|

mazda626

|

Aug 11 2009, 12:30 AM Aug 11 2009, 12:30 AM

|

|

QUOTE(sjz @ Aug 11 2009, 12:23 AM) so what's the conclusion?  sometimes technical reading can just be considered as a reference only yes agreed these figures only for comparison with e.g ....KNM or other oil stocks. Cannot say chief, as i am equaly blur for next 2/3 weeks......  1 thing 4 sure SAAG highest price is $0.94 in 15th June 2007 (5 Years record). This post has been edited by mazda626: Aug 11 2009, 12:35 AM |

|

|

|

|

|

mazda626

|

Aug 11 2009, 12:46 AM Aug 11 2009, 12:46 AM

|

|

QUOTE(sjz @ Aug 11 2009, 12:36 AM) my analysis is: it definitely will move up following the uptrend of O&G sector due to the increasing of Crude Oil Price but the uptrend might or might not be sustainable for long. From the charts, it only last about 3 months price above $0.40 (strong uptrend). Then it plunge to the current scenario, taking long downward trend. It correlated with oil madness abt 1 yr ago. |

|

|

|

|

|

mazda626

|

Aug 11 2009, 09:38 PM Aug 11 2009, 09:38 PM

|

|

Ahah.....back to 0.270 again. Seems like support at 0.265. Somebody missed to accumulate at 0.265/0.270  Will see tomolo again. *Paul Krugman sd economy need another 2 yr 4 full recovery ?!  matai ....... |

|

|

|

|

|

mazda626

|

Aug 12 2009, 11:16 PM Aug 12 2009, 11:16 PM

|

|

Hope its NOT goin to break 13th July 09 - 0.240. MA3,7,12,26&60 - all pointing down Bollinger - pointing down Envelope - down MFI - pointing down MACD - crossing down RSI 40.46 - down Fast STO - buy signal Slow STO - buy signal Median Price - 0.26 Ayoyo.....i am doom. Enter at 0.260      |

|

|

|

|

|

mazda626

|

Aug 12 2009, 11:32 PM Aug 12 2009, 11:32 PM

|

|

QUOTE(sjz @ Aug 12 2009, 11:25 PM) don't worry... we all enter at higher price. some at 0.3x, i'm at 0.287 so hope it will rise. 0.260 buying price is a very good bargain, sure will rise Yup hope U r rite, lets cross fingers lei........  |

|

|

|

|

|

mazda626

|

Aug 13 2009, 11:55 AM Aug 13 2009, 11:55 AM

|

|

QUOTE(sjz @ Aug 13 2009, 01:01 AM) if it really flies, you got most earning compared to us la.. now i already got paper loss around 2k...    ABP 0.287 Will belanja U minum teh tarik liao wooo....ha ha ha ha ....hah up again 0.265.  Wondering why huge Q both side everyday ahh ?  |

|

|

|

|

|

mazda626

|

Aug 13 2009, 04:33 PM Aug 13 2009, 04:33 PM

|

|

QUOTE(raisontan @ Aug 13 2009, 02:55 PM) how do they make profit when the price is falling? buy the lots during low and sell at high? But how they make money if price fallen ? Long sell or how ? Confused liao...  I guess this count cannot sell then buy later type rite ? |

|

|

|

|

|

mazda626

|

Aug 14 2009, 12:01 AM Aug 14 2009, 12:01 AM

|

|

QUOTE(.:BreT:. @ Aug 13 2009, 11:54 PM) bro u forgot bout me... 0.367 not intend to avg down first.... as this stock dingdongdingdong like compugt.... so in short i'm the highest here ahhahaaa Check out THE EDGE-Financial Daily today. They run a analyst on SAAG. Details ; Issued shares - 907M Market Cap - $RM235 PE - 7.30X DY - NA Operating margin - 14.07% Pretax margin - 9.57% Return on asset - 4.60% Return on equity - 19.55% Debts to Assets ratio - 34.25% (wow so high lei.....  ) Analyst target - NA (seems the analyst aso pening....  )

Added on August 14, 2009, 12:03 am

Added on August 13, 2009, 5:20 pmhaha bro. .27 already..  belanja me lobster?   wei lobster kalu all my profit gone lei....  This post has been edited by mazda626: Aug 14 2009, 12:03 AM This post has been edited by mazda626: Aug 14 2009, 12:03 AM |

|

|

|

|

|

mazda626

|

Aug 14 2009, 12:32 AM Aug 14 2009, 12:32 AM

|

|

QUOTE(zamans98 @ Aug 14 2009, 12:09 AM) But the company is not PN17 leh. Compare this with TIME. If there's an opp to goreng, sure ppl will do. Lately, couple of odd counters, despite poor performance still "fly to the moon" My beginner hunch sd this is Gov. & local fund manager works prior to 'actual econ recovery' - to accumulate cash piles (before Maxis relisting mayb...) |

|

|

|

|

|

mazda626

|

Aug 14 2009, 01:58 AM Aug 14 2009, 01:58 AM

|

|

QUOTE(claricecmw @ Aug 14 2009, 12:38 AM) eh can u provide the link pls. I can't seem to find the write up on SAG in the The Edge though...tq Sorry chief, i bought paper at 7/11. but u may try at www.theedgemalaysia.com

Added on August 14, 2009, 7:38 pmQUOTE(mazda626 @ Aug 14 2009, 01:58 AM) Sorry chief, i bought paper at 7/11. but u may try at www.theedgemalaysia.com      shet down lagi ah 0.265 aarrrgh........... This post has been edited by mazda626: Aug 14 2009, 07:38 PM |

|

|

|

|

|

mazda626

|

Aug 17 2009, 06:59 PM Aug 17 2009, 06:59 PM

|

|

shet, no one spare blood red but got good different of point......want to wait till 0.18, no dividend at all. cost control implemented internally. Anyway how long we will be in blood red and what level of KLCI ? Any factual advise - seniors please.  |

|

|

|

|

|

mazda626

|

Aug 17 2009, 11:49 PM Aug 17 2009, 11:49 PM

|

|

QUOTE(sampool @ Aug 17 2009, 10:27 PM) dun think saag will down to 0.20. from 0.25 to 0.20 is mean it will down 0.50 (equivalent to RM500 per share before its split to 0.1 pershare from 1). saag in india is seem at uptrend. http://myiris.com/shares/company/quoteShow...?icode=KAAFOUNDmy 2 cents. ahah, okie got your point then thanks. |

|

|

|

|

|

mazda626

|

Aug 18 2009, 01:07 AM Aug 18 2009, 01:07 AM

|

|

QUOTE(sjz @ Aug 18 2009, 12:35 AM) today whole market is red... really regret buying it at such high price..   ABP 0.287 Chief, U oredi averaging aah ? U got so many bullets leh ?  i restructuring my holding into Dividends counters liao, cannot tahan wooo...can't sleep well recently. Loopoo sd i talking in sleep abt SAAG wooo..bad sign.    This post has been edited by mazda626: Aug 18 2009, 01:09 AM This post has been edited by mazda626: Aug 18 2009, 01:09 AM |

|

|

|

|

|

mazda626

|

Aug 18 2009, 03:07 PM Aug 18 2009, 03:07 PM

|

|

QUOTE(sjz @ Aug 18 2009, 12:58 PM) can't average down on SAAG already la..   because all counter i hold suffer from free fall. HWGB, L&G, OILCORP. minor fall - SKPRES, GHLSYS.   haha..if you dream on which counter will shoot in prior do let us know ya.,..

Added on August 18, 2009, 1:00 pmjust now morning SAAG worst. luckily now recover a bit. having huge B-Q at .25. come on SAAG, my ABP 0.287!!!  Lucky i got kurasia&mtronic supporting my holding....but this crap SAAG hancus....

Added on August 18, 2009, 3:26 pmcrazylah Q buy 56,210 & Q sell only 25,540 but price not moving la.....   This post has been edited by mazda626: Aug 18 2009, 03:26 PM This post has been edited by mazda626: Aug 18 2009, 03:26 PM |

|

|

|

|

|

mazda626

|

Aug 18 2009, 11:44 PM Aug 18 2009, 11:44 PM

|

|

QUOTE(sjz @ Aug 18 2009, 05:29 PM) luckily closed at .26.  the market trend recovers a bit at the afternoon session as more ppl start to average down. hah, i got mixed feeling la. Big boys might (my anticipation only ya-blue chips, dividend counters) down tomolo with small fraction but low liners moving in "piston" pattern and one of them is SAAG. Got to prepare small bullets for intraday trust-in & trust-out. Say 1x100 oni kan ?! let see & test it. try to get early bird open price.  |

|

|

|

|

|

mazda626

|

Aug 20 2009, 05:19 PM Aug 20 2009, 05:19 PM

|

|

QUOTE(kb2005 @ Aug 20 2009, 06:54 AM) I am waiting for it to go up and sell!  Strong support at 0.255 wooo...from morning till almost close still sitting doing nothing. This counter "kuat curi tulang" woo at 0.255. Seems doin 2nd double bottom lei but let see tomolo. OSK188 chart median price $o.26 |

|

|

|

|

|

mazda626

|

Aug 22 2009, 03:15 PM Aug 22 2009, 03:15 PM

|

|

QUOTE(sjz @ Aug 22 2009, 12:49 PM) any latest info on this counter? friday down to 0.250.  "Hedge funds and asset managers who have been sitting on cash now feel it's time to buy [oil]," says Göran Trapp, head of global oil trading at Morgan Stanley (MS) in London. Some $3.8 billion has flowed into oil and gas exchange traded funds this year, vs. $1.4 billion in the first half of 2008. Attached image(s) |

|

|

|

|

|

mazda626

|

Aug 25 2009, 11:20 PM Aug 25 2009, 11:20 PM

|

|

Its time to reload more units  |

|

|

|

|

|

mazda626

|

Aug 27 2009, 12:44 AM Aug 27 2009, 12:44 AM

|

|

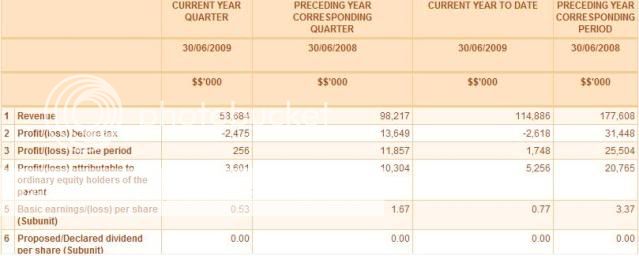

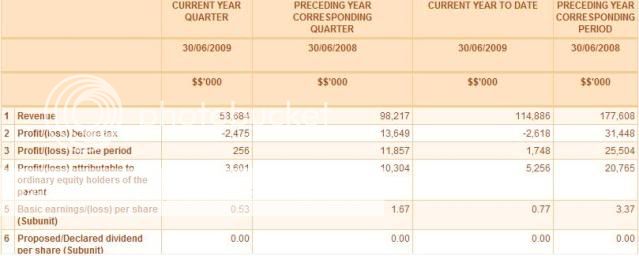

QUOTE(Irzani @ Aug 26 2009, 10:31 PM) Not a good quarterly report ...  . Will it be drop again tomorrow?  No one can tell chief, nowdays scenario moving into new direction.....gamblers types of investors are coming back into the scene. Losing money company but share price flying high. Making money company not paying dividends. I guess mayb, mayb, mayb - big players & deep pockets investors already in position in November 2008 and Mac 2009. So now, they want to liquid the profit and decide what shud the price gonna be according to their expectation. my half cents tots. The worse scenario is losing money pun tidak, making profit oso pun tidak - breakeven just ngam ngam oni. ........"The first group comprises those who believe in a robust V-shaped recovery in the sector and may have priced in an early upcycle in 2010. On the other hand, there are also investors with a huge risk appetite who may have bought into year 2010 valuations in anticipation of an upcycle in 2011. This group of investors will consider the current valuation sustainable until mid- to late-2010 (www.osk188.com)......" This post has been edited by mazda626: Aug 27 2009, 01:37 AM |

|

|

|

|

|

mazda626

|

Aug 27 2009, 11:15 PM Aug 27 2009, 11:15 PM

|

|

QUOTE(sjz @ Aug 27 2009, 05:30 PM) at least still having a profit for 1H although already decreases for 76%++ compared to last year. i already plan to hold this counter for long term until the price rises. luckily i buy using cash Seems SAAG's bull seem tired running oredi, letsv reload more units. |

|

|

|

|

Aug 11 2009, 12:30 AM

Aug 11 2009, 12:30 AM

Quote

Quote

0.0203sec

0.0203sec

0.85

0.85

7 queries

7 queries

GZIP Disabled

GZIP Disabled