Outline ·

[ Standard ] ·

Linear+

PBB housing loan, refinance (its time to save)!, Public Bank mortgage service provider

|

TSJasonpbb

|

Jul 22 2009, 09:26 PM, updated 14y ago Jul 22 2009, 09:26 PM, updated 14y ago

|

New Member

|

In Public Bank, we do offer low and attractive interest rate, high margin of finance, fast approval. If you need loan to finance your house or need to know more details on housing loan, i can always help you out. You can also op to refinance existing property to save interest/cash out. Want to know how much you can save from refinancing existing property? Ask me for more! Public Bank offers flexible and affordable Home Loan packages that provide value added benefits and greater cost savings: -High margin of financing up to 95% including MRTA & legal fees -Extended repayment period up to 40 years or age 70- Overdraft up to 70% of the combined loan amount - Daily rest interest calculation - Redraw facility available -F ree credit card for entire loan tenure Terms & conditions applyCall / send me personal message / sms / reply me anytime, i am free even weekends. Looking forward to hear from you soon. Have a nice day ahead!  Jason Wong Senior Sales and Marketing Executive Public bank. 012-3747588 This post has been edited by Jasonpbb: Aug 17 2009, 06:53 PM |

|

|

|

|

|

TSJasonpbb

|

Aug 5 2009, 07:54 PM Aug 5 2009, 07:54 PM

|

New Member

|

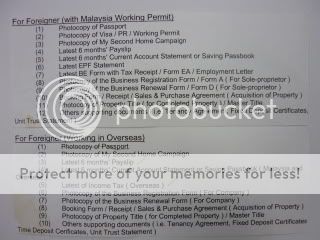

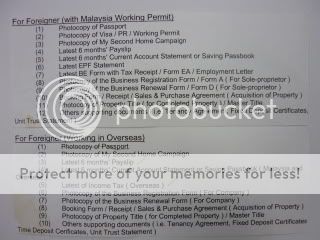

QUOTE(semmyda @ Aug 5 2009, 08:41 AM) for foreigner... how to apply ?... whats the procedure / process ? thanks Hi, Glad to hear from you. For foreigner, same procedure and process. However, margin of finance slightly lower (60%-70%). Below are the documents required:  Looking forward to hear from you soon. Have a nice day!  |

|

|

|

|

|

TSJasonpbb

|

Aug 12 2009, 07:56 AM Aug 12 2009, 07:56 AM

|

New Member

|

QUOTE(Yummy_Girl @ Aug 11 2009, 08:41 AM) may i know what is the interest rate for public bank housing loan?can it be full loan?or same with other bank, 90%?? U G PM

Added on August 12, 2009, 7:58 amQUOTE(mymaran4u @ Aug 11 2009, 08:03 AM) Can PBB offer 100% loan for locals? U G Pm too This post has been edited by Jasonpbb: Aug 12 2009, 07:58 AM |

|

|

|

|

|

TSJasonpbb

|

Aug 12 2009, 07:39 PM Aug 12 2009, 07:39 PM

|

New Member

|

QUOTE(mymaran4u @ Aug 12 2009, 04:44 PM) Sorry I don't understand. what do u mean 'U G PM'?  Mymaran4u, I replied you via personal message. Thx.  |

|

|

|

|

|

TSJasonpbb

|

Aug 19 2009, 10:28 PM Aug 19 2009, 10:28 PM

|

New Member

|

QUOTE(izaman @ Aug 19 2009, 09:44 PM) Bro, Give me your email or contact number so that i can show you the charts and explain further on our loan package.  Btw, i have calculated and you can save up to RM40k interest. Looking forward to hear from you. |

|

|

|

|

|

TSJasonpbb

|

Aug 25 2009, 07:10 PM Aug 25 2009, 07:10 PM

|

New Member

|

QUOTE(casmadscientist @ Aug 25 2009, 11:25 AM) can go for 100% loan? if yes PM me ur number You got pm from me. Feel free, give me a call and i will explain further to you. Thanks and have a nice day ahead! |

|

|

|

|

|

TSJasonpbb

|

Aug 31 2009, 01:54 PM Aug 31 2009, 01:54 PM

|

New Member

|

QUOTE(smcg @ Aug 31 2009, 12:52 AM) Replied via Pm. Thanks.

Added on August 31, 2009, 1:54 pmQUOTE(ifeel100 @ Aug 30 2009, 12:37 PM) Interested here. Pls PM me the package details for house re-financing. Double-Storey house, market price shld b 400k. If want to re-finance 300k, wat's the package? *Got some issue due to bad record & high commiment... Still can b done? Need it ASAP as for setting up a biz soon. TQ! Replied via pm. Thanks. This post has been edited by Jasonpbb: Aug 31 2009, 01:54 PM |

|

|

|

|

|

TSJasonpbb

|

Sep 17 2009, 10:50 PM Sep 17 2009, 10:50 PM

|

New Member

|

QUOTE(temptation1314 @ Sep 17 2009, 08:55 AM) Hello.. PM'ed you.. waiting for reply from you. Thanks Replied via Pm. Thanks. |

|

|

|

|

|

TSJasonpbb

|

Oct 12 2009, 09:14 PM Oct 12 2009, 09:14 PM

|

New Member

|

QUOTE(chae @ Oct 12 2009, 04:28 PM) bro..just PM u. about housing loan. in the midst of buying a property Got it, and replied via pm. Have a nice day ahead! |

|

|

|

|

|

TSJasonpbb

|

Oct 27 2009, 09:00 PM Oct 27 2009, 09:00 PM

|

New Member

|

QUOTE(FaTJ3sT3R aka Th!NjOK3R @ Oct 26 2009, 11:48 AM) What rates are we looking at here? BLR minus 2.3 or 2.4? Lock down period? Repayment panalty? MRTA? Legal & Stamp fee free? Just bought a 2nd property...looking for good package. let me know ya. Thanks. replied via pm. Thanks and have a nice day ahead! |

|

|

|

|

|

TSJasonpbb

|

Nov 21 2009, 11:08 AM Nov 21 2009, 11:08 AM

|

New Member

|

QUOTE(acad615 @ Nov 20 2009, 05:48 PM) I thought bank negara issued some policy to all banks where the rates are the same now, and that there will be no ZEC as well right? just to confirm that, cause my CIMB banker told me so. Hi acad615, Glad to hear from you. Yes, your information is correct and accurate. We started this since beginning of the month nov. Thanks and have a nice day! |

|

|

|

|

|

TSJasonpbb

|

Dec 1 2009, 06:46 PM Dec 1 2009, 06:46 PM

|

New Member

|

QUOTE(workingal @ Nov 30 2009, 09:03 PM) no offence but just wan to highlight that i have just spoken to a PBB officer today to enquire of refinancing. existingly i hv a housing loan from PBB. unfortunately, i got to know that the loan is BLR-1.5% only and max also can go up to 1.8% n the worst thing is no special offer for existing customer. earlier enquire about refinancing but they say cannot. can only revised interest rate (but still higher than outside bank) and need to lock for another 5 yrs. after agree to accept it (and kena locked), now say can refinance pulak. just need to apply like any new customer. but since hv been locked for 5 yrs, if wan to apply refinance within same bank to a better package, hv to pay penalty and legal fees. and refinance only up to 90%. wat is this???? Hi, Let me clarify some of the issues of your scenario. Now we have new policies which applies to most of the banks. Where interest rate can only go up to BLR-1.8% p.a . Before this, we have BLR-2.2%, even BLR-2.3% . It appeared in the newspaper just recently, that the bank is not earning money, therefore interest rate for all the local banks only up to BLR-1.8%. Regarding, the lock in period, most of the banks have standard lock in period of 5 years. Some even go further than 5 years (7 years). So, if you plan to refinance your loan, and do not want to undergo penalty, might as well you stay with Public bank until the lock in period mature. After the lock in period, you can refinance anytime without paying any penalty to the bank. However, if refinance can save you 30k and the penalty is only 10k. I would say, you can go ahead with the refinancing plan. Refinance is only up to 90%, same applies to new purchase. Unless you want to include MRTA and Legal fees inside, then we called it 90% ++ (up to 95%). Hope i clear your doubts regarding housing loan and refinancing plan. |

|

|

|

|

|

TSJasonpbb

|

Dec 3 2009, 12:37 AM Dec 3 2009, 12:37 AM

|

New Member

|

QUOTE(workingal @ Dec 2 2009, 09:38 PM) hi, yes i understand what u mean and thanks for the clarification. my point is as the financial advisor (or even a bank officer), i feel that they should advise the client on the impact of their decision and give professional advise. for my case, since i am just a few months away from the 5 yrs lock in period, the officer should advise me to wait until after the lock in period and apply for refinancing. however, instead of doing that, she just informed me that there's no possibility of refinancing at all and the only way is to apply for revision of interest rate. it may be true that at that point of time, it's not possible for refinancing to a new package since i am still within the lock in period, however, since she is well aware that i would be completing the lock in period in a few months time, she should give constructive advise! i just happen to know about this possibility recently and to my dismay, if i wan to apply for refinancing (within the same bank now), i would need to pay penalty since i am in for another 5 yrs lock in period!   No worries workingal, if you are still unsure about the refinance package, you can always consult me. I will definately advise you on how you can do it. I agree that some of the financial advisor, they did not advice professionally due lack of experiance. Regarding the lock in period, even you refinance to other bank, the bank will also lock you for 5 years. Some even 7 years. It is just a standard policy by the bank. |

|

|

|

|

|

TSJasonpbb

|

Dec 16 2009, 11:00 PM Dec 16 2009, 11:00 PM

|

New Member

|

QUOTE(jackie_chua @ Dec 16 2009, 02:59 AM) Public Bank HQ. |

|

|

|

|

|

TSJasonpbb

|

Jan 18 2010, 09:38 PM Jan 18 2010, 09:38 PM

|

New Member

|

All Pm replied. Looking forward to hear from you guys and have a nice day ahead!  |

|

|

|

|

|

TSJasonpbb

|

Jan 20 2010, 06:28 PM Jan 20 2010, 06:28 PM

|

New Member

|

QUOTE(Floogen @ Jan 19 2010, 11:30 PM) Hi! Pls pm me yr housing packages too. Am buying a 2nd house for RM330k and lookng for a loan of about RM250k Thanks You got Pm. Looking forward to hear from you. Thanks.  |

|

|

|

|

|

TSJasonpbb

|

Mar 10 2010, 06:48 PM Mar 10 2010, 06:48 PM

|

New Member

|

QUOTE(esprit87 @ Mar 9 2010, 10:04 PM) Hi, can u send me the details of housing loan??what is the most recommend housing loan can take? coz i hear my fren say interest rate will be increasing soon.. can pm me? Esprit87, i already pm you the latest loan package. thanks. |

|

|

|

|

|

TSJasonpbb

|

Mar 22 2010, 08:56 PM Mar 22 2010, 08:56 PM

|

New Member

|

QUOTE(bL4cK_73dDy @ Mar 19 2010, 09:24 PM) Hi, do u do used car loan? I only deal in housing loan , commercial loan and trade financing. |

|

|

|

|

|

TSJasonpbb

|

Mar 31 2010, 07:40 PM Mar 31 2010, 07:40 PM

|

New Member

|

QUOTE(butterfly80 @ Mar 31 2010, 09:40 AM) hi pls provide the best packge for my housing loan 210k with tenure 30yrs. It will be great if I can get BLR-2.2..  .. MRTA with/without financing...ZEC..locked in period...etc...i'm still looking for the best packge in town...  You got pm, Public bank latest package. Thanks. |

|

|

|

|

|

TSJasonpbb

|

Apr 13 2010, 07:19 PM Apr 13 2010, 07:19 PM

|

New Member

|

QUOTE(iman_210 @ Apr 6 2010, 10:23 AM) interested to refinance my house at USJ with loan O/S of RM180k. Mkt value at 290k looking at 95% margin inclusive of legal fees and MRTA. pls pm me the best package and how best can i expedite the application. Pm you already, let me know if you are interested. Thanks.!  |

|

|

|

|

Jul 22 2009, 09:26 PM, updated 14y ago

Jul 22 2009, 09:26 PM, updated 14y ago

Quote

Quote

0.0267sec

0.0267sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled