:50 PM]

[quote=zamans98,Dec 8 2009, 10:14 PM] wow, very good market. Damn, missed RBS again. whaddafuk. 10.08, worth to SHORT? hmm. Maybe after dumping INTC. missed? u short? tot it is dropping? [/quote] yup, short opps missed. now wanna buy, 9.92? MGM Q 10.00 not hit, now LVS and MGM singing song together, flying high. |

|

|

Dec 8 2009, 10:58 PM Dec 8 2009, 10:58 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

Dec 8 2009, 11:04 PM Dec 8 2009, 11:04 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(danmooncake @ Dec 8 2009, 10:58 PM) hope they will. just cut loss on INTC. Crappy monkey. Mega news this Thu+Fri.. Thu Dec 10 9:30pm Trade Balance 9:30pm Unemployment Claims Fri Dec 11 9:30pm Core Retail Sales m/m 9:30pm Retail Sales m/m |

|

|

Dec 8 2009, 11:48 PM Dec 8 2009, 11:48 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

MGM is tanking.

I will keep it unless it falls until 9. |

|

|

Dec 8 2009, 11:52 PM Dec 8 2009, 11:52 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

Dec 8 2009, 11:55 PM Dec 8 2009, 11:55 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 9 2009, 12:21 AM Dec 9 2009, 12:21 AM

|

Senior Member

534 posts Joined: Dec 2006 |

Sigh, C is down to USD3.98 now. Why can't the treasury just sell their stake and pocket the money.

|

|

|

Dec 9 2009, 12:44 AM Dec 9 2009, 12:44 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

I'm in ERX 36.10, TNA 36.60 for swing trading

Update: 2:08am Scalped and sold TNA for 38.40 for quick profit Update: 4:08am Selling accelerated.. In another batch of TCK 32.40 for long. Who cares commodities tanking but I'm long. Dollar strength will be short lived. Buying opportunity here. Closing update: 5:23am Dow 10285.97 -104.14 -1.00% Nasdaq 2172.99 -16.62 -0.76% S&P 500 1091.93 -11.32 -1.03% This post has been edited by danmooncake: Dec 9 2009, 05:25 AM |

|

|

Dec 9 2009, 09:12 AM Dec 9 2009, 09:12 AM

|

Senior Member

768 posts Joined: Jan 2005 |

Finally post in v2.

Closed all my short positions in MGM and LVS. Now time to keep the bullets for the rebound. |

|

|

Dec 9 2009, 04:49 PM Dec 9 2009, 04:49 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 9 2009, 05:49 PM Dec 9 2009, 05:49 PM

|

Senior Member

4,305 posts Joined: Sep 2008 |

|

|

|

Dec 9 2009, 10:04 PM Dec 9 2009, 10:04 PM

|

Junior Member

81 posts Joined: Jun 2009 |

any idea whether etf is available in cimbinvest?

|

|

|

Dec 9 2009, 10:11 PM Dec 9 2009, 10:11 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

ETF? CIMB? Not sure.

Which ETF u;re looking at? |

|

|

Dec 9 2009, 10:14 PM Dec 9 2009, 10:14 PM

|

Junior Member

81 posts Joined: Jun 2009 |

haha, searching...

any recommendation? financial related? |

|

|

Dec 9 2009, 10:17 PM Dec 9 2009, 10:17 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

We may have another dip today... the majors are weak. Gold and Silver selloff continues, dollar strengthening another notch.

If you're long and up, sell this pop and buy at lower level. If you're short, it may too late to try it at this level. Use caution. |

|

|

Dec 9 2009, 10:18 PM Dec 9 2009, 10:18 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(syong @ Dec 9 2009, 10:14 PM) my favorite:Financial : UYG Properties: URE Its 2x ETF, sometimes with good swings. URE breached 6 and staying there, biggest underlying stock is SPG. UYG : Underlying are: GS, JPM, C, BAC. UYG looks delicious now. Good entry 5-540's |

|

|

Dec 9 2009, 10:25 PM Dec 9 2009, 10:25 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Banks are in trouble again.. the Dubai issue seems to be trickling to Europe now.

US banks are hardening their credit again. Set your eyes on S&P 1080. Go long and buy some if we dip down to this level. |

|

|

Dec 9 2009, 10:36 PM Dec 9 2009, 10:36 PM

|

Junior Member

81 posts Joined: Jun 2009 |

QUOTE(zamans98 @ Dec 9 2009, 10:18 PM) my favorite: since seldom trade, only have account with cimb.Financial : UYG Properties: URE Its 2x ETF, sometimes with good swings. URE breached 6 and staying there, biggest underlying stock is SPG. UYG : Underlying are: GS, JPM, C, BAC. UYG looks delicious now. Good entry 5-540's no point even if counter look delicious yet cant enter. |

|

|

Dec 9 2009, 10:55 PM Dec 9 2009, 10:55 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

Tanking agan..

all bears will followed by a bull... |

|

|

Dec 9 2009, 11:04 PM Dec 9 2009, 11:04 PM

|

Senior Member

534 posts Joined: Dec 2006 |

|

|

|

Dec 9 2009, 11:18 PM Dec 9 2009, 11:18 PM

|

Junior Member

81 posts Joined: Jun 2009 |

higher than what they r charging me for the online services?

shit, they have been charging damn high fees. Is Hong Leong or Maybank provide a better (= lower) brokerage fees? |

|

|

Dec 9 2009, 11:55 PM Dec 9 2009, 11:55 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

And... it touched 1086 and rebound..

Did you all get some? I did.. Bought another batch: 250 ERX 35.80 1000 TNA 36.50 500 TCK 32.85 Update: 11:58pm Sold 1000 TNA 37.50 Quick $1K profit. Looking for re-entry again if we sell later in afternoon. This post has been edited by danmooncake: Dec 9 2009, 11:59 PM |

|

|

Dec 10 2009, 12:13 AM Dec 10 2009, 12:13 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(danmooncake @ Dec 9 2009, 11:55 PM) And... it touched 1086 and rebound.. wow,congrats. Ur popular ETF = TNA and ERX.. Did you all get some? I did.. Bought another batch: 250 ERX 35.80 1000 TNA 36.50 500 TCK 32.85 Update: 11:58pm Sold 1000 TNA 37.50 Quick $1K profit. Looking for re-entry again if we sell later in afternoon. mine holding tight with LVS, hope to HEDGE against the heavy losses of C. |

|

|

Dec 10 2009, 12:22 AM Dec 10 2009, 12:22 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(zamans98 @ Dec 10 2009, 12:13 AM) wow,congrats. Ur popular ETF = TNA and ERX.. Yes, those are two most predictable 3x ETF for now.mine holding tight with LVS, hope to HEDGE against the heavy losses of C. I'm holding some C too, but not too worry about it. If it drops to 3.75-3.80, I'll buy another batch. LVS almost drop to my BUY price again (below 15). Update 12:46am: Don't want to be greedy. Sold 1/2 position TCK@ 34.25 for small profit, still holding the other half. Market losing strength, I may rebuy at lower price. Update 4:00am Bought 500 TCK @ 33.60 1000 TNA @ 36.60 250 ERX @ 35.05 Update: 4:48am Sold 1000 TNA @ 37.70 (~ another 1K here) 250 ERX @ 36.07 (~ small profit.. 0.25K) Still keeping TCK.. I love this roller coaster! Update: 4:50am Bought 500 C 3.80 It hits my price, therefore I'm nipping it here. Closing Update: 5:20am Dow 10337.05 +51.08 +0.50% Nasdaq 2183.73 +10.74 +0.49% S&P 500 1095.89 +3.95 +0.36% I'm not sure what causing the volatility today but we have crossed from green to red to green again.. Today, has been good day for me. I'm 2K+ richer. Thank you Mr. NYSE. This post has been edited by danmooncake: Dec 10 2009, 07:23 AM |

|

|

Dec 10 2009, 08:48 AM Dec 10 2009, 08:48 AM

|

Senior Member

1,120 posts Joined: Jul 2006 |

DMC, nice profits there

So easy gain. Click here and there, can earn USD2K++ dy..lolz News from Citi: Citi could sell $20 bln of shares soon: report On 5:52 pm EST, Wednesday December 9, 2009 Buzz up! 0 Print.Companies:Bank Of America CorporationCitigroup, Inc.Goldman Sachs Group Inc. NEW YORK (Reuters) - Citigroup Inc (NYSE:C - News) plans to pay back TARP by raising money in an equity offering that could be announced as early as Thursday and could be some $20 billion, television network CNBC reported, citing sources. No wonder my GS climbed almost 3% yesterday nite. Go Go go.. Year-End bull..haha Just wait for next Wednesday FOMC rate decision. If Fed continue to suppress the interest rate, equities may have small rally.. |

|

|

Dec 10 2009, 09:14 AM Dec 10 2009, 09:14 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(dreams_achiever @ Dec 10 2009, 08:48 AM) DMC, nice profits there looks like a recycle news, something injected to support the dropped in C and GS.So easy gain. Click here and there, can earn USD2K++ dy..lolz News from Citi: Citi could sell $20 bln of shares soon: report On 5:52 pm EST, Wednesday December 9, 2009 Buzz up! 0 Print.Companies:Bank Of America CorporationCitigroup, Inc.Goldman Sachs Group Inc. NEW YORK (Reuters) - Citigroup Inc (NYSE:C - News) plans to pay back TARP by raising money in an equity offering that could be announced as early as Thursday and could be some $20 billion, television network CNBC reported, citing sources. No wonder my GS climbed almost 3% yesterday nite. Go Go go.. Year-End bull..haha Just wait for next Wednesday FOMC rate decision. If Fed continue to suppress the interest rate, equities may have small rally.. GS and AAPL is the most favourite/darling stock of NYSE according to a poll run by CNBC DMC, congrats. I was in dreamland when you make $$$ |

|

|

Dec 10 2009, 09:38 AM Dec 10 2009, 09:38 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Guys, not so easy-lah..

I had to glue my butt to the seat and sit in front my 4 big screens monitors. Hardly take a break.. didn't even had my midnight snack. If you saw the chart for TNA, it oscillated from top of the Bollinger Band to bottom almost 3 times today.. I was afraid to let go and if I did, I would have missed it. Anyway, I guess I was lucky today. Phew! Just took my last call and signing off work now. Going for my afternoon nap and coming back again tonight after 9pm. |

|

|

Dec 10 2009, 10:12 AM Dec 10 2009, 10:12 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(danmooncake @ Dec 10 2009, 09:38 AM) Guys, not so easy-lah.. dunno how u managed ur time. I cannot take a nite job. Too tiring for me.I had to glue my butt to the seat and sit in front my 4 big screens monitors. Hardly take a break.. didn't even had my midnight snack. If you saw the chart for TNA, it oscillated from top of the Bollinger Band to bottom almost 3 times today.. I was afraid to let go and if I did, I would have missed it. Anyway, I guess I was lucky today. Phew! Just took my last call and signing off work now. Going for my afternoon nap and coming back again tonight after 9pm. dun forget to add - the adrenaline rush during the day. The feel! Like drugged ... especially on a volatile stock like 3x ETF! C was 3.85? |

|

|

Dec 10 2009, 10:24 AM Dec 10 2009, 10:24 AM

|

Senior Member

1,120 posts Joined: Jul 2006 |

QUOTE(zamans98 @ Dec 10 2009, 10:12 AM) dunno how u managed ur time. I cannot take a nite job. Too tiring for me. Same as me too. Day need to work as programmer.dun forget to add - the adrenaline rush during the day. The feel! Like drugged ... especially on a volatile stock like 3x ETF! C was 3.85? Night become part time trader. If want me to stay whole night watching stocks, i think my life will shorter 10 years. Earn so much money also no use, no life to spend on it..haha. Citi been consolidating for quite long time. I think it is just waiting to climb. Been steady around 3.70 - 4.20 for many days. (7 weeks) |

|

|

Dec 10 2009, 10:24 AM Dec 10 2009, 10:24 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(zamans98 @ Dec 10 2009, 10:12 AM) dunno how u managed ur time. I cannot take a nite job. Too tiring for me. Been working night for years now. No issue. No choice since my customers are all US based.dun forget to add - the adrenaline rush during the day. The feel! Like drugged ... especially on a volatile stock like 3x ETF! C was 3.85? Otherwise, my team and I would not have jobs. I'm lucky that my employer allows me to process trouble tickets and day trade at the same time. Anyway, C dropped to 3.79 the last 5 mins. I saw it dived, so I scooped some up @ 3.80 to average down. For C, the swing trade has to play out longer. Since BAC is getting back its feet, I'm sure C will be next. Gotta be patient there. I'm getting tired now. This post has been edited by danmooncake: Dec 10 2009, 10:25 AM |

|

|

Dec 10 2009, 04:36 PM Dec 10 2009, 04:36 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

MGM is tanking..

very tired after work. I dun care, if MGM not drop below 9, I am not selling.. |

|

|

Dec 10 2009, 05:00 PM Dec 10 2009, 05:00 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 10 2009, 07:32 PM Dec 10 2009, 07:32 PM

|

Junior Member

81 posts Joined: Jun 2009 |

have checked. cant buy etf vide cimbinvest.

already own 300 bac and c, plan to hold for long term. if i were to choose between rbs and mgm, which is the better option, perhaps short to medium? rbs has been dropping for the past few months, worse even after dubai's news... mgm? since dont put all my eggs in all financial shares? |

|

|

Dec 10 2009, 07:47 PM Dec 10 2009, 07:47 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(syong @ Dec 10 2009, 07:32 PM) have checked. cant buy etf vide cimbinvest. MGM or LVS. Avoid Financial counter for now. I hold 3,000 C, now lose almost 20% of the value.already own 300 bac and c, plan to hold for long term. if i were to choose between rbs and mgm, which is the better option, perhaps short to medium? rbs has been dropping for the past few months, worse even after dubai's news... mgm? since dont put all my eggs in all financial shares? I highly suggest open an account with J2trader or Sogo. Cheap rate, easy monitoring n management. But then again, its your choice and money. |

|

|

Dec 10 2009, 08:03 PM Dec 10 2009, 08:03 PM

|

Junior Member

81 posts Joined: Jun 2009 |

how to transfer monies there / back? how long it takes?

know cimb's brokerage fees going to cost me a lot. but i hardly trade, hvnt tried cimb even account opened early this year. |

|

|

Dec 10 2009, 08:40 PM Dec 10 2009, 08:40 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(syong @ Dec 10 2009, 08:03 PM) how to transfer monies there / back? how long it takes? via TT/wire, use CIMB or HSBC for wire. Normally receiving broker banker will charge USD25 or 85RM for the funding fee. Same fees apply for transfer out. know cimb's brokerage fees going to cost me a lot. but i hardly trade, hvnt tried cimb even account opened early this year. Unless u have US Bank account, it is cheaper. The fees you only paid once. Dun worry about the exchange rate, now USD /MYR is low, so grab the opportunity . 3.35-3.40 is a good rate. |

|

|

Dec 10 2009, 09:31 PM Dec 10 2009, 09:31 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

8:30am EST US Jobless Claims: 474K. That's UP from prior: 457K

but... the 4-weeks moving averages are lower: 473.75K (as opposed to 481.25K), therefore market is interpreting this as good news. Less employers fire people during holidays seasons.. infact more temp hiring, dollar slightly higher. VIX low, Oil back above $71 and S&P above 1090. All is calm and buyers are returning. Let's ride this up! This post has been edited by danmooncake: Dec 10 2009, 09:58 PM |

|

|

Dec 10 2009, 10:39 PM Dec 10 2009, 10:39 PM

|

Junior Member

81 posts Joined: Jun 2009 |

can ask some stupid questions?

there is market order and limit order, which one should i used? if i want to buy ABC at 10 and not willing to pay anything more than that, i should use limit order? tks |

|

|

Dec 10 2009, 10:53 PM Dec 10 2009, 10:53 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(syong @ Dec 10 2009, 10:39 PM) can ask some stupid questions? market order is the bid/ask price. Say 10.00 (buy)-10.01 (sell).there is market order and limit order, which one should i used? if i want to buy ABC at 10 and not willing to pay anything more than that, i should use limit order? tks Im market order, your buy price will be 10.01 yes, use limit order for set price, say 9.90. etc |

|

|

Dec 10 2009, 11:03 PM Dec 10 2009, 11:03 PM

|

Senior Member

768 posts Joined: Jan 2005 |

QUOTE(syong @ Dec 10 2009, 08:03 PM) how to transfer monies there / back? how long it takes? Typically pretty fast, I normally use Public Bank and the receiving bank charges 15usd and the money gets there that night itself.know cimb's brokerage fees going to cost me a lot. but i hardly trade, hvnt tried cimb even account opened early this year. --------------------------------------------- Queue to buy MGM @ 10.86 and C @ 3.84 Let's see if can get it or not. This post has been edited by miuk: Dec 10 2009, 11:42 PM |

|

|

Dec 10 2009, 11:44 PM Dec 10 2009, 11:44 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

|

|

|

Dec 10 2009, 11:47 PM Dec 10 2009, 11:47 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

Dec 11 2009, 12:19 AM Dec 11 2009, 12:19 AM

|

Senior Member

768 posts Joined: Jan 2005 |

Haha, typo. 9.86.

Phew, actually thought i made a mistake keying in the order, had to go and double check it. --------------------------------------- Guys, Any idea whats the story with CIT Group? CIT is now back trading on the NYSE after emerging from brankruptcy @ 26 dollars As far as i can recall CIT - 80 cents then declared brankrupt became CITGQ trading for like 20 cents then now become CIT again for 26 dollars?? This post has been edited by miuk: Dec 11 2009, 12:28 AM |

|

|

Dec 11 2009, 12:30 AM Dec 11 2009, 12:30 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Sold 250 ERX @ 37.50, still got 250 left.

Let see how high we can get.. Come'on Dow.. attempt another 10500 will ya? Closing Update 5:08am Dow 10405.83 +68.78 +0.67% Nasdaq 2190.86 +7.13 +0.33% S&P 500 1102.35 +6.40 +0.58% Not a rally today, just a slight push up. This post has been edited by danmooncake: Dec 11 2009, 07:13 AM |

|

|

Dec 11 2009, 02:26 PM Dec 11 2009, 02:26 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(miuk @ Dec 11 2009, 12:19 AM) Haha, typo. 9.86. CIT? wow +13%.Phew, actually thought i made a mistake keying in the order, had to go and double check it. --------------------------------------- Guys, Any idea whats the story with CIT Group? CIT is now back trading on the NYSE after emerging from brankruptcy @ 26 dollars As far as i can recall CIT - 80 cents then declared brankrupt became CITGQ trading for like 20 cents then now become CIT again for 26 dollars?? Base price : 25.50$. It is a reverse split. |

|

|

Dec 12 2009, 12:29 AM Dec 12 2009, 12:29 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Sold all my ERX 37.80.. Oil price has weaken (below $70).

Waiting for down cycle and rebuy at lower price. The bulls are getting tired. |

|

|

Dec 12 2009, 01:12 AM Dec 12 2009, 01:12 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 12 2009, 05:11 AM Dec 12 2009, 05:11 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Closing update (5:10am)

Dow 10471.50 +65.67 +0.63% Nasdaq 2190.31 -0.55 -0.03% S&P 500 1106.41 +4.06 +0.37% We closed up, but the bullish strength certainly has weaken 'coz we're close to the top again. I've closed out all my 3x positions. All cash for the weekend. But, still holding non-3x longs like TCK, C, etc.. You all have a good weekend! This post has been edited by danmooncake: Dec 12 2009, 05:13 AM |

|

|

Dec 12 2009, 07:32 AM Dec 12 2009, 07:32 AM

|

Junior Member

71 posts Joined: Feb 2009 |

feel like selling all shares in klse and dump into berkshire hathaway b share when it split.

|

|

|

Dec 12 2009, 08:32 AM Dec 12 2009, 08:32 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

Yeah, MGM is recovering.

my target price to sell is 11.. |

|

|

Dec 12 2009, 03:11 PM Dec 12 2009, 03:11 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 14 2009, 10:11 PM Dec 14 2009, 10:11 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Look at that.. Dubai is non-issue now and Citigroup to repay Tarp.

Looks like we got one more push up north tonight. Dow bouncing off 10500 ceiling again.. Will it be able to punch thru this time? This post has been edited by danmooncake: Dec 14 2009, 11:31 PM |

|

|

Dec 15 2009, 12:30 AM Dec 15 2009, 12:30 AM

|

Senior Member

768 posts Joined: Jan 2005 |

Crap C choose to repay the TARP money, there goes my money in there all diluted in their new stock offering.

|

|

|

Dec 15 2009, 12:37 AM Dec 15 2009, 12:37 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

TARP payment is actually a TRAP.

Same case happen with BAC. up then down by 2$. Now crappy C also down from 4.05 few days back to now 3.78$. Oh crap, time to hedge against C. I hold 3,000 C @ avg 4.70. Damn! |

|

|

Dec 15 2009, 12:50 AM Dec 15 2009, 12:50 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Dow 10505, S&P 1113

Sold 750 TCK 36.35, still have 250 left. Those holding C may want to be patient and play some other stocks while C finds its ground. I missed run on TNA this morning. |

|

|

Dec 15 2009, 12:58 AM Dec 15 2009, 12:58 AM

|

Junior Member

118 posts Joined: Sep 2009 |

It's dangerous to hold C. Or accumulate more on C . Please Guide. |

|

|

Dec 15 2009, 01:16 AM Dec 15 2009, 01:16 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

Dec 15 2009, 01:50 AM Dec 15 2009, 01:50 AM

|

Senior Member

2,352 posts Joined: Jan 2003 From: Pixelgasm |

|

|

|

Dec 15 2009, 05:18 AM Dec 15 2009, 05:18 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Closing update

10501.05 +29.55 +0.28% Nasdaq 2212.10 +21.79 +0.99% S&P 500 1114.11 +7.70 +0.70% Look at that! We crossed over and closed above 10500.. Man, this bull market got conviction. The question now is.. will we see 11000 first or 10000 first? Not much trading today since I'm letting some of remaining longs ride up (eg. TCK). Should have hold on more.. but heck, profits are profits. C is a dismay today due to Tarp repayment and fear of dilution but I think we have to let it it settle down. Too many panic sellers today and it may last a couple of trading sessions before C find its footing. This post has been edited by danmooncake: Dec 15 2009, 05:20 AM |

|

|

Dec 15 2009, 07:48 AM Dec 15 2009, 07:48 AM

|

Senior Member

2,352 posts Joined: Jan 2003 From: Pixelgasm |

QUOTE(danmooncake @ Dec 15 2009, 05:18 AM) Closing update How will dilution effect it? Can shed some light?10501.05 +29.55 +0.28% Nasdaq 2212.10 +21.79 +0.99% S&P 500 1114.11 +7.70 +0.70% Look at that! We crossed over and closed above 10500.. Man, this bull market got conviction. The question now is.. will we see 11000 first or 10000 first? Not much trading today since I'm letting some of remaining longs ride up (eg. TCK). Should have hold on more.. but heck, profits are profits. C is a dismay today due to Tarp repayment and fear of dilution but I think we have to let it it settle down. Too many panic sellers today and it may last a couple of trading sessions before C find its footing. I am looking forward to C at 3.50. |

|

|

Dec 15 2009, 08:22 AM Dec 15 2009, 08:22 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Future is reddish for now. C is now out of the channel. Its downwards. Dunno if I should get more or just let it be.

|

|

|

Dec 15 2009, 08:53 AM Dec 15 2009, 08:53 AM

|

All Stars

17,018 posts Joined: Jan 2005 |

|

|

|

Dec 15 2009, 08:59 AM Dec 15 2009, 08:59 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 15 2009, 09:03 AM Dec 15 2009, 09:03 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Seems like WFC is following C foot steps. Repaying TARP, getting the govt out of the way as quickly as possible.

Oh boy, they can't wait, can they? |

|

|

Dec 15 2009, 09:12 AM Dec 15 2009, 09:12 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(danmooncake @ Dec 15 2009, 09:03 AM) Seems like WFC is following C foot steps. Repaying TARP, getting the govt out of the way as quickly as possible. everyone is chasing to clear. But C is winning the war ahead by clearing all debts. The plan is much clearer than WFC, BAC, JPM, GSOh boy, they can't wait, can they? Refer here : http://bailout.propublica.org/main/list/refunds Added on December 15, 2009, 4:11 pmLVS and MGM are doing well. I'm holding small volume of both. Another GOOD ETF for those who are interested in GOLD. Market Vectors Junior Gold Miners ETF (GDXJ) Price range 25-29. Not volatile, good liquidity. or Barrick Gold Corporation > ABX : NYSE Surprisingly, RBS is doing well. Time to short MEGANEWS ALERT: Uncle Ben & Co is not looking forward for interest rate revision. Hence, the strategy BUY on DIPS (ensure u got extra cash to hold in-case market u turn) and sell on rally. [doesn't work in Kurap Land Stock Exchange KLSE] This post has been edited by zamans98: Dec 15 2009, 04:11 PM |

|

|

Dec 15 2009, 10:01 PM Dec 15 2009, 10:01 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

--From AP wire--

Stock futures are extending their decline after the government says wholesale inflation rose more than expected in November, led by surge in energy costs. The increase will likely be of topic among Federal Reserve policymakers who begin a two-day meeting on interest rates Tuesday. The Fed is expected to keep rates unchanged. Stocks have fallen overseas as the dollar rose against the euro amid continuing worries about Greece's debts and the financial health of Austria's banks. Dow Jones industrial average futures are down 52, or 0.5 percent, at 10,446. Standard & Poor's 500 index futures are down 6.10, or 0.6 percent, at 1,102.50, while Nasdaq 100 index futures are down 9.75, or 0.5 percent, at 1,798.00 -- Yeah.. already expected some pullback here since we're the top anyway. Let's go south. For those who watch Mad Money, J.Cramer pumps C on his show yesterday. http://www.cnbc.com/id/34419773/site/14081545 This post has been edited by danmooncake: Dec 15 2009, 10:18 PM |

|

|

Dec 15 2009, 10:25 PM Dec 15 2009, 10:25 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

having fun! its the holiday season & read wat old man minum at kopi shop says... haha, its been some time did not 'ah kiew' in forum 1. Obama Administration Can't Decide Whether The Recession Is Over, But It Wants Banks To Lever Up Joe Weisenthal|Dec. 13, 2009, 2:39 PM Politico recognizes inconsistency emanating out of the Obama administration based on comments from today's Sunday morning yak-fests. Two of President Obama’s top economic advisers disagreed Sunday about whether the recession had ended. Lawrence Summers, director of the National Economic Council, flatly said that it had. "Today, everybody agrees that the recession is over, and the question is what the pace of the expansion is going to be," Summers said on ABC's "This Week." But Christina Romer, who heads the White House Council of Economic Advisers, offered a more cautious view on NBC’s “Meet the Press.” What's going on here? Basically, the administration would love to take credit for a recovery, while also acknowledging the continued pain in the economy and allowing itself the ability to fire off a second stimulus if need be. It's a tigh trope to walk, though it's probably one they'll be trying to walk until the 2010 elections (though from then out, they want to be fully into taking-credit mode. If they're still talking about a recession in 2011, Obama may be a one-termer. The other message today was that Obama wants banks to lever up -- er, lend more -- again. The White House will have the nation's bankers as its guest on Monday CBS News: When I asked top White House economic advisor Larry Summers if the President needs to encourage banks to do more lending, he told me that bankers “need to recognize that they've got obligations to the country after all that's been done for them, and there is a lot more they can do.” Tomorrow, the President will meet with heads of the country’s biggest banks and Summers told me the White House has a blunt message: “President Obama is going to be talking with them about what they can do to support enhanced lending to customers across the country. "We were there for them. And the banks need to do everything they can to be sure they're there for customers across this country.” 2. Wall Street Blows Off Obama Meeting, Showing Mr. President Who's Boss Andrew Ross Sorkin|Dec. 15, 2009, 7:16 AM President Obama didn’t exactly look thrilled as he stared at the Polycom speakerphone in front of him. “Well, I appreciate you guys calling in,” he began the meeting at the White House with Wall Street’s top brass on Monday. He was, of course, referring to the three conspicuously absent attendees who were being piped in by telephone: Lloyd C. Blankfein, the chief executive of Goldman Sachs; John J. Mack, chairman of Morgan Stanley; and Richard D. Parsons, chairman of Citigroup. Their excuse? “Inclement weather,” according to the White House... That awkward moment on speakerphone in the White House, for better or worse, spoke volumes about how the balance of power between Wall Street and Washington has shifted again, back in Wall Street’s favor. » Click to show Spoiler - click again to hide... «

|

|

|

Dec 15 2009, 10:40 PM Dec 15 2009, 10:40 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

Dow is up.

But MGM and C is down. |

|

|

Dec 15 2009, 10:42 PM Dec 15 2009, 10:42 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

SOLD Long position of LVS @ 16.45, highest peak pre-market. Some1 bought a few thousand Units and Short the position. I missed it.

Waiting for C to drop to 3.60 to pump in a little. |

|

|

Dec 15 2009, 10:54 PM Dec 15 2009, 10:54 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

Dec 15 2009, 11:00 PM Dec 15 2009, 11:00 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

suspek epalbee reading index future for wednesday, when fed remain int rate as it is

friday is opex day, for now up 50 point, down 50 point & dance around resistance level |

|

|

Dec 15 2009, 11:06 PM Dec 15 2009, 11:06 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

epalbee is using TIME machine.. No wonder.

C is down again, everyday dropped 4-7cts. LVS is hard to catch at 15.80. Wanna reload some more before it bounced back to 16. MGM on the other hand is eroding. Never mind, my buy price is 9.95. In fact, it rebounded from 9.60 few days back. |

|

|

Dec 15 2009, 11:11 PM Dec 15 2009, 11:11 PM

|

Senior Member

2,352 posts Joined: Jan 2003 From: Pixelgasm |

Christmas liao ma. Cashing out time, wait for price to drop gau gau then pick up more lo.

|

|

|

Dec 15 2009, 11:26 PM Dec 15 2009, 11:26 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(zamans98 @ Dec 15 2009, 11:06 PM) epalbee is using TIME machine.. No wonder. u guys really hav patience scalping lvs & mgm, along with titanic c C is down again, everyday dropped 4-7cts. LVS is hard to catch at 15.80. Wanna reload some more before it bounced back to 16. MGM on the other hand is eroding. Never mind, my buy price is 9.95. In fact, it rebounded from 9.60 few days back. short etfs really tying up my funds buy the dip

» Click to show Spoiler - click again to hide... «

|

|

|

Dec 15 2009, 11:38 PM Dec 15 2009, 11:38 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

» Click to show Spoiler - click again to hide... « Sul, I'm really amaze. How come u know a lot of counters and keep track of 'em? My list are simple : C, UYG, URE, LVS, MGM. TNA and ERX as gauge. This post has been edited by zamans98: Dec 15 2009, 11:40 PM |

|

|

Dec 16 2009, 12:14 AM Dec 16 2009, 12:14 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

I almost got LVS last Friday.. queue to 14.80.. just a notch too low. Didn't pay too much attention on it.

I was busy watching ERX, TNA and TCK. Many people have asked me via PM. Frankly, I'm not too worry about C now. Eventho I know their balance sheet sucks at the moment. I'm long on C. Currently holding only 750 shares avg 4.10. I'll have to see how it plays out after they've issued the new shares. I plan to average down if they drop to low $3. Meanwhile, for those playing long, don't spend too much of your portfolio percentage on Financials. Financials led us back to recovery but I believe it may lead the way down if we have a second dip next year. For other LONGs, I'm into Technology (CSCO,AAPL), Copper/Gold Metals Mining (TCK/FCX), Food/Restaurant (MCD), Emerging Markets (EWT/EWZ/FXI), Shipping (DSX) and Industrials (GE) and broad based ETFs like VTI and VEU. I'm beginning to look at Airlines, perhaps even Automobiles Manufacturers, which are the worst of breeds (meaning badly hammered) during downturn. For short-term trades: I'm playing ERX/TNA for 3x bulls, ERY/TZA for 3x bears. I'm not holding any bears or shorts for now. I may jump back soon, watching VIX for signs. Another short term swing plays are US Dollar versus Yen: UUP,YCS,YCL Most likely, I will play some gambling stocks like LVS/MGM for swing trades. Good luck to all. This post has been edited by danmooncake: Dec 16 2009, 12:23 AM |

|

|

Dec 16 2009, 01:07 AM Dec 16 2009, 01:07 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(zamans98 @ Dec 15 2009, 11:38 PM) Sul, I'm really amaze. How come u know a lot of counters and keep track of 'em? My list are simple : C, UYG, URE, LVS, MGM. TNA and ERX as gauge. which i have given lots of clue in last thread i stick to the top 50 sector & for swing trade, ensure price above $10 with ok type of FA for roket type, see they beat earnings, momo float is low & p/e is getting high sample of the 'pay' a bit info : ctrp = 45.2% abv = 39.9% pwrd = 56% lft = 54.2% wcrx = 44% Strong profit margin is a hallmark of any great stock. A profit margin of 50% means the company is generating 50 cents of profit for each $1 of sales. Stocks with the high annual profit margin, sorted by profit margin, secondary sort by latest quarter EPS % change; price >= $15, average daily volume >= 400,000 shares, within 30% of a 52-week high if u gonna do something about it, u can learn to create ur own watchlist, trust ur own instinct & refine it over time the journey of a thousand miles begin with a single step next kopitiam question is : where / how to start |

|

|

Dec 16 2009, 07:07 AM Dec 16 2009, 07:07 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Closing update:

Dow 10452.000 -49.05 -0.47% Nasdaq 2212.10 -11.05 -0.50% S&P 500 1107.93 -6.18 -0.55% The market is looking for a bounce off the top and we got it. The excuse this time is "Spike in wholesale inflation" - this also sent the policymakers to mull on interest rates. As usual, we got a spike in Dollar index on this "Fear of hikes". Bought back some ERX for trades. I see Oil bouncing back from the 6-7 sessions of being oversold. C saw its low today at 3.51 and we bounced off. I guess we got some level of support here. If you're hurting at C, perhaps just go play at some other stocks for now. But, here's a piece on C that some of you may find it interesting: http://www.reuters.com/article/idCNN1519003720091215?rpc=44 This post has been edited by danmooncake: Dec 16 2009, 07:08 AM |

|

|

Dec 16 2009, 07:18 AM Dec 16 2009, 07:18 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

QUOTE(zamans98 @ Dec 15 2009, 10:42 PM) SOLD Long position of LVS @ 16.45, highest peak pre-market. Some1 bought a few thousand Units and Short the position. I missed it. zaman, it's time for you to buy C now.Waiting for C to drop to 3.60 to pump in a little. Added on December 16, 2009, 7:20 am QUOTE(danmooncake @ Dec 15 2009, 10:54 PM) last night saw dow at ++30 points.may be they never updated yet? my target price for MGM changed to 11.10. Added on December 16, 2009, 7:32 am QUOTE(zamans98 @ Dec 15 2009, 11:06 PM) epalbee is using TIME machine.. No wonder. If I have TIME machine.. then rich already.. C is down again, everyday dropped 4-7cts. LVS is hard to catch at 15.80. Wanna reload some more before it bounced back to 16. MGM on the other hand is eroding. Never mind, my buy price is 9.95. In fact, it rebounded from 9.60 few days back. As you see, the TARP is going to sell all the C shares at 3.70, that's y the price can be lowered down. My buy price for MGM is 10.80, still waiting for it to boost. This post has been edited by epalbee3: Dec 16 2009, 07:32 AM |

|

|

Dec 16 2009, 08:14 AM Dec 16 2009, 08:14 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(epalbee3 @ Dec 16 2009, 07:18 AM) zaman, it's time for you to buy C now. MGM, sold @ 10.50 all. Should be selling at 10.80 but forgot to placed my trailing STOP. Duh! Too excited, perhaps?Added on December 16, 2009, 7:20 am last night saw dow at ++30 points. may be they never updated yet? my target price for MGM changed to 11.10. Added on December 16, 2009, 7:32 am If I have TIME machine.. then rich already.. As you see, the TARP is going to sell all the C shares at 3.70, that's y the price can be lowered down. My buy price for MGM is 10.80, still waiting for it to boost. Short MGM @ 10.75 but didn't materialised. Short LVS @ 16.35 - the same story. So, LONG LVS @ 15.90 x 500 C? What d fcuk? Hit 3.51? Nevermind, today will wait, re-enter 1,000 @ 3.45-3.50. |

|

|

Dec 16 2009, 09:51 AM Dec 16 2009, 09:51 AM

|

Senior Member

534 posts Joined: Dec 2006 |

Didn't check on my shares for the past few days and now C is at USD3.57.

If it does drop to USD3 I might pick up some to average down. |

|

|

Dec 16 2009, 10:41 AM Dec 16 2009, 10:41 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(mH3nG @ Dec 16 2009, 09:51 AM) Didn't check on my shares for the past few days and now C is at USD3.57. yup, me too. Will re-enter C. Sold off MAXIS kurap share to buy CIf it does drop to USD3 I might pick up some to average down. You only can keep ur stocks if market is bullish, economic is sounds and stable. In this current market, a DAY trader method works best (if u got time, and money) I'm just short of few K USD to enable my DAY Trade a/c. |

|

|

Dec 16 2009, 10:57 AM Dec 16 2009, 10:57 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

The longer term chart and trend for both Dow and S&P still bullish.

Some of the longer term play with broad coverage of various sector are still good to invest and buy at this level eg. materials, industrials, shipping and energy. This post has been edited by danmooncake: Dec 16 2009, 10:57 AM |

|

|

Dec 16 2009, 04:54 PM Dec 16 2009, 04:54 PM

|

Senior Member

2,352 posts Joined: Jan 2003 From: Pixelgasm |

C definitely looks super delicious but i think can't breach 3.50 so easy.

|

|

|

Dec 16 2009, 09:49 PM Dec 16 2009, 09:49 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(redken @ Dec 16 2009, 04:54 PM) What do you mean? Break down BELOW 3.50? It already did! Energy looks good now. Riding on ERX since yesterday. We'll see how far it can go. Also, watching INTC and AMD today.. INTC got slapped by FTC for "unfair" practice. This post has been edited by danmooncake: Dec 16 2009, 10:05 PM |

|

|

Dec 16 2009, 10:04 PM Dec 16 2009, 10:04 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(danmooncake @ Dec 16 2009, 09:49 PM) What do you mean? Break down BELOW 3.50? oh no, my SHORT Q not materialized. Again. Why???It already did! I'm holding off trading any financials for now. Energy looks good now. Riding on ERX since yesterday. We'll see how far it can go. Watching INTC and AMD today.. INTC got slapped by FTC for "unfair" practice. yes, C is now 3.45 and heading to 3.40. My gosh. When will the bloodbath stop? |

|

|

Dec 16 2009, 10:06 PM Dec 16 2009, 10:06 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(zamans98 @ Dec 16 2009, 10:04 PM) oh no, my SHORT Q not materialized. Again. Why??? C is expected to price their secondary offering between $3.30 - $3.50.yes, C is now 3.45 and heading to 3.40. My gosh. When will the bloodbath stop? I'm holding off trading any financials for now but I am watching it. But, ready to buy the dip. |

|

|

Dec 16 2009, 10:25 PM Dec 16 2009, 10:25 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Looking at INTC, LONG

Worth to check ING out, been uptrend lately from long winding downtrend. Added on December 16, 2009, 10:36 pmscooped INTC @ 19.46 LONG x250, TP 19.75 This post has been edited by zamans98: Dec 16 2009, 10:36 PM |

|

|

Dec 16 2009, 10:39 PM Dec 16 2009, 10:39 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

MGM is raising a bit.

But C is dropping. |

|

|

Dec 16 2009, 10:43 PM Dec 16 2009, 10:43 PM

|

Junior Member

81 posts Joined: Jun 2009 |

|

|

|

Dec 16 2009, 11:10 PM Dec 16 2009, 11:10 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(syong @ Dec 16 2009, 10:43 PM) Looking at current BUY trend, worth a shot. But be cautious, same with RBS.LONG INTC, hit 19.70, nearing my TP but all the way down in less than 5 minutes back to 19.40. Its a good LONG. Reload another batch of LVS. MGM looking tired at current price. |

|

|

Dec 17 2009, 12:18 AM Dec 17 2009, 12:18 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

yupe.. MGM is tired. but I still will wait for 11.10.

|

|

|

Dec 17 2009, 12:34 AM Dec 17 2009, 12:34 AM

|

Senior Member

768 posts Joined: Jan 2005 |

Woah, looks like my C bought at 3.84 really become titanic already. Only good news is other sectors doing well. HDD manufacturers gained 3% today.

|

|

|

Dec 17 2009, 01:58 AM Dec 17 2009, 01:58 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(miuk @ Dec 17 2009, 12:34 AM) Woah, looks like my C bought at 3.84 really become titanic already. Only good news is other sectors doing well. HDD manufacturers gained 3% today. Not yet.. C is not Titanic yet unless it drops below $3.IMO, between $3.35 and $3.50 is a gift. I'm ready to pull the trigger. I'm still watching Oil and USD tonight. The bulls for Dow and S&P are getting tired but Oil rally keeping it up. Dow needs to reach 10500 again and attempt one more time to break thru. Update: 4:30am Fed keeps interest rate low.. as usual, we'll have sell the news going on. Dow in -18 now. Let's buy this dip! Managed to grab more ERX @ 38.75 Closing update Dow 10441.12 -10.88 -0.10% Nasdaq 2206.91 +5.86 +0.27% S&P 500 1107.93 +1.25 +0.11% We got a bit of sell off during the closing after Fed news. But, overall, stocks did move higher! Oil has confirmation on bullish trend now (close above $72.50). This post has been edited by danmooncake: Dec 17 2009, 06:22 AM |

|

|

Dec 17 2009, 06:22 AM Dec 17 2009, 06:22 AM

|

Senior Member

4,305 posts Joined: Sep 2008 |

|

|

|

Dec 17 2009, 08:49 AM Dec 17 2009, 08:49 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Oh fcuk, C is "historic" low again for since DOG JONES at 7,000 pts.

and Uncle Ben is TIME's man of the year. Oh my! CITIGROUP INC (NYSE: C) After Hours: 3.19 Down -0.26 (-7.54%) 7:34pm ET |

|

|

Dec 17 2009, 08:58 AM Dec 17 2009, 08:58 AM

|

All Stars

17,018 posts Joined: Jan 2005 |

|

|

|

Dec 17 2009, 08:59 AM Dec 17 2009, 08:59 AM

|

Senior Member

4,305 posts Joined: Sep 2008 |

|

|

|

Dec 17 2009, 09:01 AM Dec 17 2009, 09:01 AM

|

All Stars

17,018 posts Joined: Jan 2005 |

QUOTE(zamans98 @ Dec 17 2009, 08:49 AM) Oh fcuk, C is "historic" low again for since DOG JONES at 7,000 pts. Time to go in for C? and Uncle Ben is TIME's man of the year. Oh my! CITIGROUP INC (NYSE: C) After Hours: 3.19 Down -0.26 (-7.54%) 7:34pm ET Added on December 17, 2009, 9:05 am QUOTE(htt @ Dec 17 2009, 08:59 AM) Hmm.. than now is not low enough. Should wait it fall further. This post has been edited by ozak: Dec 17 2009, 09:05 AM |

|

|

Dec 17 2009, 09:31 AM Dec 17 2009, 09:31 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

look at this:

http://www.firstrade.com/public/en_us/news...&imageField.y=0 Citi today announced the pricing of 5.4 billion common shares and 35 million tangible equity units as part of its agreement with the U.S. government and its regulators to repay U.S. taxpayers for the $20 billion the government holds in TARP trust preferred securities and to terminate the loss-sharing agreement with the government. The common stock priced at $3.15 per share, generating net proceeds of approximately $17 billion. |

|

|

Dec 17 2009, 09:38 AM Dec 17 2009, 09:38 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Yup, saw on CNBC this morning.

Offer is $3.15/share, with 7.5% Div Yield? Hence, the Government is not selling yet, they got 90 days frozen period. |

|

|

Dec 17 2009, 09:40 AM Dec 17 2009, 09:40 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

As you can see, Citi is increasing the stock volumn and pushing the 7.7 billion stock it holds to the market. US Treasury wants to get away from Citi. Ben does not announce interest increase now, for the price of C also.

Added on December 17, 2009, 9:44 amIt all depends on Citibank management capability already, if they can turn to profit, then the stock price will go up; if not the price will dip. This post has been edited by epalbee3: Dec 17 2009, 09:44 AM |

|

|

Dec 17 2009, 09:45 AM Dec 17 2009, 09:45 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Not so fast, read back few pages. Some blog already spit out that the interest rate won't be moving up. So, Uncle Ben is the most powerful man in US right now. (and he's Jewish)

Saw on CNBC, that few CEO of many Investment firms looking at DOW 13K next year. |

|

|

Dec 17 2009, 10:55 AM Dec 17 2009, 10:55 AM

|

Senior Member

2,148 posts Joined: Nov 2007 |

My target to enter C again is below 3.00.

|

|

|

Dec 17 2009, 11:02 AM Dec 17 2009, 11:02 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 17 2009, 11:05 AM Dec 17 2009, 11:05 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

There are tremendous number of shorts for C due to this secondary offering or people are dumping

it ahead of the offering because they're angry. Now that the brokerage house have grab them all, the govt is not selling their shares, I wonder if this would trigger a sudden short squeeze the next few days? If it does, it would be funny to watch, suddenly shorts have to cover, trigger massive buy, C would rise back to $5. This post has been edited by danmooncake: Dec 17 2009, 11:05 AM |

|

|

Dec 17 2009, 11:26 AM Dec 17 2009, 11:26 AM

|

Senior Member

534 posts Joined: Dec 2006 |

QUOTE(danmooncake @ Dec 17 2009, 11:05 AM) There are tremendous number of shorts for C due to this secondary offering or people are dumping Buy on dips and then wait for the short squeeze to happen. it ahead of the offering because they're angry. Now that the brokerage house have grab them all, the govt is not selling their shares, I wonder if this would trigger a sudden short squeeze the next few days? If it does, it would be funny to watch, suddenly shorts have to cover, trigger massive buy, C would rise back to $5. |

|

|

Dec 17 2009, 12:01 PM Dec 17 2009, 12:01 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

QUOTE(mH3nG @ Dec 17 2009, 11:26 AM) only after it drops to < 3.15. secondary offers make the stock volumn increases but with same booking value. It is possible to raise back to 5, if insider new show that C has recovered and started to earn. Added on December 17, 2009, 12:04 pmAs long as government is not selling their stocks, the real value cannot be disclosed. who wants to push the stock price high for government to reap? It might swing between 3.15 - 3.75. the price US government wants to sell.. This post has been edited by epalbee3: Dec 17 2009, 12:04 PM |

|

|

Dec 17 2009, 01:25 PM Dec 17 2009, 01:25 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(danmooncake @ Dec 17 2009, 11:05 AM) would be funny to watch, suddenly shorts have to cover, trigger massive buy, C would rise back to $5. QUOTE(epalbee3 @ Dec 17 2009, 12:01 PM) only after it drops to < 3.15. Just read many Investment house analyst and CEO, plus there are on-going debate in CNBC a moment ago.It might swing between 3.15 - 3.75. the price US government wants to sell.. C is part of S&P 500 - now by Friday (this friday?) or next week before christmas, they need to re-adjust/balance the S&P 500. 2 billions shares need to change hand. Thus the short term we will see C rise but how high, nobody knows. I'm ready to enter today, for short term, to reduce my losses before C downhill again, when GOVT start selling. |

|

|

Dec 17 2009, 07:46 PM Dec 17 2009, 07:46 PM

|

Senior Member

2,549 posts Joined: Dec 2004 From: Sungai Petani, Kedah |

QUOTE(zamans98 @ Dec 17 2009, 01:25 PM) Just read many Investment house analyst and CEO, plus there are on-going debate in CNBC a moment ago. But why after market price drop?C is part of S&P 500 - now by Friday (this friday?) or next week before christmas, they need to re-adjust/balance the S&P 500. 2 billions shares need to change hand. Thus the short term we will see C rise but how high, nobody knows. I'm ready to enter today, for short term, to reduce my losses before C downhill again, when GOVT start selling. |

|

|

Dec 17 2009, 08:26 PM Dec 17 2009, 08:26 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

Pre-market price:

C: 3.18 MGM: 10.29 Market is heading south today. MGM afraid of interest increase.. |

|

|

Dec 17 2009, 09:44 PM Dec 17 2009, 09:44 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Bought pre-market C @ 3.15, then it spiral downwards to 3.09.

As usual, today's market will be bad. Unemployment Claims getting worst, but that is common towards year end. More action around 11pm when Philly Fed Manufacturing Index will be announced. |

|

|

Dec 17 2009, 10:17 PM Dec 17 2009, 10:17 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Dollar now on v_iagra!

C - getting slapped left and right. I'll be buying some more C since it has down more than 20%, $3 is very attractive. Bernanke is getting his final grade today whether he pass or fail by US Congress. If US Congress fails him, we'll see minus 3 digits on the Dow. If he confirms, I'm sure we'll get a bounce up. This post has been edited by danmooncake: Dec 17 2009, 10:30 PM |

|

|

Dec 17 2009, 10:31 PM Dec 17 2009, 10:31 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

MGM is slipping..

|

|

|

Dec 17 2009, 10:58 PM Dec 17 2009, 10:58 PM

|

Senior Member

2,155 posts Joined: May 2005 |

wow everything is slipping....time to go shopping again

|

|

|

Dec 17 2009, 11:06 PM Dec 17 2009, 11:06 PM

|

Senior Member

2,549 posts Joined: Dec 2004 From: Sungai Petani, Kedah |

|

|

|

Dec 17 2009, 11:07 PM Dec 17 2009, 11:07 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

I'm watching the votes for Bernanke now. It seems that the No votes got higher, that's why.

Like I said, if Bernanke gets voted down, this market will not like it. |

|

|

Dec 17 2009, 11:10 PM Dec 17 2009, 11:10 PM

|

Senior Member

2,155 posts Joined: May 2005 |

|

|

|

Dec 17 2009, 11:11 PM Dec 17 2009, 11:11 PM

|

Senior Member

4,305 posts Joined: Sep 2008 |

Sailang all my USD position... can go sleep liao...

|

|

|

Dec 17 2009, 11:18 PM Dec 17 2009, 11:18 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

I have faith that Uncle Ben will stay and market will turn bullish to 11,000

|

|

|

Dec 17 2009, 11:23 PM Dec 17 2009, 11:23 PM

|

Senior Member

534 posts Joined: Dec 2006 |

|

|

|

Dec 17 2009, 11:24 PM Dec 17 2009, 11:24 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

they want to fire ben?

|

|

|

Dec 17 2009, 11:27 PM Dec 17 2009, 11:27 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

|

|

|

Dec 17 2009, 11:32 PM Dec 17 2009, 11:32 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

|

|

|

Dec 17 2009, 11:34 PM Dec 17 2009, 11:34 PM

|

Senior Member

534 posts Joined: Dec 2006 |

Natural gas shot up as the storage dropped by 207 billion cubic feet.

|

|

|

Dec 17 2009, 11:36 PM Dec 17 2009, 11:36 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

So far, he got 4 YES, 3 NO.

more coming.. One senator pending says he vote will NO against him. On Live tv - I can see people are calling in their Senators office either vouch for him or against him. American system - very open. |

|

|

Dec 17 2009, 11:49 PM Dec 17 2009, 11:49 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Go Uncle Ben..

LONG INTC, LONG LVS, LONG MGM.. |

|

|

Dec 17 2009, 11:53 PM Dec 17 2009, 11:53 PM

|

Senior Member

534 posts Joined: Dec 2006 |

C is trying to break the USD3.20 barrier. Go C!

|

|

|

Dec 17 2009, 11:57 PM Dec 17 2009, 11:57 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(mH3nG @ Dec 17 2009, 11:53 PM) If C can close above 3.20 today, that's a good sign. C so far has 2.1 billion in volume today.. BAC is dropping.. JPM dropping.. all financials dropping today. FAS is looking attractive again. Update for Bernanke Vote: 8 YES 10 NO 2 UNDECIDED This post has been edited by danmooncake: Dec 18 2009, 12:05 AM |

|

|

Dec 18 2009, 12:02 AM Dec 18 2009, 12:02 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 18 2009, 12:12 AM Dec 18 2009, 12:12 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

like that, bernanke is in dangerous.

which site you watch? Added on December 18, 2009, 12:22 ambernanke won. This post has been edited by epalbee3: Dec 18 2009, 12:22 AM |

|

|

Dec 18 2009, 12:22 AM Dec 18 2009, 12:22 AM

|

Senior Member

534 posts Joined: Dec 2006 |

Ben gets to keep his job.

|

|

|

Dec 18 2009, 12:23 AM Dec 18 2009, 12:23 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Watched it on CSPAN live.

Final vote for Bernanke: 16 YES 7 NO He's confirmed by the Senate. |

|

|

Dec 18 2009, 12:24 AM Dec 18 2009, 12:24 AM

|

Senior Member

1,345 posts Joined: Sep 2009 |

Senate Banking Committee confirms Bernanke for 2nd term as Fed chief by vote of 16-7. Confirmation moves to full Senate.

|

|

|

Dec 18 2009, 12:36 AM Dec 18 2009, 12:36 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Dec 18 2009, 01:02 AM Dec 18 2009, 01:02 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

still hanging on to my positions darn, titanic c did not hit my target buy price of $3.04 gld short squeeze so funi, who ever cover, would have been cursing...haha opex day oh well, next week wil have some clearer sleepy holiday direction actually opex day is tomolo suspek titanic c is due for short squeeze nex week or the next or the next, after this heavy volume gap down who knows, its gambling mah... as usual, kopitiam story below is design to provoke fun, so can ah kiew » Click to show Spoiler - click again to hide... «

|

|

|

Dec 18 2009, 06:06 AM Dec 18 2009, 06:06 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Closing

Dow 10308.26 -132.86 -1.27% Nasdaq 2108.05 -26.86 -1.22% S&P 500 1096.07 -13.11 -1.18% Well, the shorts didn't get squeezed today but rather the bulls got scared off. C closed at exactly 3.2, I think it this is a good sign. Bought some more C 3.15, ERX 37.80, XPP 69 and TCK 36.10 on pullback today. This post has been edited by danmooncake: Dec 18 2009, 06:12 AM |

|

|

Dec 18 2009, 09:42 PM Dec 18 2009, 09:42 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

slow market today, pre-market volume is not so great. C volume is only 22 million. yesterday it was close to 1/4 billion at this time

|

|

|

Dec 18 2009, 09:46 PM Dec 18 2009, 09:46 PM

|

Senior Member

1,345 posts Joined: Sep 2009 |

minor rally expected..

|

|

|

Dec 18 2009, 10:11 PM Dec 18 2009, 10:11 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

Guess what's going to happen on Quad Witching Day?

|

|

|

Dec 18 2009, 10:24 PM Dec 18 2009, 10:24 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(danmooncake @ Dec 18 2009, 10:11 PM) as long as it dun b**** d market, i'm hepi. C trying to scale higher, looking at 3.30. Perhaps it will get a boost today, before looking back at 3.15. with more than 100billion market cap, it will move slow, unless reverse split is executed right away. |

|

|

Dec 18 2009, 10:30 PM Dec 18 2009, 10:30 PM

|

All Stars

10,123 posts Joined: Aug 2007 |

QUOTE(zamans98 @ Dec 18 2009, 10:24 PM) as long as it dun b**** d market, i'm hepi. C trying to scale higher, looking at 3.30. Perhaps it will get a boost today, before looking back at 3.15. with more than 100billion market cap, it will move slow, unless reverse split is executed right away. Perhaps so.. scalping C maybe the way to go now since we got huge dilution. Anyway, I'm watching Oil surging again. Hopefully, it is pay day for my ERX! |

|

|

Dec 18 2009, 11:46 PM Dec 18 2009, 11:46 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

oh no, my MGM and LVS ... sprialling down. WTF. Can be sold for profit on early trade, now down a lot.

Good entry for those wanna enter MGM now and LVS. |

|

|

Dec 19 2009, 12:25 AM Dec 19 2009, 12:25 AM

|

All Stars

10,123 posts Joined: Aug 2007 |

Well, as expected with Option Expiration day, buyers buy in am, sellers sell losers to drive down stocks afterwards.