they are announcing results this thursday. now 3. anyone buying?

Supermax

Supermax

|

|

Oct 13 2009, 10:36 AM, updated 16y ago Oct 13 2009, 10:36 AM, updated 16y ago

Show posts by this member only | Post

#1

|

Junior Member

347 posts Joined: Jul 2009 |

they are announcing results this thursday. now 3. anyone buying?

|

|

|

|

|

|

Oct 13 2009, 12:59 PM Oct 13 2009, 12:59 PM

Show posts by this member only | Post

#2

|

Junior Member

11 posts Joined: Jun 2007 |

glove makers seem to be making profit with the H1N1 is around

|

|

|

Oct 13 2009, 01:46 PM Oct 13 2009, 01:46 PM

Show posts by this member only | Post

#3

|

Senior Member

869 posts Joined: Mar 2008 |

should be a good news

|

|

|

Oct 13 2009, 02:30 PM Oct 13 2009, 02:30 PM

Show posts by this member only | Post

#4

|

Junior Member

347 posts Joined: Jul 2009 |

heard they will declare interim divi also

|

|

|

Dec 9 2009, 12:02 PM Dec 9 2009, 12:02 PM

Show posts by this member only | Post

#5

|

Newbie

2 posts Joined: Jul 2009 |

|

|

|

Dec 9 2009, 04:18 PM Dec 9 2009, 04:18 PM

Show posts by this member only | Post

#6

|

Junior Member

347 posts Joined: Jul 2009 |

now is a good price to go in? how far can it go?

|

|

|

|

|

|

Dec 9 2009, 09:50 PM Dec 9 2009, 09:50 PM

Show posts by this member only | Post

#7

|

Junior Member

253 posts Joined: Jun 2009 From: Sg Long |

|

|

|

Dec 11 2009, 02:28 AM Dec 11 2009, 02:28 AM

Show posts by this member only | Post

#8

|

Junior Member

37 posts Joined: Aug 2009 |

It seems to always go down after touching RM4.00 mark.

|

|

|

Dec 11 2009, 02:52 AM Dec 11 2009, 02:52 AM

Show posts by this member only | Post

#9

|

Senior Member

1,006 posts Joined: Mar 2006 From: Proud of Kelantan |

to those who have money, it is good to accumulate below rm4

|

|

|

Dec 11 2009, 09:15 PM Dec 11 2009, 09:15 PM

|

Senior Member

1,499 posts Joined: Jan 2003 |

Yup, i think just need to wait until end of this month, this counter will shoot up again ....simple as that, the profit is almost match to TopGlove as topGlove selling almost double of Supermx price

|

|

|

Dec 13 2009, 09:55 AM Dec 13 2009, 09:55 AM

|

Junior Member

347 posts Joined: Jul 2009 |

hope they declare some special divi next month!! |

|

|

Dec 23 2009, 03:48 AM Dec 23 2009, 03:48 AM

|

Junior Member

37 posts Joined: Aug 2009 |

Bought @2.84 then accumulate again @3.64, don't know good idea to buy in some more before next month.

If I can get around 4.15, then ABP would be 3.54 |

|

|

Dec 26 2009, 10:43 AM Dec 26 2009, 10:43 AM

|

Junior Member

66 posts Joined: Aug 2009 |

7106 SUPERMX SUPERMAX CORPORATION BHD

Notice of Resale/Cancellation of Treasury Shares - Immediate Announcement Date of Transaction : 21/12/2009 Total No. of Treasury Shares Sold : 2,100,000 shares Minimum Price Paid For Each Share Sold : RM 4.100 Maximum Price Paid For Each Share Sold : RM 4.160 Total Amount Received For Treasury Shares Sold : RM 8,636,670.00 Total No. of Treasury Shares Cancelled : 0 shares Cumulative Net Outstanding Treasury Shares As At To-Date : 3,460,000 shares Adjusted Issued Capital After Cancellation/Resale : 0 |

|

|

|

|

|

Dec 27 2009, 02:47 PM Dec 27 2009, 02:47 PM

|

Senior Member

633 posts Joined: Jan 2006 |

QUOTE(kplu @ Dec 26 2009, 10:43 AM) 7106 SUPERMX SUPERMAX CORPORATION BHD Net profit will be given back to share holders in the form of dividends Notice of Resale/Cancellation of Treasury Shares - Immediate Announcement Date of Transaction : 21/12/2009 Total No. of Treasury Shares Sold : 2,100,000 shares Minimum Price Paid For Each Share Sold : RM 4.100 Maximum Price Paid For Each Share Sold : RM 4.160 Total Amount Received For Treasury Shares Sold : RM 8,636,670.00 Total No. of Treasury Shares Cancelled : 0 shares Cumulative Net Outstanding Treasury Shares As At To-Date : 3,460,000 shares Adjusted Issued Capital After Cancellation/Resale : 0 |

|

|

Dec 28 2009, 11:59 AM Dec 28 2009, 11:59 AM

|

Junior Member

66 posts Joined: Aug 2009 |

|

|

|

Dec 28 2009, 04:49 PM Dec 28 2009, 04:49 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

Supermax hit 52-weeks high today!

Now at 4.44 (+30 sens) |

|

|

Dec 28 2009, 05:13 PM Dec 28 2009, 05:13 PM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

|

|

|

Dec 28 2009, 05:16 PM Dec 28 2009, 05:16 PM

|

Junior Member

253 posts Joined: Jun 2009 From: Sg Long |

|

|

|

Dec 28 2009, 09:04 PM Dec 28 2009, 09:04 PM

|

Junior Member

66 posts Joined: Aug 2009 |

7106 SUPERMX SUPERMAX CORPORATION BHD

Notice of Resale/Cancellation of Treasury Shares - Immediate Announcement Date of Transaction : 28/12/2009 Total No. of Treasury Shares Sold : 3,461,000 shares Minimum Price Paid For Each Share Sold : RM 4.100 Maximum Price Paid For Each Share Sold : RM 4.120 Total Amount Received For Treasury Shares Sold : RM 14,191,138.30 Total No. of Treasury Shares Cancelled : 0 shares Cumulative Net Outstanding Treasury Shares As At To-Date : 0 shares Adjusted Issued Capital After Cancellation/Resale : 0 Date Lodged With Registrar of Company : Lodged By : Remarks: |

|

|

Dec 28 2009, 09:10 PM Dec 28 2009, 09:10 PM

|

Junior Member

327 posts Joined: Apr 2009 |

QUOTE(tan1818 @ Dec 23 2009, 03:48 AM) Bought @2.84 then accumulate again @3.64, don't know good idea to buy in some more before next month. If you don't know what's the Fair Value for this share b4 you buy, then you're gambling If I can get around 4.15, then ABP would be 3.54 This post has been edited by DanielW: Dec 28 2009, 09:11 PM |

|

|

Dec 28 2009, 11:03 PM Dec 28 2009, 11:03 PM

|

Senior Member

5,191 posts Joined: May 2009 |

QUOTE(panasonic88 @ Dec 28 2009, 04:49 PM) Hey, Pana, this was the price I paid for KPJ... Added on December 28, 2009, 11:05 pm The way Supermx sold its treasury shares, your special dividend is very near liao... This post has been edited by protonw: Dec 28 2009, 11:05 PM |

|

|

Dec 29 2009, 01:16 AM Dec 29 2009, 01:16 AM

|

Senior Member

633 posts Joined: Jan 2006 |

QUOTE(kplu @ Dec 28 2009, 11:59 AM) Supermax sold off the treasury shares because they don't have confidence and expecting to buy back at lower price? The Co have already announced that they will be disposing of treasury shares and distributing the profit as dividend. Go look it up . Also have stated their dividend policy for year end 31 Dec 2009. Do a bit of research. |

|

|

Dec 29 2009, 09:03 AM Dec 29 2009, 09:03 AM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

QUOTE(protonw @ Dec 28 2009, 11:03 PM) Hey, Pana, this was the price I paid for KPJ... Added on December 28, 2009, 11:05 pm The way Supermx sold its treasury shares, your special dividend is very near liao... QUOTE(penangmee @ Dec 29 2009, 01:16 AM) The Co have already announced that they will be disposing of treasury shares and distributing the profit as dividend. Go look it up . Also have stated their dividend policy for year end 31 Dec 2009. Do a bit of research. wow, great, that would be our CNY Big Ang Pow by Supermax |

|

|

Dec 29 2009, 10:34 AM Dec 29 2009, 10:34 AM

|

Senior Member

8,447 posts Joined: Nov 2005 |

|

|

|

Dec 29 2009, 10:30 PM Dec 29 2009, 10:30 PM

|

Junior Member

89 posts Joined: May 2007 |

|

|

|

Jan 2 2010, 11:26 AM Jan 2 2010, 11:26 AM

|

Newbie

2 posts Joined: Jan 2010 |

QUOTE(protonw @ Dec 29 2009, 12:03 AM) Hey, Pana, this was the price I paid for KPJ... Based on the treasury shares sold amount and the estimated FY2009 earning of 125 millions. Added on December 28, 2009, 11:05 pm The way Supermx sold its treasury shares, your special dividend is very near liao... I have worked out the dividend plus special dividend will be 20.4 cents per share ! |

|

|

Jan 2 2010, 12:01 PM Jan 2 2010, 12:01 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

QUOTE(forestbird @ Jan 2 2010, 11:26 AM) Based on the treasury shares sold amount and the estimated FY2009 earning of 125 millions. Thanks for the calculation, forestbird. I have worked out the dividend plus special dividend will be 20.4 cents per share ! Yuppie, Indeed a good news for fellow shareholders |

|

|

Jan 4 2010, 10:10 AM Jan 4 2010, 10:10 AM

|

Junior Member

127 posts Joined: Aug 2008 |

whats the TP for this counter ?

|

|

|

Jan 4 2010, 11:07 AM Jan 4 2010, 11:07 AM

|

Junior Member

112 posts Joined: Apr 2008 |

based on average of 10 research it is RM5.53

|

|

|

Jan 5 2010, 08:51 AM Jan 5 2010, 08:51 AM

|

Junior Member

89 posts Joined: May 2007 |

|

|

|

Jan 5 2010, 12:05 PM Jan 5 2010, 12:05 PM

|

Junior Member

66 posts Joined: Aug 2009 |

QUOTE(superhifi77 @ Jan 5 2010, 08:51 AM) tabung haji and foreign fund are selling supermax. |

|

|

Jan 5 2010, 12:47 PM Jan 5 2010, 12:47 PM

|

Senior Member

5,191 posts Joined: May 2009 |

|

|

|

Jan 6 2010, 03:18 PM Jan 6 2010, 03:18 PM

|

Junior Member

89 posts Joined: May 2007 |

ALL GLOVE & CONDOM MAKERS ARE CRAZY SHOOT TODAY!

|

|

|

Jan 6 2010, 04:11 PM Jan 6 2010, 04:11 PM

|

Junior Member

66 posts Joined: Aug 2009 |

• In great shape; maintain OVERWEIGHT. The rubber glove sector had a

spectacular year in 2009, raising the question of further upside from here on. We believe that prospects remain favourable and demand growth is sustainable. This underpins our decision to retain our OVERWEIGHT stance on the sector. Factors that could extend the re-rating include the continuing uptick in demand from the healthcare industry, ongoing capacity expansion and above-market earnings growth driven by major capacity expansion by many of the glove companies. Adventa and Supermax remain our top picks. • Outperform and higher targets for all stocks. We retain our earnings forecasts and Outperform recommendations for all the glove stocks under our coverage. In light of the positive industry outlook and superior earnings growth prospects, we now value Top Glove at a 10% premium over our target market P/E of 15x instead of parity. Our target prices for the remaining glove companies rise in tandem, except for Adventa and Supermax for which we reduced our discount relative to Top Glove by 10% in view of their exposure to the OBM segment and high liquidity. This raises their target prices by about 25%. • 2009 was a great year. 2009 was an excellent year for Malaysian rubber glove manufacturers. Customers’ order cycle returned to normal, latex prices came down from record levels, energy prices also fell, the US$ strengthened and to top it off, H1N1 broke about in early 2Q, leading to a rubber glove shortage which manufacturers believe will continue well into 2010. • Strong performance but still undervalued. Rubber glove companies outperformed the KLCI in 2009, surging 94-540% compared to a 45% gain for the KLCI. Despite the strong performance, their P/E ratings remain at a discount to the market instead of the premium that they historically traded at. The sector now stands at an average FY10 P/E of 9.4x or just half of the peak during end-06/early- 07. We believe that the rubber glove companies are still undervalued and offer tremendous earnings upside due to their expansion programmes. • Demand to remain strong... Demand for rubber gloves is expected to be strong over the next few years. Malaysian glovemakers predominantly manufacture examination and medical-grade gloves which make up on average 90% of their output. We believe demand will not only be resilient but will continue to grow along with hygiene awareness, health regulations and population size. • …, underpinning major expansion plans. Malaysian glove manufacturers will be expanding their capacity in a big way over the next few years. Supermax, Latexx and Top Glove have even brought forward their plans. Over the next two years, each of the industry giants will be adding annual capacity of 3bn-7bn pieces (17- 97% growth) to capture a bigger slice of the expanding market. Research done by CIMB |

|

|

Jan 6 2010, 04:56 PM Jan 6 2010, 04:56 PM

|

Junior Member

347 posts Joined: Jul 2009 |

ppl making lots of $$$ from this glove makers!!!!1

|

|

|

Jan 6 2010, 05:01 PM Jan 6 2010, 05:01 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

|

|

|

Jan 6 2010, 05:01 PM Jan 6 2010, 05:01 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

Recorded a 52-weeks high - RM5.35 (up 65 sens) today!

|

|

|

Jan 6 2010, 05:08 PM Jan 6 2010, 05:08 PM

|

Junior Member

194 posts Joined: Dec 2009 |

really amazing day today. such a rally. 12% increase in one day. who do you think the buyers are? funds or retail investors?

|

|

|

Jan 6 2010, 05:15 PM Jan 6 2010, 05:15 PM

|

Senior Member

7,960 posts Joined: Dec 2007 From: Kuala Lumpur |

QUOTE(Chill4x @ Jan 6 2010, 05:08 PM) really amazing day today. such a rally. 12% increase in one day. who do you think the buyers are? funds or retail investors? from my observation, the buying pattern doesnt look like retail players... they goreng is very organized...most likely funds... any CIMB funds invest in rubber industry ? -- anyway congratz everyone |

|

|

Jan 6 2010, 05:22 PM Jan 6 2010, 05:22 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

|

|

|

Jan 6 2010, 05:24 PM Jan 6 2010, 05:24 PM

|

Senior Member

7,960 posts Joined: Dec 2007 From: Kuala Lumpur |

|

|

|

Jan 6 2010, 05:24 PM Jan 6 2010, 05:24 PM

|

Junior Member

194 posts Joined: Dec 2009 |

yeah, the goreng today was very obvious. non-stop buying all the way from 4.70-5.35. doesnt help that CIMB also released research reports saying rubber glove sector will be overweight this year. Affin investment bank set the TP at RM 6.60. Who thinks it will hit this by Dec? XD

|

|

|

Jan 6 2010, 09:30 PM Jan 6 2010, 09:30 PM

|

Senior Member

641 posts Joined: Jun 2009 |

i checked the stock tracker, noticed that only the small fish sapu...make the price fly up high!!

|

|

|

Jan 6 2010, 10:57 PM Jan 6 2010, 10:57 PM

|

Senior Member

5,191 posts Joined: May 2009 |

|

|

|

Jan 7 2010, 08:31 AM Jan 7 2010, 08:31 AM

|

Junior Member

66 posts Joined: Aug 2009 |

After so much of gained and top the gainers list yesterdays, rubber glove counters could be in top losers list today.

|

|

|

Jan 7 2010, 02:46 PM Jan 7 2010, 02:46 PM

|

Senior Member

1,174 posts Joined: Feb 2005 |

|

|

|

Jan 8 2010, 12:03 PM Jan 8 2010, 12:03 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

for Supermax fans, hoh seh ah

Supermax sees strong glove demand Supermax, Malaysia’s No 2 rubber glove maker, expects another year of strong profit growth in 2010 as fears about a resurgence of the H1N1 flu fuel demand for its products. The glove maker had previously forecast a net profit of RM133m for 2010 and it may upgrade its earnings outlook for this year when it unveils full-year earnings for 2009 in Feb 2010. (Malaysian Insider) Comments: The potential earnings revision comes within our expectation for the same reasons that we stated in the sector report. We reiterate trading buy on the stock with a target price of RM5.85. |

|

|

Jan 8 2010, 04:56 PM Jan 8 2010, 04:56 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

Today Supermax is recording new high~!

Now at 5.70 (+0.310) |

|

|

Jan 8 2010, 08:41 PM Jan 8 2010, 08:41 PM

|

Senior Member

934 posts Joined: Sep 2005 |

supermax really superman.. fly non stop

|

|

|

Jan 10 2010, 08:16 PM Jan 10 2010, 08:16 PM

|

Senior Member

2,335 posts Joined: Jul 2008 |

QUOTE(panasonic88 @ Jan 8 2010, 12:03 PM) for Supermax fans, hoh seh ah http://www.facebook.com/?flyingspaghettimonster=home#/profile...100000386838545Supermax sees strong glove demand Supermax, Malaysia’s No 2 rubber glove maker, expects another year of strong profit growth in 2010 as fears about a resurgence of the H1N1 flu fuel demand for its products. The glove maker had previously forecast a net profit of RM133m for 2010 and it may upgrade its earnings outlook for this year when it unveils full-year earnings for 2009 in Feb 2010. (Malaysian Insider) Comments: The potential earnings revision comes within our expectation for the same reasons that we stated in the sector report. We reiterate trading buy on the stock with a target price of RM5.85. May chat with SUPERMAX bozz personally. |

|

|

Jan 10 2010, 11:09 PM Jan 10 2010, 11:09 PM

|

Senior Member

5,191 posts Joined: May 2009 |

|

|

|

Jan 13 2010, 05:24 PM Jan 13 2010, 05:24 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

Glove rally continues!

Supermax is recording new high today! Broke 6.00, highest 6.04, closing 5.99. Gambateh! |

|

|

Feb 20 2010, 01:57 AM Feb 20 2010, 01:57 AM

|

Junior Member

37 posts Joined: Aug 2009 |

Sold in 1st session today for reasonable profit. Waiting for it to drop so can re-enter again

|

|

|

Feb 20 2010, 04:39 AM Feb 20 2010, 04:39 AM

|

Junior Member

50 posts Joined: Oct 2008 |

Hi, im a newbie here. Regarding this stock, around how much would u guys advice to buy? =)

|

|

|

Feb 21 2010, 05:11 PM Feb 21 2010, 05:11 PM

|

Newbie

2 posts Joined: Jan 2010 |

QUOTE(panasonic88 @ Jan 13 2010, 06:24 PM) Glove rally continues! DATO SERI Stanley Thai 的reply如下:Supermax is recording new high today! Broke 6.00, highest 6.04, closing 5.99. Gambateh! The Gain from Sale of Treasury Shares is capitalized in the Capital Reserve in Share Premium Account as one of the Balance Sheet items. It would be distributed to Shareholders in the form of Bonus Issue among others. The company would make the announcement via Investment Banker once the IB is appointed in early March,2010 Thank you Dato’Seri Stanley Thai Group Managing Director Supermax Corporation Added on February 21, 2010, 5:24 pm QUOTE(xken @ Feb 20 2010, 05:39 AM) DATO SERI Stanley Thai 的reply如下:The Gain from Sale of Treasury Shares is capitalized in the Capital Reserve in Share Premium Account as one of the Balance Sheet items. It would be distributed to Shareholders in the form of Bonus Issue among others. The company would make the announcement via Investment Banker once the IB is appointed in early March,2010 Thank you Dato’Seri Stanley Thai Group Managing Director Supermax Corporation This post has been edited by forestbird: Feb 21 2010, 05:24 PM |

|

|

Feb 21 2010, 05:56 PM Feb 21 2010, 05:56 PM

|

Senior Member

1,164 posts Joined: Sep 2004 From: KaYeLL� |

QUOTE(DanielW @ Dec 28 2009, 09:10 PM) And When you are gambling , u will get addicted.. and when u get addicted , u will lose money instead of earning and when u lose money , u will feel like wanna jump from KLCC well , why i said so ? coz i experienced this before |

|

|

Feb 21 2010, 10:19 PM Feb 21 2010, 10:19 PM

|

Senior Member

785 posts Joined: Jan 2003 |

fair value is less than RM 1.50 when the rubber play is over. beware of this counter and only for contra player or very short term players.

|

|

|

Feb 21 2010, 10:46 PM Feb 21 2010, 10:46 PM

|

Junior Member

371 posts Joined: Jan 2003 |

|

|

|

Feb 21 2010, 11:05 PM Feb 21 2010, 11:05 PM

|

Senior Member

1,164 posts Joined: Sep 2004 From: KaYeLL� |

|

|

|

Feb 22 2010, 09:19 AM Feb 22 2010, 09:19 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Feb 22 2010, 09:47 AM Feb 22 2010, 09:47 AM

|

Senior Member

3,037 posts Joined: Jun 2007 |

Today OSK gave Superman a TP of RM10.00.

|

|

|

Feb 22 2010, 09:54 AM Feb 22 2010, 09:54 AM

|

Senior Member

4,966 posts Joined: Nov 2008 |

|

|

|

Feb 22 2010, 01:17 PM Feb 22 2010, 01:17 PM

|

Junior Member

25 posts Joined: Nov 2007 |

can supermx keep for long term within 1 yrs with target of 7.50?

|

|

|

Feb 22 2010, 01:36 PM Feb 22 2010, 01:36 PM

|

Junior Member

138 posts Joined: Nov 2008 |

|

|

|

Feb 22 2010, 03:47 PM Feb 22 2010, 03:47 PM

|

Junior Member

371 posts Joined: Jan 2003 |

Last year when I bought Superman at 0.84 during mid March and I told my friend my TP end of 2009 is 4 he don't believe. This year my TP is 8! Fat fat

|

|

|

Feb 23 2010, 05:34 PM Feb 23 2010, 05:34 PM

|

Junior Member

89 posts Joined: May 2007 |

|

|

|

Feb 23 2010, 09:20 PM Feb 23 2010, 09:20 PM

|

All Stars

14,990 posts Joined: Jan 2003 |

|

|

|

Feb 24 2010, 12:06 AM Feb 24 2010, 12:06 AM

|

Junior Member

371 posts Joined: Jan 2003 |

TP 8 just conservative prediction.

Latest eps would be around 18 sen if not due to the 5.4M bond. Higher TP is likely based on this year EPS around 18x4= 72 sen then x 12 PE. Note that 72sen haven't factor in the rise in production by about 20%, which translate into more profit later this year. |

|

|

Feb 24 2010, 04:30 PM Feb 24 2010, 04:30 PM

|

Junior Member

350 posts Joined: Sep 2008 From: tyrsflgiugiug |

so how far would superma fly untill any ideas?

|

|

|

Feb 24 2010, 04:47 PM Feb 24 2010, 04:47 PM

|

Junior Member

162 posts Joined: Aug 2009 |

this stock was so tempting...my TP probably RM7 by end of this yr...

|

|

|

Apr 5 2010, 10:10 PM Apr 5 2010, 10:10 PM

|

Junior Member

56 posts Joined: Mar 2010 |

|

|

|

Apr 8 2010, 04:36 PM Apr 8 2010, 04:36 PM

|

Junior Member

22 posts Joined: Aug 2007 |

Bought at 5.xx, now at 7.xx, still have upside, think eventually will overtake Kossan because of it's lower PE and higher liquidity.

This post has been edited by tankahhoe: Apr 8 2010, 04:37 PM |

|

|

Apr 19 2010, 03:44 PM Apr 19 2010, 03:44 PM

|

Junior Member

56 posts Joined: Mar 2010 |

Excellent latest 2010 Q1 quarter report result, price shoot up soon after this correction

|

|

|

Apr 19 2010, 05:11 PM Apr 19 2010, 05:11 PM

|

Junior Member

347 posts Joined: Jul 2009 |

|

|

|

Apr 19 2010, 06:11 PM Apr 19 2010, 06:11 PM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

If tomorrow breaks 7.00 (high possiblity), then it will fly.

|

|

|

Apr 19 2010, 06:26 PM Apr 19 2010, 06:26 PM

|

Junior Member

371 posts Joined: Jan 2003 |

Tmr CIMB will raise the TP to 11 ++ , hopefully I can see a rally to 8 this week

|

|

|

Apr 19 2010, 06:29 PM Apr 19 2010, 06:29 PM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

|

|

|

Apr 19 2010, 07:27 PM Apr 19 2010, 07:27 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

Sharing another blog on Supermax.

SUPERMX net profit triple jump http://kstockview.blogspot.com/2010/04/sup...riple-jump.html |

|

|

Apr 20 2010, 09:23 AM Apr 20 2010, 09:23 AM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

Supermax - Trading Buy. TP: RM8.80

Buy/Hold with confidence! Attached File(s)  researchview_Supermax_200410.pdf ( 90.73k )

Number of downloads: 19

researchview_Supermax_200410.pdf ( 90.73k )

Number of downloads: 19 |

|

|

Apr 20 2010, 12:11 PM Apr 20 2010, 12:11 PM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

Supermx (from 6.90) breached 7.00 and then 7.10 today.

|

|

|

Apr 20 2010, 12:20 PM Apr 20 2010, 12:20 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

Attaching CIMB Research Paper on Supermax.

CIMB changed their Supermax target price rises from RM9.65 to RM11.90 as we continue to value the stock at a 20% discount to Top Glove’s target P/E of 16.5x. We maintain our BUY call on Supermax. Attached File(s)  Supermax_200410_by_CIMB.pdf ( 223k )

Number of downloads: 59

Supermax_200410_by_CIMB.pdf ( 223k )

Number of downloads: 59 |

|

|

Apr 20 2010, 01:30 PM Apr 20 2010, 01:30 PM

|

Senior Member

2,148 posts Joined: Nov 2007 |

supermax = superman up up and away.

|

|

|

Apr 20 2010, 02:05 PM Apr 20 2010, 02:05 PM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

Let see whether it can breach 7.20 in the 2nd session today.

|

|

|

Apr 20 2010, 02:16 PM Apr 20 2010, 02:16 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

Let's hope it break the previous high 7.45 by end of the month

|

|

|

Apr 20 2010, 02:26 PM Apr 20 2010, 02:26 PM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

|

|

|

Apr 21 2010, 09:48 AM Apr 21 2010, 09:48 AM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

More readings & blogs about Supermax.

http://bursa99.blogspot.com/2010/04/supermax-apr10.html QUOTE Affin Keeps Supermax At Buy, Raises TP To RM10.69 Affin Investment kept Supermax Corp at Buy, but raised its target for the glove maker to RM10.69 from RM8.47 after its 1Q10 net profit more than double from a year ago. The brokerage said the results were 24% ahead of consensus as well as its own estimates, hence it raised its FY10-12 net profit projections for Supermax by 26-34%. Affin said, “with the recent pullback in share price and the upgrade in our earnings estimates, Supermax’s valuations are looking even more attractive, trading at CY10 P/E of 8.6X, and is backed by a robust 62% on-year earnings growth.” http://www.stockmarketsreview.com/reports/..._20100420_4902/ |

|

|

Apr 21 2010, 11:27 AM Apr 21 2010, 11:27 AM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

QUOTE(panasonic88 @ Apr 21 2010, 09:48 AM) More readings & blogs about Supermax. Thanks for the links. http://bursa99.blogspot.com/2010/04/supermax-apr10.html http://www.stockmarketsreview.com/reports/..._20100420_4902/ With many good reviews from various parties, I wonder why its price is not that bullish as anticipated. Even Adventa is going up at a higher rate (in terms of %). |

|

|

Apr 21 2010, 11:48 AM Apr 21 2010, 11:48 AM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

|

|

|

Apr 21 2010, 12:00 PM Apr 21 2010, 12:00 PM

|

Senior Member

2,148 posts Joined: Nov 2007 |

sikit sikit lama jadi bukit.

|

|

|

Apr 21 2010, 12:15 PM Apr 21 2010, 12:15 PM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

|

|

|

Apr 21 2010, 12:40 PM Apr 21 2010, 12:40 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

Bringing out my crystall ball:

Mid of next month, we shall see Supermax comes to 8.00-8.20. |

|

|

Apr 21 2010, 12:46 PM Apr 21 2010, 12:46 PM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

|

|

|

Apr 24 2010, 12:47 AM Apr 24 2010, 12:47 AM

|

All Stars

17,100 posts Joined: Mar 2005 |

i still collecting supermax. it shd shoots over rm8.35, i guess. hope i am right this time. after this level there is 'no way back' .... good luck to all super supporters.

|

|

|

Apr 24 2010, 02:27 AM Apr 24 2010, 02:27 AM

|

Junior Member

371 posts Joined: Jan 2003 |

8.88 nicer haha

|

|

|

Apr 24 2010, 12:23 PM Apr 24 2010, 12:23 PM

|

Senior Member

1,082 posts Joined: Mar 2009 |

|

|

|

Apr 24 2010, 05:00 PM Apr 24 2010, 05:00 PM

|

Junior Member

124 posts Joined: Dec 2008 |

Topglove, Harta and Adventa are managed by highly ethical and top notch people. I can't say the same about Supermax.

Maybe you do not know something. Do you know that Lim Wee Chai (Topglove boss) used to work with Supermax boss? Due to diference in opinion, Lim Wee Chai set up Topglove and became the largest glove company in the world. On the other hand, Supermax was tangled in a messy web of corporate takeovers and it's run like a chinamen company. I would not go into business with Supermax boss! As a shareholder, just be carefull who is running your business. Hartalega and Topglove are the only two companies I admire the most. |

|

|

May 23 2010, 01:08 PM May 23 2010, 01:08 PM

|

Junior Member

114 posts Joined: Mar 2010 |

TopGlove boss learn from Stanley mistake!

I would like to work with SUPERMAX boss,learn his mistake ,take huge salary and set up Megaglove |

|

|

May 23 2010, 02:25 PM May 23 2010, 02:25 PM

|

Senior Member

732 posts Joined: May 2008 |

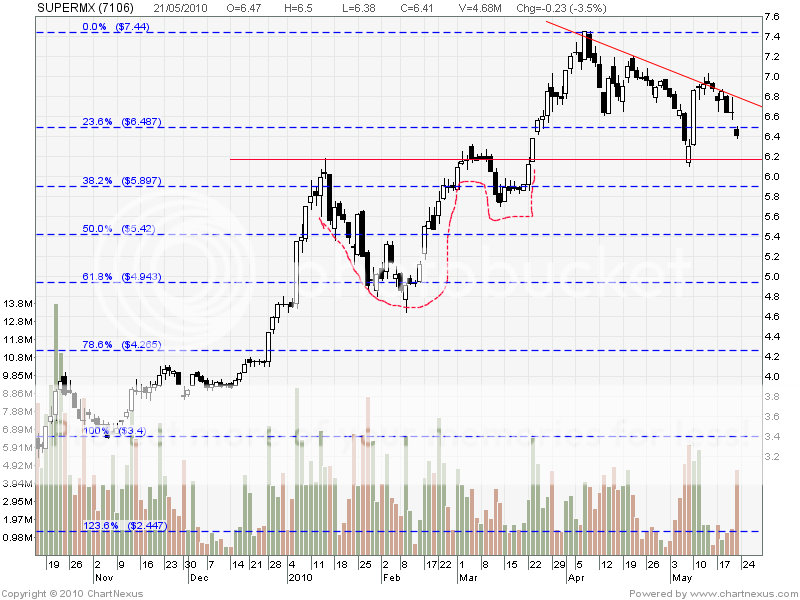

support fibo retracement 23.6% broken down again for second time in may.

This post has been edited by imax80: May 23 2010, 02:31 PM |

|

|

May 23 2010, 05:11 PM May 23 2010, 05:11 PM

|

Junior Member

114 posts Joined: Mar 2010 |

Good trend?sorry donno ta lah.

Tomolo Supermax CHIONG? |

|

|

May 23 2010, 09:44 PM May 23 2010, 09:44 PM

|

Senior Member

732 posts Joined: May 2008 |

|

|

|

May 27 2010, 02:26 AM May 27 2010, 02:26 AM

|

Junior Member

73 posts Joined: Dec 2005 |

When is Supermax going to announce it's approved 1 for 4 bonus issue?Already 26th May ..I thought the tentative date was 26th May?

|

|

|

May 28 2010, 12:23 AM May 28 2010, 12:23 AM

|

All Stars

17,100 posts Joined: Mar 2005 |

i am still waiting. sin chew states that it is still waiting for SE approval.

also, it declares dividend liao .... patient, it shd go up and up and up .... |

|

|

May 31 2010, 11:57 PM May 31 2010, 11:57 PM

|

All Stars

17,053 posts Joined: Jan 2003 |

if it refuses to breach the RM7 soon I might just sell all of it and go into some defensive counter soon

|

|

|

Jun 2 2010, 12:50 AM Jun 2 2010, 12:50 AM

|

Junior Member

73 posts Joined: Dec 2005 |

When is Supermax going to announce the good news??? Already 1st June! By the time they announce, the bloody stock would have collapsed already..siallar

|

|

|

Jun 2 2010, 01:15 AM Jun 2 2010, 01:15 AM

|

All Stars

17,053 posts Joined: Jan 2003 |

|

|

|

Jun 4 2010, 03:14 AM Jun 4 2010, 03:14 AM

|

Junior Member

73 posts Joined: Dec 2005 |

Finally! Supermax announces bonus issue...EX date is 16th

|

|

|

Sep 5 2010, 02:04 PM Sep 5 2010, 02:04 PM

|

Junior Member

114 posts Joined: Mar 2010 |

Why the price going down ? Most of the stock already bounce back ma! Dividen also on the way.Monday will try to cautch knife. http://www.btimes.com.my/Current_News/BTIM...icle/index_html]supermax[/URL] This post has been edited by ekhoono: Sep 5 2010, 02:05 PM |

|

|

Sep 5 2010, 02:06 PM Sep 5 2010, 02:06 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

this counter shows some resistence at RM5.10. yeah, maybe its time for the rubber counters again to move up. they stayed too long in the oversold position.

|

|

|

Sep 5 2010, 02:26 PM Sep 5 2010, 02:26 PM

|

Junior Member

114 posts Joined: Mar 2010 |

|

|

|

Sep 5 2010, 03:45 PM Sep 5 2010, 03:45 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

so tempted to as they said, catch the fslling knife this monday .....wow

|

|

|

Sep 6 2010, 09:41 PM Sep 6 2010, 09:41 PM

|

Senior Member

4,518 posts Joined: Apr 2010 |

Glove counters are in for a downward revision following top glove management guidance on the forthcoming release of the quarterly results.

|

|

|

Sep 7 2010, 05:01 PM Sep 7 2010, 05:01 PM

|

Junior Member

327 posts Joined: Apr 2009 |

|

|

|

Sep 7 2010, 09:11 PM Sep 7 2010, 09:11 PM

|

Senior Member

2,850 posts Joined: Aug 2006 From: Stellar Nursery |

Wow, almost 30% drop since the last high

Added on September 7, 2010, 9:23 pmI think 4.65 is a good entry if it bounces This post has been edited by Polaris: Sep 7 2010, 09:23 PM |

|

|

Sep 7 2010, 09:36 PM Sep 7 2010, 09:36 PM

|

Senior Member

4,966 posts Joined: Nov 2008 |

|

|

|

Sep 7 2010, 10:33 PM Sep 7 2010, 10:33 PM

|

Senior Member

546 posts Joined: Dec 2009 From: Malaysia |

i entered @ 4.82 today!!

This post has been edited by Jtic: Sep 7 2010, 10:33 PM |

|

|

Sep 7 2010, 10:57 PM Sep 7 2010, 10:57 PM

|

Junior Member

114 posts Joined: Mar 2010 |

I caught babi hell 20lot @5.04 yesterday!!

|

|

|

Sep 8 2010, 12:37 AM Sep 8 2010, 12:37 AM

|

Junior Member

271 posts Joined: Oct 2007 |

entered too damn early today at 4.95 .. saddddddd

|

|

|

Sep 8 2010, 12:15 PM Sep 8 2010, 12:15 PM

|

Senior Member

3,037 posts Joined: Jun 2007 |

|

|

|

Sep 8 2010, 12:15 PM Sep 8 2010, 12:15 PM

|

Senior Member

2,850 posts Joined: Aug 2006 From: Stellar Nursery |

4.65 now, I'm preparing to go in...

Wonder if it'll go even lower.. |

|

|

Sep 8 2010, 12:43 PM Sep 8 2010, 12:43 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Sep 8 2010, 12:47 PM Sep 8 2010, 12:47 PM

|

Senior Member

1,307 posts Joined: Sep 2009 |

glove industries get hammered these few days. Wondering whether "they" will re-bounce soon...

Will try q at 4.60, let's c how... |

|

|

Sep 8 2010, 01:15 PM Sep 8 2010, 01:15 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

rubber counters like topglove was downgraded few weeks back, and it led the downtrend of all the rubbers. but still, they cant be so bad right? now they are worth 'penniless'....damn !

|

|

|

Sep 8 2010, 01:37 PM Sep 8 2010, 01:37 PM

|

Junior Member

114 posts Joined: Mar 2010 |

U want Q @4.60, tomolo drop till RM4.50 how?

any technic to average down? |

|

|

Sep 8 2010, 01:53 PM Sep 8 2010, 01:53 PM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

QUOTE(ekhoono @ Sep 8 2010, 01:37 PM) technical analysis is useless for bursa stocks that are heavily sundicatedsundicates are big and more poweful then us Added on September 8, 2010, 1:56 pmi queue at 4.50 Added on September 8, 2010, 1:57 pmrubberex is the only counter in my list that still tahan today This post has been edited by amalthea: Sep 8 2010, 01:57 PM |

|

|

Sep 8 2010, 02:09 PM Sep 8 2010, 02:09 PM

|

Senior Member

1,307 posts Joined: Sep 2009 |

|

|

|

Sep 8 2010, 04:34 PM Sep 8 2010, 04:34 PM

|

Junior Member

59 posts Joined: Oct 2008 |

|

|

|

Sep 8 2010, 05:13 PM Sep 8 2010, 05:13 PM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

|

|

|

Sep 8 2010, 05:58 PM Sep 8 2010, 05:58 PM

|

Senior Member

5,291 posts Joined: Dec 2004 From: I Luv Msia |

|

|

|

Sep 8 2010, 06:22 PM Sep 8 2010, 06:22 PM

|

Senior Member

713 posts Joined: Mar 2005 |

|

|

|

Sep 8 2010, 06:33 PM Sep 8 2010, 06:33 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

100 shares each , are not like to boost the price of Supermax. We need more uncles to buy 100 lots x 1000 shares. Just joking . This post has been edited by SKY 1809: Sep 8 2010, 06:34 PM |

|

|

Sep 8 2010, 08:20 PM Sep 8 2010, 08:20 PM

|

Senior Member

5,291 posts Joined: Dec 2004 From: I Luv Msia |

be it 100unit or 1000unit, so long as all of us making $$$, cheers

tomolo bursa opens half day, how much more dip u expected |

|

|

Sep 8 2010, 10:24 PM Sep 8 2010, 10:24 PM

|

Junior Member

114 posts Joined: Mar 2010 |

QUOTE(shelynssl @ Sep 8 2010, 04:34 PM) 20 lot is 2000 unit share, i also small fish nia.Don't follow me. Added on September 8, 2010, 10:29 pm QUOTE(sotong168 @ Sep 8 2010, 08:20 PM) be it 100unit or 1000unit, so long as all of us making $$$, cheers Today whole day,drop Rm0.19,tomolo bursa opens half day, how much more dip u expected Tomolo half day , drop RM 0.08 =supermax RM4.56 This post has been edited by ekhoono: Sep 8 2010, 10:29 PM |

|

|

Sep 9 2010, 01:39 AM Sep 9 2010, 01:39 AM

|

Senior Member

2,850 posts Joined: Aug 2006 From: Stellar Nursery |

The index looks like it's in correction mode now, but since august or so supermax is not moving in step with it.

|

|

|

Sep 9 2010, 10:00 AM Sep 9 2010, 10:00 AM

|

Junior Member

29 posts Joined: Feb 2010 |

Lower down your expectation for the near term for this stock but do place an eye on it =D

|

|

|

Sep 13 2010, 07:10 PM Sep 13 2010, 07:10 PM

|

Junior Member

172 posts Joined: Jun 2009 |

i buy supermax today at 4.90. Is my entry price high?

I realise the dividend yield is rather low...any opinion? Please advise, |

|

|

Sep 13 2010, 09:47 PM Sep 13 2010, 09:47 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(BrendaChee @ Sep 13 2010, 07:10 PM) i buy supermax today at 4.90. Is my entry price high? Gloves are not dividend stocks i guess, where most bank's stocks are dividend stocks. I realise the dividend yield is rather low...any opinion? Please advise, On dividend stocks, normally we don't expect dramatic price change. For non-dividend stocks, more drama loh...either make you cry or make you laugh. |

|

|

Sep 17 2010, 05:23 PM Sep 17 2010, 05:23 PM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

I think not only Supermax but the whole the glove industry would have come through an adjustment period that their share prices heading south in the next 6 to 12 months. Crude Oil and rubber prices would be higher if the world economy still keep growing instead of double dip. Another point need to factor in is that RM is going stronger and the exporter would be jeopardised.

My investing strategy is based on value investing, so I'd only start to accumulate Supermax once its price drops below RM3.5 This post has been edited by kinwing: Sep 17 2010, 05:27 PM |

|

|

Sep 17 2010, 05:27 PM Sep 17 2010, 05:27 PM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

QUOTE(BrendaChee @ Sep 13 2010, 07:10 PM) i buy supermax today at 4.90. Is my entry price high? There are 2 ways to make money from Supermax.I realise the dividend yield is rather low...any opinion? Please advise, One way is to buy Supermax in cheap when it's undervalued. If you have bought Supermax 3 years with its share price around RM1.8 (before the bonus issue but after share split), you would have made a few hundred % of return from capital appreciation. Another way is to buy Supermax based on growth vision. But you think can Supermax's growth outpace Top Glove or Hartalega? BTW, if anyone want to get good dividend, then Supermax won't match the expectation. |

|

|

Sep 17 2010, 07:05 PM Sep 17 2010, 07:05 PM

|

Junior Member

491 posts Joined: Jan 2005 |

Rubbergloves have been growing in leaps and bounds even before recession till today. Don't u think its time for a shake up in the industry. Those rubber companies who invest more and have high gearing will be hardest hit. Those companies which have highest stocks level will also be hardest hit. There is also possibility that some of these companies may be manipulating their stocks level to show higher profits and thus misleading investors to buy the stocks at a much higher price.

http://whereiszemoola.blogspot.com/2010_09_01_archive.html |

|

|

Sep 19 2010, 09:19 PM Sep 19 2010, 09:19 PM

|

Junior Member

271 posts Joined: Oct 2007 |

are we getting the dividend 2.5sen in term of cheque ? or a direct bank in our investment bank acc ?

and also roughly by when can we expect to receive them ? cheers |

|

|

Sep 20 2010, 01:09 PM Sep 20 2010, 01:09 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

this morning got hit again, just cant say what is the entry price. but i think better wait.

|

|

|

Sep 20 2010, 05:28 PM Sep 20 2010, 05:28 PM

|

Senior Member

1,307 posts Joined: Sep 2009 |

I think now is also another chance to go in this counter.

|

|

|

Sep 20 2010, 05:51 PM Sep 20 2010, 05:51 PM

|

Senior Member

1,006 posts Joined: Mar 2006 From: Proud of Kelantan |

people still dumping glove counters, so need to wait

|

|

|

Sep 20 2010, 10:29 PM Sep 20 2010, 10:29 PM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

i bought at a higher price around sept 9

not planning to cut lose need to improve my holding power |

|

|

Sep 21 2010, 12:08 AM Sep 21 2010, 12:08 AM

|

Senior Member

1,028 posts Joined: Oct 2006 From: Urban area, Rural area now back to Urban area |

I'm holding it too.. need to be patience

|

|

|

Sep 21 2010, 12:44 AM Sep 21 2010, 12:44 AM

|

Junior Member

62 posts Joined: Mar 2010 |

wait until rm4.10?

|

|

|

Sep 21 2010, 01:43 AM Sep 21 2010, 01:43 AM

|

Junior Member

172 posts Joined: Jun 2009 |

|

|

|

Sep 21 2010, 01:57 AM Sep 21 2010, 01:57 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Sep 21 2010, 05:01 AM Sep 21 2010, 05:01 AM

|

Senior Member

2,850 posts Joined: Aug 2006 From: Stellar Nursery |

I got in at 4.6, this could be a shakeout

|

|

|

Sep 21 2010, 07:03 AM Sep 21 2010, 07:03 AM

|

All Stars

17,100 posts Joined: Mar 2005 |

|

|

|

Sep 21 2010, 12:18 PM Sep 21 2010, 12:18 PM

|

Senior Member

4,518 posts Joined: Apr 2010 |

Not expecting any significant turnaround in prices at least in the near term unless "surprise" upwards bias in the forthcoming Sept quarter results announcment.

|

|

|

Sep 21 2010, 09:29 PM Sep 21 2010, 09:29 PM

|

Junior Member

198 posts Joined: Mar 2009 |

Will this stock reach rm8.00? Why?

|

|

|

Sep 21 2010, 10:04 PM Sep 21 2010, 10:04 PM

|

All Stars

10,125 posts Joined: Aug 2007 |

Hey guys, I think the bullish side is over for SUPERMX.

Prices moved below 200MA, that is very bearish. Sell signal in, not buy. Price target: $3.70 |

|

|

Sep 22 2010, 10:51 AM Sep 22 2010, 10:51 AM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

QUOTE(danmooncake @ Sep 21 2010, 10:04 PM) Hey guys, I think the bullish side is over for SUPERMX. do not always use technical indicators to predict market sentiments especially as the case for KLSePrices moved below 200MA, that is very bearish. Sell signal in, not buy. Price target: $3.70 » Click to show Spoiler - click again to hide... « this couldn't mean anything else |

|

|

Sep 22 2010, 11:44 AM Sep 22 2010, 11:44 AM

|

All Stars

17,100 posts Joined: Mar 2005 |

agree agrre, cant agree more. klse is irrational with no directions in the trend. movement does not coincide nor agree with sector play, perhaps there is a new sector in play now .... the glc sector. haha ..... a new sector ?

|

|

|

Sep 22 2010, 11:04 PM Sep 22 2010, 11:04 PM

|

Senior Member

546 posts Joined: Dec 2009 From: Malaysia |

my charges is so high. average buy price 4.39 but breakeven at 4.47

sigh... ikan bilis life |

|

|

Sep 23 2010, 09:11 AM Sep 23 2010, 09:11 AM

|

Senior Member

1,307 posts Joined: Sep 2009 |

|

|

|

Sep 23 2010, 05:44 PM Sep 23 2010, 05:44 PM

|

Senior Member

4,518 posts Joined: Apr 2010 |

There will be more freefall with more forced selling on the way.

|

|

|

Sep 23 2010, 11:35 PM Sep 23 2010, 11:35 PM

|

Junior Member

491 posts Joined: Jan 2005 |

Supermax on superdive...................... RM 3.70 reacheable as dow go on correction. The shake up on the rubber glove industry has just begin.

|

|

|

Sep 23 2010, 11:56 PM Sep 23 2010, 11:56 PM

|

Junior Member

13 posts Joined: Mar 2007 From: KL/SG |

rm4.19....

|

|

|

Sep 24 2010, 12:16 AM Sep 24 2010, 12:16 AM

|

Junior Member

66 posts Joined: Jun 2008 From: seremban |

hi supermx buddy ~

today i m join u guy lo~ |

|

|

Sep 24 2010, 10:27 AM Sep 24 2010, 10:27 AM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

|

|

|

Sep 24 2010, 10:43 AM Sep 24 2010, 10:43 AM

|

Junior Member

271 posts Joined: Oct 2007 |

|

|

|

Sep 24 2010, 11:03 AM Sep 24 2010, 11:03 AM

|

All Stars

10,125 posts Joined: Aug 2007 |

Like I've said SELL signal is in. Very bearish and ugly looking chart.

|

|

|

Sep 24 2010, 11:12 AM Sep 24 2010, 11:12 AM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

|

|

|

Sep 24 2010, 01:05 PM Sep 24 2010, 01:05 PM

|

All Stars

11,058 posts Joined: Jun 2008 |

|

|

|

Sep 24 2010, 09:35 PM Sep 24 2010, 09:35 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

it simply cant make a breakthrough in the morning!!!

|

|

|

Sep 25 2010, 02:40 PM Sep 25 2010, 02:40 PM

|

Senior Member

641 posts Joined: Jun 2009 |

it's totally over sold, maybe can wait til the technical rebound to sell at a higher price.

my entry price is 5.65...damn |

|

|

Sep 25 2010, 05:08 PM Sep 25 2010, 05:08 PM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

|

|

|

Sep 25 2010, 06:05 PM Sep 25 2010, 06:05 PM

|

Junior Member

491 posts Joined: Jan 2005 |

Any of u guys know when technical rebound coming? Let's all of us here put our brains together and offer a solution of when to jump in b4 the boat leave.

|

|

|

Sep 26 2010, 01:50 AM Sep 26 2010, 01:50 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

OSK already response days ago with some lower TP etc., still not too bad.

Maybank looks bad on it. RHB, Alliance all response. Where is CIMB? Response yet? |

|

|

Sep 26 2010, 12:43 PM Sep 26 2010, 12:43 PM

|

Junior Member

114 posts Joined: Mar 2010 |

21 SEPT 2010 THE EDGE

KUALA LUMPUR: Glove manufacturers' share price declined on Bursa Malaysia after OSK Research downgraded the sector to neutral from overweight and said the rubber glove sector had been experiencing normalising demand since the start of 2H10 when the H1N1 pandemic lost its influence as a factor driving demand growth and as new capacity started to flood the market. It said on Tuesday, Sept 21 that as rubber glove manufacturers were unable to pass on to their customers all additional cost increases arising from higher latex prices and an unfavourable US dollar-ringgit exchange rate, most saw their margins as well as absolute bottom lines being compressed. At 11.20am, Top Glove fell 22 sen to RM5.58, Hartalega down 12 sen to RM4.58, Supermax lost six sen to RM4.29, Adventa fell three sen to RM2.44 while Kossan shed two sen to RM3.10. NO HAVE REBOUNCE FACTOR! minor rebounce wound't save bloody lost. |

|

|

Sep 26 2010, 01:14 PM Sep 26 2010, 01:14 PM

|

Junior Member

114 posts Joined: Mar 2010 |

|

|

|

Sep 26 2010, 11:29 PM Sep 26 2010, 11:29 PM

|

Junior Member

105 posts Joined: Oct 2008 |

according to my observations, the prices for rubber gloves stocks do rely on the demand and supply needed daily. few months back, i read an article that the nations are demanding for rubber gloves and the next day, the prices sky rocketed. now, i don't think there's season of demand for the rubber gloves unless an epidemic attack the whole world again which we wouldnt want.

|

|

|

Sep 26 2010, 11:51 PM Sep 26 2010, 11:51 PM

|

Junior Member

172 posts Joined: Jun 2009 |

|

|

|

Sep 27 2010, 07:35 AM Sep 27 2010, 07:35 AM

|

Senior Member

714 posts Joined: Jan 2009 |

QUOTE(ekhoono @ Sep 26 2010, 12:43 PM) 21 SEPT 2010 THE EDGE got to have strong heart to hold man ... cause many negative news flowing in for rubber stock counter this month... KUALA LUMPUR: Glove manufacturers' share price declined on Bursa Malaysia after OSK Research downgraded the sector to neutral from overweight and said the rubber glove sector had been experiencing normalising demand since the start of 2H10 when the H1N1 pandemic lost its influence as a factor driving demand growth and as new capacity started to flood the market. It said on Tuesday, Sept 21 that as rubber glove manufacturers were unable to pass on to their customers all additional cost increases arising from higher latex prices and an unfavourable US dollar-ringgit exchange rate, most saw their margins as well as absolute bottom lines being compressed. At 11.20am, Top Glove fell 22 sen to RM5.58, Hartalega down 12 sen to RM4.58, Supermax lost six sen to RM4.29, Adventa fell three sen to RM2.44 while Kossan shed two sen to RM3.10. NO HAVE REBOUNCE FACTOR! minor rebounce wound't save bloody lost. the rest of the market like property counter and small cheap cents counters are coming in wave .. all my friends are avoiding rubber stock ... at the moment.. until clearer picture coming in please take care and cautious with it... |

|

|

Sep 27 2010, 11:40 PM Sep 27 2010, 11:40 PM

|

Senior Member

641 posts Joined: Jun 2009 |

|

|

|

Sep 28 2010, 12:02 AM Sep 28 2010, 12:02 AM

|

Senior Member

546 posts Joined: Dec 2009 From: Malaysia |

adventa qtr report out. pretty handsome. shd have a look there. this may bring a little rebound on glove? no idea~

|

|

|

Sep 29 2010, 06:20 AM Sep 29 2010, 06:20 AM

|

Senior Member

4,966 posts Joined: Nov 2008 |

Supermax expects RM1b sales this year

Published: 2010/09/28 SUPERMAX Corporation Bhd expects to achieve close to RM1 billion annual sales by the end of its current financial year ending Dec 31, 2010. Its executive chairman and group managing director Datuk Seri Stanley Thai, in stating this, said sales would be driven world demand and good marketing strategy. "This will an increase of 20 per cent from the previous year's annual sales of RM800,000," Thai said on the sidelines of the Fifth International Rubber Gloves Conference and Exhibition launch here today. He said by December this year, the group's installed capacity should be able to produce 17.5 billion pieces of gloves. Asked about the group's plans, Thai said the company was building its Glove City in Kapar, Klang, under a project costing RM400 million. "Phase one of the project is expected to be commissioned by the second half of next year," he said. The project will be funded by internal sources and is expected to be completed by 2020, Thai said. "Upon completion, Glove City will consist of six rubber glove manufacturing plants in which every plant can generate 4.1 billion pieces of gloves a year," he said. - BERNAMA Read more: Supermax expects RM1b sales this year http://www.btimes.com.my/articles/20100928.../#ixzz10rfNd1Jf First 2 quarters revenue 220652+ 234825 = 455477. So they are 45% from the full year revenue. That is revenue la. Profit is another thing of course. |

|

|

Sep 29 2010, 12:35 PM Sep 29 2010, 12:35 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(GregPG01 @ Sep 29 2010, 06:20 AM) Supermax expects RM1b sales this year you are right, revenue doesn't mean profit. Published: 2010/09/28 SUPERMAX Corporation Bhd expects to achieve close to RM1 billion annual sales by the end of its current financial year ending Dec 31, 2010. Its executive chairman and group managing director Datuk Seri Stanley Thai, in stating this, said sales would be driven world demand and good marketing strategy. "This will an increase of 20 per cent from the previous year's annual sales of RM800,000," Thai said on the sidelines of the Fifth International Rubber Gloves Conference and Exhibition launch here today. He said by December this year, the group's installed capacity should be able to produce 17.5 billion pieces of gloves. Asked about the group's plans, Thai said the company was building its Glove City in Kapar, Klang, under a project costing RM400 million. "Phase one of the project is expected to be commissioned by the second half of next year," he said. The project will be funded by internal sources and is expected to be completed by 2020, Thai said. "Upon completion, Glove City will consist of six rubber glove manufacturing plants in which every plant can generate 4.1 billion pieces of gloves a year," he said. - BERNAMA Read more: Supermax expects RM1b sales this year http://www.btimes.com.my/articles/20100928.../#ixzz10rfNd1Jf First 2 quarters revenue 220652+ 234825 = 455477. So they are 45% from the full year revenue. That is revenue la. Profit is another thing of course. however, since our major concern is capacity, so revenue does mean something. lets hope the sentiment can come back to glove. |

|

|

Sep 29 2010, 03:20 PM Sep 29 2010, 03:20 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(yok70 @ Sep 29 2010, 12:35 PM) you are right, revenue doesn't mean profit. Revenue means little if company cannot make profit.however, since our major concern is capacity, so revenue does mean something. lets hope the sentiment can come back to glove. The worry on capacity is about over-capacity will lead to price war, and profit margin shrinking. |

|

|

Sep 29 2010, 06:35 PM Sep 29 2010, 06:35 PM

|

Junior Member

491 posts Joined: Jan 2005 |

Stanley super forecast of increase sales is to stem decline in the rubberglove stock price. Nothing new. Ok see if next quarter results of supermax is closed and reliable to what he forecasted.

Often from experienced, especially in chicken feed business, stocks were delibrately sent to buyer without them ordering just to meet forecasts. In the end this high flyer chicken feed company closed shop. |

|

|

Sep 30 2010, 03:01 AM Sep 30 2010, 03:01 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Sep 30 2010, 07:59 PM Sep 30 2010, 07:59 PM

|

Junior Member

114 posts Joined: Mar 2010 |

Name Employees Provident Fund Board

Address Tingkat 19, Bangunan KWSP, Jalan Raja Laut, 50350 Kuala Lumpur NRIC/Passport No/Company No. EPF Act 1991 Nationality/Country Of Incorporation. Malaysia Descriptions(Class & Nominal Value) Ordinary Shares of RM0.50 each Date Of Cessation Sep 24, 2010 Name & Address Of Registered Holder Employees Provident Fund Board of Tingkat 19, Bangunan KWSP, Jalan Raja Laut, 50350 Kuala Lumpur (2,000,000) Details of changes Type of transaction Acquired Date of change Sep 23, 2010 No of securities 2,000,000 Circumstances by reason of which change has occurred Purchase of shares from open market Nature Of Interest Direct Direct (units) Direct (%) Indirect/deemed interest (units) Indirect/deemed interest (%) Total no of securities after change 28,816,900 Date of notice Sep 30, 2010 Remarks: (1) Employees Provident Fund Board - 25,987,600(2) AmInvestment Management Sdn. Bhd. - 1,250,000(3) Amundi Malaysia Sdn. Bhd. - 945,000(4) BNP Paribas Asset Management Malaysia Sdn. Bhd.- 34,300(5) Mayban Investment Management Sdn. Bhd. - 600,000Supermax Corporation Berhad received the Form 29B dated 24 September 2010 fromEmployees Provident Fund Board on 30 September 2010 EPF KEEPON BUYING Goods news to come? |

|

|

Sep 30 2010, 08:08 PM Sep 30 2010, 08:08 PM

|

Junior Member

236 posts Joined: Jul 2006 |

QUOTE(ekhoono @ Sep 30 2010, 07:59 PM) Name Employees Provident Fund Board haha... i hope.. but why keep heading south ? Address Tingkat 19, Bangunan KWSP, Jalan Raja Laut, 50350 Kuala Lumpur NRIC/Passport No/Company No. EPF Act 1991 Nationality/Country Of Incorporation. Malaysia Descriptions(Class & Nominal Value) Ordinary Shares of RM0.50 each Date Of Cessation Sep 24, 2010 Name & Address Of Registered Holder Employees Provident Fund Board of Tingkat 19, Bangunan KWSP, Jalan Raja Laut, 50350 Kuala Lumpur (2,000,000) Details of changes Type of transaction Acquired Date of change Sep 23, 2010 No of securities 2,000,000 Circumstances by reason of which change has occurred Purchase of shares from open market Nature Of Interest Direct Direct (units) Direct (%) Indirect/deemed interest (units) Indirect/deemed interest (%) Total no of securities after change 28,816,900 Date of notice Sep 30, 2010 Remarks: (1) Employees Provident Fund Board - 25,987,600(2) AmInvestment Management Sdn. Bhd. - 1,250,000(3) Amundi Malaysia Sdn. Bhd. - 945,000(4) BNP Paribas Asset Management Malaysia Sdn. Bhd.- 34,300(5) Mayban Investment Management Sdn. Bhd. - 600,000Supermax Corporation Berhad received the Form 29B dated 24 September 2010 fromEmployees Provident Fund Board on 30 September 2010 EPF KEEPON BUYING Goods news to come? |

|

|

Sep 30 2010, 08:31 PM Sep 30 2010, 08:31 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

i really hope so. lets hope that it will take a BIG U-turn to the north ... make sure its to the NORTH !!! cant tahan ady ....

|

|

|

Sep 30 2010, 11:38 PM Sep 30 2010, 11:38 PM

|

Junior Member

8 posts Joined: Feb 2010 |

|

|

|

Oct 1 2010, 02:04 AM Oct 1 2010, 02:04 AM

|

All Stars

10,125 posts Joined: Aug 2007 |

Just keep selling till you see an uptick candlestick.

Now we know their "intended" sales forecast are nothing but BS, because they have to issue clarification to Bursa. This post has been edited by danmooncake: Oct 1 2010, 02:07 AM |

|

|

Oct 1 2010, 11:06 AM Oct 1 2010, 11:06 AM

|

Senior Member

1,616 posts Joined: Aug 2010 |

On BFM radio, news reports blame the heavy laosai on the recent bonus issue

I thought it was overcapacity concerns? |

|

|

Oct 1 2010, 11:31 AM Oct 1 2010, 11:31 AM

|

Senior Member

1,022 posts Joined: Mar 2006 |

QUOTE(Currylaksa @ Oct 1 2010, 11:06 AM) On BFM radio, news reports blame the heavy laosai on the recent bonus issue It's in the Star I thought it was overcapacity concerns? Thai blames bonus issues for share price falls This post has been edited by kroegand: Oct 1 2010, 11:32 AM |

|

|

Oct 1 2010, 01:31 PM Oct 1 2010, 01:31 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Currylaksa @ Oct 1 2010, 11:06 AM) On BFM radio, news reports blame the heavy laosai on the recent bonus issue It is the downgrade that prompt the recent fall due to potential overcapacity which soon coming online as well as USD depreciation issue.I thought it was overcapacity concerns? Do remember fund managers do follow such rating to invest around. |

|

|

Oct 1 2010, 02:56 PM Oct 1 2010, 02:56 PM

|

Junior Member

33 posts Joined: Dec 2005 |

just restocking at 3.83 go go go

|

|

|

Oct 1 2010, 03:42 PM Oct 1 2010, 03:42 PM

|

Senior Member

1,022 posts Joined: Mar 2006 |

|

|

|

Oct 1 2010, 04:48 PM Oct 1 2010, 04:48 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

i got him i got him !!! wa ka ka .....

|

|

|

Oct 1 2010, 11:26 PM Oct 1 2010, 11:26 PM

|

Senior Member

1,616 posts Joined: Aug 2010 |

|

|

|

Oct 3 2010, 11:02 AM Oct 3 2010, 11:02 AM

|

All Stars

17,100 posts Joined: Mar 2005 |

if comes moday there is an uptrend for the rubbers, perhaps it shows sign of oversold, and they go upwards again ? .... i got to hope so. anyone?

|

|

|

Oct 3 2010, 10:10 PM Oct 3 2010, 10:10 PM

|

Senior Member

4,966 posts Joined: Nov 2008 |

QUOTE(kroegand @ Oct 1 2010, 11:31 AM) Thai blames bonus issues for share price falls = BS |

|

|

Oct 4 2010, 12:11 AM Oct 4 2010, 12:11 AM

|

Junior Member

327 posts Joined: Apr 2009 |

QUOTE(mikehwy @ Oct 3 2010, 11:02 AM) if comes moday there is an uptrend for the rubbers, perhaps it shows sign of oversold, and they go upwards again ? .... i got to hope so. anyone? It's still too early to say if the stock will U-turn. But it's selling at an attractive valuation now. The best strategy will be to buy in stages. |

|

|

Oct 4 2010, 02:26 AM Oct 4 2010, 02:26 AM

|

Junior Member

62 posts Joined: Mar 2010 |

Supermax...

http://www.kwongwah.com.my/news/2010/10/03/29.html so what will happen 2molo? ==================== http://1klse.blogspot.com/ ==================== |

|

|

Oct 4 2010, 03:55 AM Oct 4 2010, 03:55 AM

|

Senior Member

7,960 posts Joined: Dec 2007 From: Kuala Lumpur |

OMG.... Superman.. under.. fire.. O_o

seems like gloves factory catches fire easily =/ last year was Kossan, now Supermax... 二零一零年十月三日 上午十一时七分 = 2010/Oct/03 11:07 AM.... i cant find other sources to read abt this probably need to wait till tomorrow.. This post has been edited by mopster: Oct 4 2010, 04:02 AM |

|

|

Oct 4 2010, 04:01 AM Oct 4 2010, 04:01 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Oct 4 2010, 08:54 AM Oct 4 2010, 08:54 AM

|

All Stars

17,100 posts Joined: Mar 2005 |

analysts from sin chew predicts target prices at, rm6.80 and 7.60 ... wow !!!

|

|

|

Oct 4 2010, 09:20 AM Oct 4 2010, 09:20 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Oct 4 2010, 09:58 AM Oct 4 2010, 09:58 AM

|

All Stars

17,100 posts Joined: Mar 2005 |

sin chew newspaper, financial section. although many analyss have been downgrading due to lowre demand and unfavourable forex, still some are more upbeat now ....

rubbers ... go go go !!! |

|

|

Oct 4 2010, 10:35 AM Oct 4 2010, 10:35 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Oct 4 2010, 11:37 AM Oct 4 2010, 11:37 AM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

glad i am still holding some

|

|

|

Oct 4 2010, 11:17 PM Oct 4 2010, 11:17 PM

|

Junior Member

327 posts Joined: Apr 2009 |

QUOTE(mopster @ Oct 4 2010, 03:55 AM) OMG.... Superman.. under.. fire.. O_o Probably someone is burning it down to reduce over-supply of rubber gloves in the market.. seems like gloves factory catches fire easily =/ last year was Kossan, now Supermax... 二零一零年十月三日 上午十一时七分 = 2010/Oct/03 11:07 AM.... i cant find other sources to read abt this probably need to wait till tomorrow.. This post has been edited by DanielW: Oct 4 2010, 11:18 PM |

|

|

Oct 5 2010, 06:11 AM Oct 5 2010, 06:11 AM

|

All Stars

10,125 posts Joined: Aug 2007 |

|

|

|

Oct 5 2010, 06:58 AM Oct 5 2010, 06:58 AM

|

All Stars

17,100 posts Joined: Mar 2005 |

topglove shd always be the major choice for the rubber exposure?

|

|

|

Oct 5 2010, 06:35 PM Oct 5 2010, 06:35 PM

|

All Stars

17,053 posts Joined: Jan 2003 |

|

|

|

Oct 5 2010, 08:24 PM Oct 5 2010, 08:24 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

i personally think that tglove is the best bet at the time being. hope i am right ... else ... OMG le

|

|

|

Oct 5 2010, 10:16 PM Oct 5 2010, 10:16 PM

|

Senior Member

4,526 posts Joined: Mar 2006 |

you guys missed the ride...

latexx was behind |

|

|

Oct 6 2010, 01:00 AM Oct 6 2010, 01:00 AM

|

All Stars

17,100 posts Joined: Mar 2005 |

|

|

|

Oct 6 2010, 07:27 PM Oct 6 2010, 07:27 PM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

supermax up people dun wanna talk

Added on October 6, 2010, 7:28 pmtomolo down sad people will start posting here This post has been edited by amalthea: Oct 6 2010, 07:28 PM |

|

|

Oct 6 2010, 09:05 PM Oct 6 2010, 09:05 PM

|

Senior Member

641 posts Joined: Jun 2009 |

quite optimistic on supermx performance tomolo, who said? ME!!

|

|

|

Oct 6 2010, 11:49 PM Oct 6 2010, 11:49 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

all rubber counters seemes oversold? they have to play catch up with the KLCI. go go go ....

|

|

|

Oct 7 2010, 11:41 AM Oct 7 2010, 11:41 AM

|

Junior Member

383 posts Joined: Aug 2010 From: Hamburg |

|

|

|

Oct 11 2010, 08:01 PM Oct 11 2010, 08:01 PM

|

Junior Member

236 posts Joined: Jul 2006 |

today the stock up ! why r ?

|

|

|

Oct 11 2010, 09:41 PM Oct 11 2010, 09:41 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Oct 11 2010, 10:24 PM Oct 11 2010, 10:24 PM

|

Junior Member

327 posts Joined: Apr 2009 |

QUOTE(max2k @ Oct 11 2010, 08:01 PM) Could be temporary rise only.."The strengthening ringgit, rising latex prices and overcapacity in the industry are expected to translate into thinner margins for Malaysian rubber glove manufacturers." http://www.theedgemalaysia.com/business-ne...e-ijm-land.html |

|

|

Oct 11 2010, 10:32 PM Oct 11 2010, 10:32 PM

|

Junior Member

225 posts Joined: Mar 2010 From: nipporn |

QUOTE(DanielW @ Oct 11 2010, 10:24 PM) Could be temporary rise only.. so bila balu mau masok? wait until usd strengthened, lower latex price or high demand balu mau masok? guide me pls "The strengthening ringgit, rising latex prices and overcapacity in the industry are expected to translate into thinner margins for Malaysian rubber glove manufacturers." http://www.theedgemalaysia.com/business-ne...e-ijm-land.html |

|

|

Oct 12 2010, 04:36 PM Oct 12 2010, 04:36 PM

|

Junior Member

327 posts Joined: Apr 2009 |

QUOTE(Heihachi777 @ Oct 11 2010, 10:32 PM) so bila balu mau masok? wait until usd strengthened, lower latex price or high demand balu mau masok? guide me pls I think it's gonna take years for USD to be strengthened since they print so much money already..demand won't suddenly go high unless there is H2N2 outbreak Lower latex price is possible because the price of this commodity is always volatile. Another positive factor will be reduction of overcapacity problem which this industry is facing now, as well as better management of cost. Wait for the next quarter earnings report in 3 months time. |

|

|

Oct 13 2010, 10:01 PM Oct 13 2010, 10:01 PM

|

All Stars

17,100 posts Joined: Mar 2005 |

i guess its still a decent stock to observe?

|

|

|

Oct 13 2010, 10:31 PM Oct 13 2010, 10:31 PM

|

Junior Member

236 posts Joined: Jul 2006 |

|

|

|

Oct 14 2010, 02:23 AM Oct 14 2010, 02:23 AM

|

Senior Member

4,526 posts Joined: Mar 2006 |

i hope to see it red again..

|

|

|

Oct 14 2010, 03:45 AM Oct 14 2010, 03:45 AM

|

Senior Member

2,850 posts Joined: Aug 2006 From: Stellar Nursery |

Up people quiet, it's not like retail investors exert any meaningful influence in Bursa.

|

|

|

Oct 14 2010, 04:25 AM Oct 14 2010, 04:25 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Dec 14 2010, 09:32 AM Dec 14 2010, 09:32 AM

|

Newbie

4 posts Joined: Nov 2010 |

Supermx wait for good news......

All the best... This post has been edited by money_man85: Dec 14 2010, 08:41 PM |

|

|

Dec 14 2010, 06:29 PM Dec 14 2010, 06:29 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

Good news.

Supermax to get foreign investors. Read the paper attached. Attached File(s)  Supermax_20101214_ADR.pdf ( 201.18k )

Number of downloads: 51

Supermax_20101214_ADR.pdf ( 201.18k )

Number of downloads: 51 |

|

|

Jan 7 2011, 02:44 PM Jan 7 2011, 02:44 PM

|

Junior Member

82 posts Joined: Jan 2011 |

Very nice! Yesterday +0.2xx, till afternoon today, +0.1xx.

It's catching up |

|

|

Jan 7 2011, 03:02 PM Jan 7 2011, 03:02 PM

|

Senior Member

5,291 posts Joined: Dec 2004 From: I Luv Msia |

|

|

|

Jan 7 2011, 03:56 PM Jan 7 2011, 03:56 PM

|

Junior Member

112 posts Joined: Apr 2008 |

any chance rm5.50? by next week?

|

|

|

Jan 7 2011, 04:06 PM Jan 7 2011, 04:06 PM

|

Senior Member

5,291 posts Joined: Dec 2004 From: I Luv Msia |

|

|

|

Jan 7 2011, 05:17 PM Jan 7 2011, 05:17 PM

|

Junior Member

118 posts Joined: Nov 2007 |

everything is possible is such bullish market...

|

|

|

Jan 7 2011, 05:25 PM Jan 7 2011, 05:25 PM

|

Junior Member

82 posts Joined: Jan 2011 |

looks like there is resistance at 4.80, if can clear this, looks like can reach 6.50, if clear this then 7.50?

anyone know when supermax declare dividend? Q4 dividend not out yet.. |

|

|

Jan 7 2011, 08:04 PM Jan 7 2011, 08:04 PM

|

Junior Member

732 posts Joined: Jul 2010 |

Ive spoken to a latex supplier, presumeably the largest in Msia & Thailand, he actually told Stanley go fly kite when Stan wanted to buy more latex. This is bcos when Stan wants to buy, he'll call personally. When time to pay, Stan will not answer call & giving esok lusa excuses. But then again, this is between buyer & supplier, y do we care

|

|

|

Feb 14 2011, 04:24 PM Feb 14 2011, 04:24 PM

|

Junior Member

82 posts Joined: Jan 2011 |

|

|

|

Feb 14 2011, 04:27 PM Feb 14 2011, 04:27 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

QUOTE(newbie_trader @ Feb 14 2011, 04:24 PM) |

|

|

Feb 14 2011, 04:41 PM Feb 14 2011, 04:41 PM

|

Junior Member

82 posts Joined: Jan 2011 |

|

|

|

Feb 14 2011, 04:44 PM Feb 14 2011, 04:44 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Feb 14 2011, 09:14 PM Feb 14 2011, 09:14 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

Rubber gloves manufacturer Supermax Corporation Bhd expects to rake in an earnings growth of between 15-20 per cent for the financial year 2011, supported by its planned capacity growth and varying of product mix, in line with market demand.

To support the growing demand globally, Supermax said it will fast track the construction of a new plant in Meru, while rebuilding its Sg Buloh plant into a full surgical glove production facility. Once completed, the Sg Buloh plant will increase its surgical glove capacity by more than 10-fold, it said in a statement today. - Bernama |

|

|

Feb 14 2011, 10:18 PM Feb 14 2011, 10:18 PM

|

Junior Member

62 posts Joined: Mar 2010 |

QUOTE(yok70 @ Feb 14 2011, 09:14 PM) Rubber gloves manufacturer Supermax Corporation Bhd expects to rake in an earnings growth of between 15-20 per cent for the financial year 2011, supported by its planned capacity growth and varying of product mix, in line with market demand. Supermax 4Q earnings fall 24.8pct on high latex prices, unfavourable forex To support the growing demand globally, Supermax said it will fast track the construction of a new plant in Meru, while rebuilding its Sg Buloh plant into a full surgical glove production facility. Once completed, the Sg Buloh plant will increase its surgical glove capacity by more than 10-fold, it said in a statement today. - Bernama KUALA LUMPUR: Supermax Corp Bhd saw its earnings decline by 24.8% from RM43.54 million to RM32.72 million in the fourth quarter ended Dec 31, 2010 due to the continuous high latex prices and unfavourable exchange rates. The rubber glove maker said on Monday, Feb 14 its revenue rose 18.4% from RM196.42 million to RM232.67 million. Its earnings per share were 9.62 sen versus 16.22 sen. It proposed a dividend of 5% per share. The 4Q earnings also showed a decline of 14.3% from the third quarter net profit of RM38.14 million. “The rising latex costs and the weakening of the US dollar can pose a challenge but nevertheless manageable as management has the experience to tackle the headwinds and minimise their effects,” it said. Supermax said as glove prices increase in tandem with latex price increase and the management had taken steps to adjust glove price on a more regular basis to pass through the cost increases. For the financial year ended Dec 31, 2010, its earnings rose 32.8% from RM126.58 million to RM168.16 million while revenue increased 14.8% from RM803.63 million to RM932.25 million. Supermax said the group managed to achieve the profit guidance for FY10 as set out early last year despite the difficult operating environment. “Moving forward, we expect demand to remain strong, driven by new usages for gloves, rising demand from developing countries that are growing more affluent and spending more on healthcare and more and more countries regulating their healthcare industry,” it said. http://www.theedgemalaysia.com/business/18...able-forex.html |

|

|

Feb 15 2011, 04:41 PM Feb 15 2011, 04:41 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

Alex just wrote on Supermax: