QUOTE(126126 @ Jan 14 2022, 09:57 AM)

Age: Family of 4, 1 working adult. 2 child in secondary school

Active Income: RM30k+

Assets:

Stocks - RM3.2m

EPF - RM1.4m

Cash/Equivalent - RM650k

Property - RM6m

ASN - RM1.2m

Toys, collectibles and other assets - 200k

Liabilities:

Loans - RM2.1m

Other income:

Rental - 12k

ASN - 4k

EPF - 6-7k (div only but exclude employer contribution)

Div - 4k (only some equities are exposed to dividend stocks)

Expenses:

Property, tax and general living exp - 23k

Total Net worth: 10.5m

Is this profile good enough for retirement assuming adult at mid 40s?

Is this profile good enough for retirement assuming adult at mid 40s?

Assuming both you & your spouse will live for another 40 yrs...

Does your current net asset generate enough passive income to sustain your required monthly expenses n your children educational needs?

If your passive income can do that,.... Then should be ease to get answers to "is it good enough for retirement?"

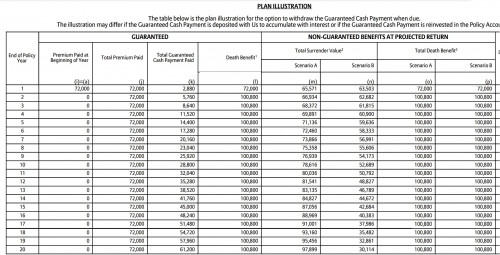

Btw, you did not list insurance plans,... Hope you got that covered too.

Overall,... You are doing extremely well in terms of net worth value in comparison to the general adult working population in malaysia. Bravo. 👏👏

Nov 21 2021, 11:55 AM

Nov 21 2021, 11:55 AM

Quote

Quote

0.0354sec

0.0354sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled