I see a number of insurance topics and I just wanted to share my experience about buying investment linked insurance, which I feel is a very poor financial decision.

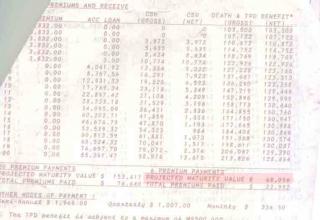

My mum bought a investment linked life policy about 20 years ago. The agent told her she would get back 60K++ upon maturity. We still have the paper document on that. My mum is illterate, so she trusted the agent who was her friend and bought it. Luckily, all was well we didn't need to make any claims. Fast forward to now, she received a letter stating the policy would mature in two more years, but she would only get back 18K.

I can understand if the amount is 50K even 40K but at 18K, it is 70% difference. I wrote in to the bank asking them why the amount differed so much. Their explanations was due to poor investment made in 1997, that's why it was so low. I don't buy that, I gonna write to Bank Negara and maybe sue them for false selling (anyone can help?).

Anyway, personally I do buy insurance but without investment. I pay a fixed sum yearly which covers everything in case of hospitalization to death. My premium is only 15% compared to an investment linked policy. My insurance agent always try to psycho me to buy investment linked polices, saying one must always invest. No thanks, I will use the 85% of not paying the premium and invest on my own. The insurance companies can't invest better, and the only reason they want to sell you investment is besides comission, they get 5% of the investment performance. Look at my mum's case, they got all their comission all these years, and the losing end is people like my mum.

If you have any investment linked insurance, check your maturity value. You can probably do a lot better financially than to leave it to the "experts". For those who will ask anway, the insurance policy is from Hong Leong Assuarance.

Insurance + investment are bad financial decisions

May 1 2009, 10:29 PM, updated 17y ago

May 1 2009, 10:29 PM, updated 17y ago

Quote

Quote

0.0277sec

0.0277sec

0.71

0.71

7 queries

7 queries

GZIP Disabled

GZIP Disabled