QUOTE(CP88 @ Sep 21 2014, 11:44 PM)

felixmask, are you keeping your's or planning to sell?

Profits are dropping declining qtr by qtr.

even the Dividend policy change below 8 sen; i still keep..for long term investment.

Telco is good cash flow company; ppl like to use phone to call..but current ppl moving to data technology like whatapps...

I read a research the ppl require live stream data..matter time data will overtake voice segment.

The one i regret is selling DIGI ;

believe PE very high.

I'm long term investment...buy never sell.

For maxis case- their dividend will shrink to repay debt for next few year..then dividend might follow DIGI dividend policy. Since their CEO also from DIGI.

Now maxis main strategic -

Gain back their Market - introduction of plan than ppl think affordable; new plan with free new smartphone

Restructure internally - reduce headcount nonproductive - Align with company direction to gain as market leader telco provider.

I want to see more Operation cost reduce more: introduction more affordability plan with smartphone like DIGI. Is not easy to change;

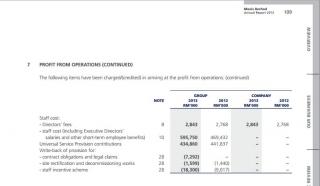

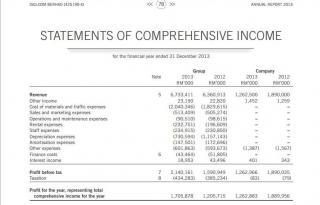

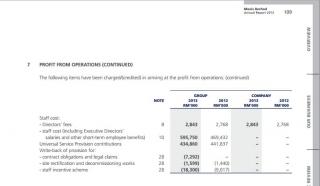

Maxis vs DIGI staff cost

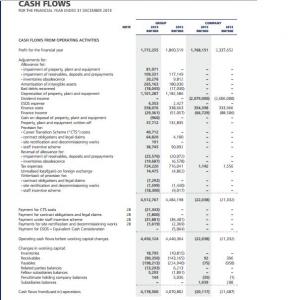

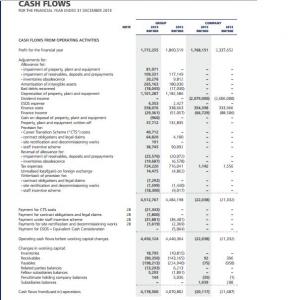

Maxis vs Digi Cash flow..i still wonder where mine mistake..when i study that Digi Cash flow get lower comparing prior year. The reason i sold it..hope it drop back below rm4.(

Im lousy accuntant)

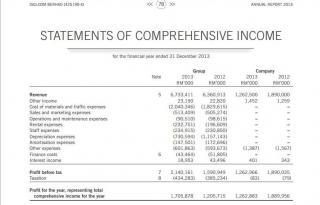

Maxis Cash Flow 2013 from their AR

Digi Cash Flow 2013 from their AR

This post has been edited by felixmask: Sep 22 2014, 12:38 AM

This post has been edited by felixmask: Sep 22 2014, 12:38 AM

Sep 19 2014, 06:02 PM

Sep 19 2014, 06:02 PM

Quote

Quote

0.0496sec

0.0496sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled