QUOTE(sleepwalker @ Jan 8 2010, 02:10 PM)

Umm... you didn't understand the context of the joke.

Sigh.. nvm to those who didn't get it....

its normal, this is lyn

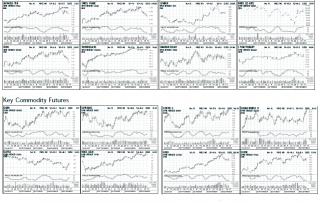

Commodity ETFs Reach New Highs

Commodities rallied across the board Wednesday as the U.S. dollar dipped from a two-month high and the Federal Reserve said it would keep short-term interest rates at record lows for an "extended period."

IPath DJ AIG Sugar Total Return Sub-Index ETN (SGG), which tracks sugar futures, blasted 5.15% to 73.31 in above-average volume. It outpaced all ETFs, including leveraged ones.

SGG has vaulted 8.14% so far this week alone. It's vaulted 80% year to date vs. 19% for the benchmark Thomson Reuters/Jefferies CRB Index, which tracks 28 commodities.

Raw sugar futures for March delivery rose 4.4% to 25.92 cents a pound in New York. The most active contract hit 26.15 cents — the highest price since February 1981.

Hot Cocoa

IPath DJ AIG Cocoa Total Return Sub-Index ETN (NIB), which tracks cocoa futures, flew 4% to 52.51 in heavy trade. The ETN broke out of a seven-week V-shaped base that's part of a deep, 18-month-long base. NIB was up 3% this week and 26% year to date.

Cocoa for March delivery climbed 2.3% to $3,778 a metric ton — its highest close in 20 years.

Harsh weather brought on by El Nino conditions this year hurt production of commodities grown in tropical climates, such as sugar, cocoa and coffee, and thereby drove up prices, noted Paul Kavanaugh, a commodities and currency analyst with PFG Best.

"Tropical commodities are inflation-sensitive because they're a want more than a need," said Kavanaugh. "It's likely to continue moving higher until we see strength in the dollar, (which has been in a major downtrend since March)."

United States Oil (USO), which tracks light sweet crude, increased 2.31% to 36.76 in higher-than-usual trade. It bounced off its 200-day moving average after falling for eight days straight. It's gained 11% year to date.

The Energy Information Administration said U.S. oil supplies dropped more than expected. Crude inventories dropped by 3.7 million barrels last week, and distillate fuels including heating oil dropped by 2.9 million barrels.

SPDR Gold Trust (GLD) picked up 1.23% to 111.57 as it bounced off its 50-day moving average. It's returned 28% year to date.

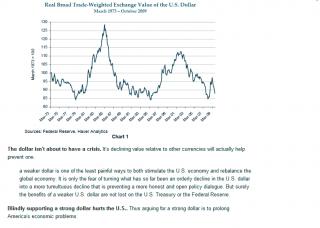

Recent Dollar Strength

PowerShares DB US Dollar Index Bullish (UUP), which tracks the greenback against the Euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc, fell as much as 0.48% in intraday trade. But it closed in the upper end of its trading range, down only 2 cents at 22.77.

The dollar rose to the highest level in more than two months on Tuesday, as stronger-than-expected U.S. economic reports lifted its prospects.

UUP has rallied 3.6% since hitting a 19-month low of 22.02 in late November. It hit an intraday high of 22.84 Tuesday. It broke above its 10-week moving average last Friday but still trades deep below its 40-week average.

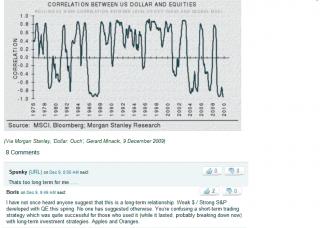

Teeter-Totter Action

Commodities, which trade in U.S. dollars, rise when the dollar weakens because it takes more dollars to buy them. One major question now is whether the dollar has truly bottomed or is just in a countertrend rally.

The dollar will remain weak until U.S. consumer spending strengthens, said Fred Fern, founder and CEO of Churchill Asset Management in Los Angeles.

"At this point it would be in the best interest of emerging markets, especially China, for the dollar to stay on the weak side," said Fern. "They're gaining from having the U.S. consumer get back in the game, but they're losing on the value of the Treasuries that they bought."

Dec 18 2009, 11:11 AM

Dec 18 2009, 11:11 AM

Quote

Quote

0.0497sec

0.0497sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled